Groceryshop plays a key role in helping food retailers and suppliers define their relationships with shoppers. And this year’s edition of the annual conference, which occurred in Las Vegas last week, was a reminder that the basic goals of bringing in customers and encouraging them to make purchases remain Job 1 for the industry.

The event had a distinctly practical feel, with the buzz in conference sessions and in the exhibit hall centered on ways grocers can serve and attract shoppers in an era where people have more choices than ever before — and remain hyper-focused on saving money. Vendors at the event showed off an array of technologies designed to help grocers personalize their offerings, attract attention from shoppers and keep people from walking out without paying.

Here are several top takeaways from this year’s conference.

A new vision for computer vision

While computer vision has fallen out of favor as a way to move shoppers through grocery stores faster, the technology is quickly coming into vogue because of its ability to help retailers monitor shopping behavior, track inventory and cut down on shrink. That trend was clear at Groceryshop.

Retailers and suppliers are showing particular interest in understanding people’s path to purchase in physical stores, just as they have long been able to online, said Amit Kumar, founder and CEO of Dragonfruit, an AI startup that uses images from standard security cameras to handle a variety of tasks, including determining people’s paths as they shop in stores, asset management, spill detection and loss prevention. The company is also marketing its technology to grocers as a way to keep an eye on products on shelves and identify theft at self-checkout units.

Another vendor, France-based VusionGroup, showed off a computer vision-based system that detects produce as people take it from a display using a small camera mounted on a track above. A screen displays the percentage of each type of item that remains in real time, and the system can also alert store personnel if a product hasn’t been touched in a certain amount of time and might need to be replaced with fresher merchandise, according to a company representative.

Self-checkout supplier Diebold Nixdorf showed off improvements in its artificial intelligence technology aimed at stopping self-checkout users from walking out without paying for goods. The technology is capable of detecting a ruse that involves a shopper scanning a tag on one item while simultaneously moving a more expensive item past the system.

Electronic shelf labels are rapidly evolving

While the simplest electronic shelf labels display little more than the price of an item in black and white, suppliers are rolling out more advanced ESLs, some of which are capable of showing information in multiple colors or communicating with shoppers’ devices as they peruse store aisles.

The latest ESLs from ESL maker Aperion feature seven colors, allowing retailers to customize their displays based on a variety of factors, such as whether an item is on sale, new, or on clearance. The company was able to add the additional colors, which include yellow, orange, light gray and dark gray, in part because its ESLs have become more power-efficient, said Tighe Renner, who handles new business development for Aperion.

Aperion, which is owned by refrigeration equipment maker Hussmann, is also beckoning retailers with larger digital signs that display information in full color. The company showed off a beverage case with the signs built in at its booth at Groceryshop.

Aperion also makes tags that can display a QR code, enabling the units to send messages from retail media networks to shoppers. That ability can make it easier for retailers to justify the cost of purchasing, installing and maintaining ESLs, said Renner.

ESLs can also allow grocers to speed up sales of products in danger of spoiling.

Ahold Delhaize-owned stores in its home market of The Netherlands are using ESLs to encourage shoppers to purchase certain goods before they go to waste by dynamically lowering prices based on AI-generated forecasts about the goods’ remaining shelf life, Ahold Delhaize President and CEO Frans Muller said during a keynote session last Monday. Stores calculate optimal prices every 15 minutes, he said, adding that the company estimates that it has prevented 450 tons of food waste on an annual basis through the program.

Retailers navigate a complex relationship with CPGs

As grocers continue to expand their private label portfolios, they’re also trying to keep a watchful eye on national brands, which can help drive traffic as well as retail media spending.

Speaking during a Monday keynote session, Ram Krishnan, CEO of North America Beverages for PepsiCo, said CPGs and retailers both stand to benefit from a “symbiotic relationship” by working together to build and maintain categories, adding that national and private brands each play a role in reaching shoppers.

“The role for national brands is, how do you keep that category healthy? How do you get new consumers into the category? How do you drive household penetration? How do you create excitement through innovation?” Krishnan said. “And the role for private brands is to make sure people are not trading out of the category.”

On the other hand, rising private label penetration poses a key risk for CPGs, Krishnan said.

“If a retailer chooses to go all the way into private brands in a certain category, sometimes you take the value out of the category and it starts to decline,” he said. “It’s a conscious choice both of us have to make. But I personally think that both can coexist.”

