The combination of large stores, a mature pickup and delivery footprint and growing ship-to-home business helped Kroger ride the e-commerce tsunami that broke over the industry last year, resulting in its digital sales doubling to more than $10 billion.

Now, the company looks to continue riding that current by expanding capacity in existing markets while also pushing its e-commerce business into new geographies like Florida. That’s expected to double sales again, to north of $20 billion, by the end of 2023. At the same time, Kroger outlined during its annual investor conference on Wednesday some of the ways it plans to improve margins in the costly business.

For Kroger and its investors, whittling down costs is crucial at a time when profit-nabbing online orders are growing considerably faster than in-store, and projected to reach as much as $250 billion by 2025.

"Digital is now a growth engine," Rodney McMullen, Kroger's CEO, said during Wednesday's presentation. "And we now have a clear path to digital profitability with retail media, economies of scale, and technology and process improvements that will lower our cost to serve."

Key to both metrics are the voluminous Ocado automated customer fulfillment centers (CFCs), or "sheds," that will begin fulfilling orders this year. The facility in Monroe, Ohio, recently soft-launched ahead of a full opening in April, with the 375,000-square-foot shed in Groveland, Florida, set to begin filling orders sometime in the coming weeks. Kroger doesn’t operate any stores in Florida, making its push into the state a pure-play venture that will test the new platform’s appeal in a highly competitive region.

Yael Cosset, Kroger’s chief information officer, noted the Florida market will be “100% incremental” for the grocer and will contribute significantly to the overall online sales growth. A company spokesperson declined to say when the facility will begin delivering grocery orders, noting that more information is forthcoming.

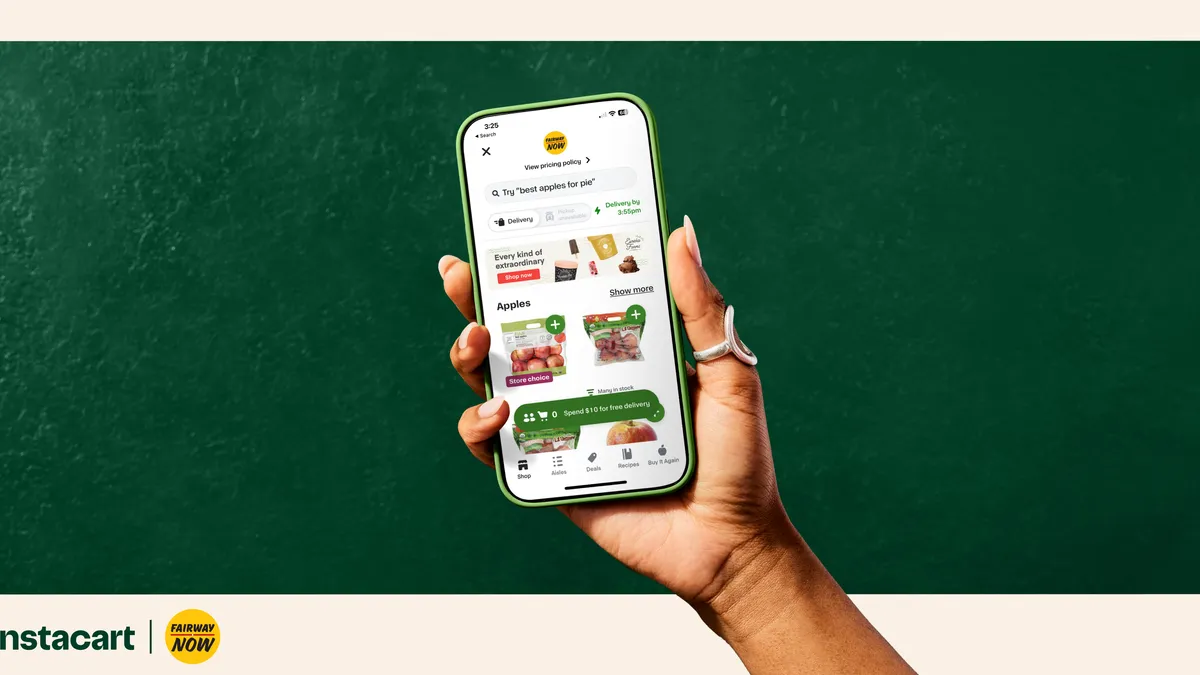

Gabriel Arreaga, Kroger’s senior vice president of supply chain, said each Ocado shed will handle the equivalent of 20 stores worth of sales and will expand its ability to reach new shoppers, with the current crop of CFC sites located within 90 miles of 75% of the U.S. population. That compares to 45% of households that live within two miles of a Kroger store, the company noted. Kroger will deliver orders from the facilities to customers’ homes using Kroger-owned and branded vans, offering an alternative delivery method to third-party services like Instacart and Shipt that the company relies on. The sheds will also be used to supply local stores.

Although Kroger and Ocado initially said they would build 20 CFCs across the country, Arreaga noted Wednesday that Kroger has committed to opening 11 sites by the end of next year, and will see how business progresses before announcing additional locations. The company expects Ocado sheds to become profitable within four years and to eventually deliver better margins than its stores.