During his keynote, Muller said his company is helping CPGs sharpen their ability to attract shopper attention even as their products compete with the Dutch grocer’s own brands.

“[We] offer them all kinds of opportunities to get more primary data to compete … on the same shelf. And in the end, we have only one interest: to do a better job for the consumer. And that’s, I think, what drives us both,” Muller said.

Instacart was on the wrong course when Simo became CEO

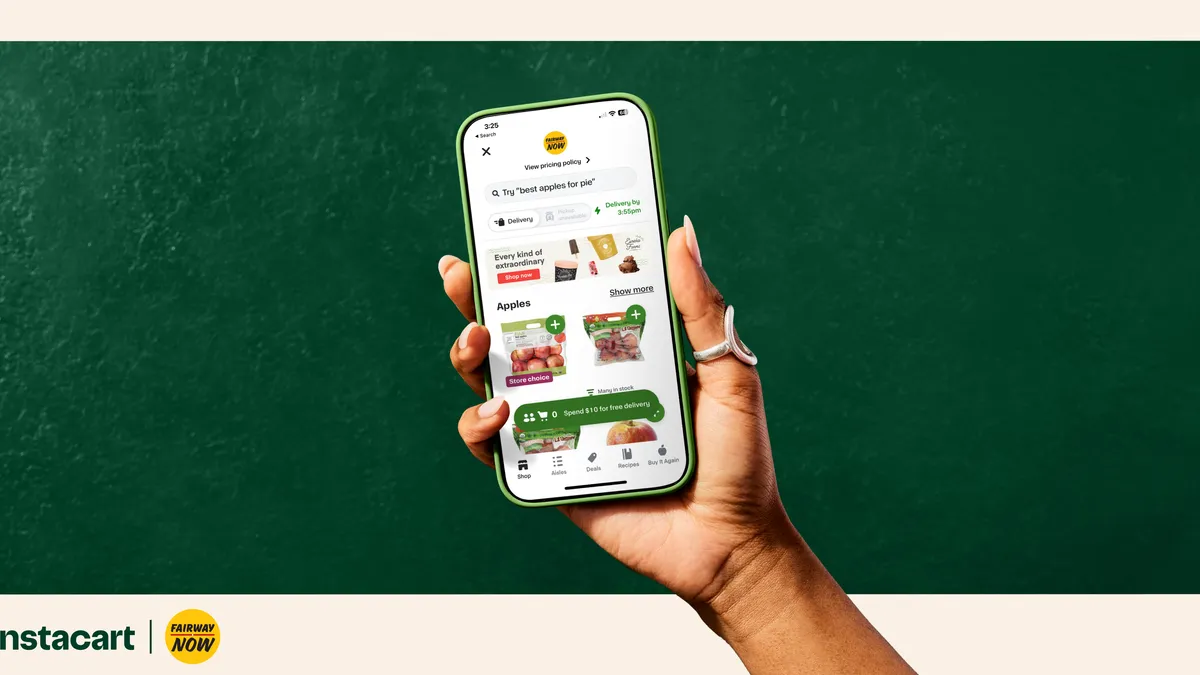

Instacart has made a concerted effort over the past couple of years to redefine itself as a grocery technology company instead of as an e-commerce provider — and when the company’s chief executive took the stage at Groceryshop on Tuesday, she made it clear that the change was about more than marketing language.

“When I came into the role, it was very clear to me that Instacart was much more than just a grocery delivery app, and my vision was really to turn it into a grocery technology company,” said Instacart Chair and CEO Fidji Simo, who assumed her position in 2021. “[But] we were quite far away from that. We were unprofitable [and there were] a lot of questions about whether we were going to be able to grow sustainably again.”

Simo said she looked to the grocery industry to help guide Instacart’s transformation into a multi-pronged company that provides data-analysis tools, smart carts, electronic shelf labels and other capabilities in addition to its legacy delivery and pickup services. In particular, Simo said she concluded that Instacart could stand out by demonstrating that it could help grocers reach more customers regardless of how they shop.

“If you’re just an online technology provider, by definition, your incentives are not aligned with grocers, because grocers want customers no matter of how they shop — whether they shop online, whether they shop in store — and my goal was to build all of the technology that can enable that relationship between a grocer and their customers,” Simo said.