"If we can be relevant in the market after those 11 sheds, and we continue to bring costs down and reduce the ramp-up curve, you'll see more and more of our releases saying which markets we're going to go next," Arreaga said.

Kroger is also looking to off-site pickup depots to expand its reach into communities that might not be dense enough to support a store. Hometown Pickup, as the program is called, began piloting late last year and currently includes around 25 “pop-up” click-and-collect points in Ohio towns like Aberdeen and Sardinia. In promotional videos played during the conference on Wednesday, Kroger promoted Hometown Pickup as a way to reach consumers in rural and underserved areas, posing what could be a competitive challenge to dollar stores and Walmart.

Kroger aims to boost capacity and efficiency at its stores, as well, by focusing further on training and technology that improves order fulfillment. Last year, Kroger lowered the cost of filling an online order from its stores by 14%. Over the next few years, it aims to lower that cost by another 30%. The company currently has almost 50,000 workers dedicated to e-commerce fulfillment across its stores and ship-to-home business. It plans to continue expanding its assortment of items available through e-commerce, most notably through the marketplace available via its ship-to-home service.

Kroger groups sales from its digital marketing services into its overall digital sales, making it somewhat difficult to separate out the efficiency of its online fulfillment business. Asked during a question-and-answer session to distinguish the profitability of the Ocado business, executives stressed the digital “ecosystem” the company is continuing to build that incorporates digital media along with personalization efforts aimed at building basket sizes. Last year, Kroger recorded more than half a trillion personalized offers for customers.

"So when you look at Kroger in total, it's just one additional piece of connecting with the customer," said McMullen. "What we find is almost every customer that engages with us from a digital standpoint, they still come into the physical store. And when we're able to serve a customer that way, our retention rate is 98% with that customer."

Continuing to press its 'fresh' advantage

Furthering a strategy established under its recently wrapped up Restock program, Kroger will keep honing its fresh assortment to drive market share gains, officials said. Technology and supply chain innovations have improved freshness and shelf life for perishable items, said Stuart Aitken, Kroger’s chief merchant and marketing officer. Milk, for instance, has a guaranteed shelf life of 10 days in stores, he said. Kroger has also deepened its investments in supply chain improvements for bananas, berries, tomatoes and bagged salads — four categories that collectively comprise 28% of produce sales for the company.

Executives noted Kroger’s fresh departments have a higher net promoter score — meaning the percentage of customers who are more likely to recommend a product, company or service to someone else — than other chain grocers, and that 70% of consumers say they choose where to buy groceries based on fresh assortment. The company currently captures around 30% share in fresh in the markets where it operates.

Aitken said the home consumption trends that took hold last year promise to stick around for the long term, driven by increased interest in cooking meals at home, as well as companies extending work-from-home policies. Prepared meals and accompaniments, he said, present a growth opportunity for brands like Home Chef, which saw sales rise 118% in 2020 and are expected to eventually eclipse $1 billion in yearly sales. Rotisserie chicken, which features under the Home Chef and Simple Truth labels, is set to become a $1 billion business within two years.

Kroger is also piloting full-service meal options, including its ghost kitchen pilot with ClusterTruck, a Saladworks location and a third, yet-to-be-announced initiative that targets family meals, Aitken said.

In private label, where Kroger has long maintained a leading position among grocers, the company plans to introduce 660 new items this year. Sixty percent of these products will be in its Simple Truth and Private Selection line, reflecting the continued demand for more premium products, Aitken noted.

Alternative profit streams, which build off Kroger’s grocery business, are expected to continue contributing between $100 million and $150 million to the bottom line in 2021. Kroger Precision Marketing has been a standout of late, with revenue up 135% in fiscal 2020 as CPG brands shift more of their spending to digital channels and seek out first-party consumer data.

Facing skeptical investors and analysts

Despite all the talk of sales growth and having finally cracked the code of online profitability, investors shrugged off Kroger’s presentation, with the company’s stock price down around 4% on Wednesday.

This reflects ongoing uncertainty around how to improve digital margins in grocery. The pandemic has spurred retailers to invest in a variety of new technologies and initiatives, including automated micro-fulfillment, and to take ownership over more of their operations from the likes of Instacart. But these steps are still in their early stages, and it’s far from certain how companies can approach parity with in-store sales as e-commerce continues to grow.

Analysts are also skeptical of claims grocers like Kroger are making about pandemic-era habits sticking around and juicing grocery sales long term. What’s more likely, they say, is that consumers will eventually return to their pre-pandemic shopping and eating habits, and stick grocers with a higher bill for online sales.

Growing sales pressure and competition from companies like Amazon, Albertsons and Walmart that are pouring money into their store and digital strategies may press Kroger to acquire other businesses, particularly regional chains that are becoming increasingly distressed as they fall behind well-capitalized chains. Asked about merger and acquisition possibilities, McMullen said Kroger will continue to evaluate opportunities that can help strengthen its business and grow its footprint, while CFO Gary Millerchip added the company’s current strategy doesn’t rely on it.

“Our focus will be on what's one of the best opportunities, the best investment opportunities, whether that be through building capability, partnering or M&A,” Millerchip said.