The grocery industry is headed into a whirlwind of change in 2025 if the way last year wrapped up is any indication.

The Kroger-Albertsons mega-merger the industry closely monitored for more than two years not only crumbled come mid-December, but the two grocers then took up arms against each other. Despite this conclusion, industry observers said that M&A activity in the new year is not unlikely.

While current Federal Trade Commission Chair Lina Khan has made a point of pushing back on large-scale corporate mergers, the agency will get a new leader under the incoming Trump administration and could become more open to allowing bigger companies to combine as a result. That could encourage more M&A activity in the grocery industry.

More M&A could also help traditional grocers combat the growing dominance of discounters in the food arena.

The rise of discounters over the past year reflects consumers’ continued efforts to seek out value — a trend that is likely to continue in 2025.

For example, many shoppers who first became familiar with Walmart when they were looking for a reliable grocery delivery provider during the COVID-19 pandemic are now shopping regularly at the discounter as they focus on saving money, said David Bishop, partner at grocery e-commerce consultancy Brick Meets Click.

“That customer, all of a sudden, was exposed to their value proposition and realized that it was more than acceptable, and they shifted and kept a large amount of their purchases there,” Bishop said.

And while inflation did become more manageable in 2024, according to experts, Trump’s promises to implement heavy tariffs on imported goods have raised concerns about how food prices will look in the near future.

Here’s a look at eight trends that are likely to impact the grocery industry in 2025.

Traditional grocers have to sharpen their differentiation

Traditional grocers are coming off a year where they faced rising competition from rivals like Walmart, Amazon and Costco, and those pressures are likely to intensify in 2025, analysts said.

“They’re going to be hyper-focused on getting price right, getting promotions right, promoting the right things, and, most importantly, having those touch points with [their] shopper so they continue to come back,” said Matt O’Grady, president of the Americas for retail analytics firm Dunnhumby.

O’Grady noted that grocers will need to craft strategies to stand out to consumers by providing a balance of value and convenience that other retailers can’t match. “Pricing and the concern about pricing and promoting products is here to stay. It's how you do it that’s going to differentiate who wins and who loses,” he said.

Grocers could counter some of the pressures they face by using personalization technology to differentiate their shopping experience, said Spencer Price, vice president of strategy for Halla, a unit of grocery e-commerce company Wynshop. “In 2025, the focus is going to be on fixing the digital foundation to meet rising shopper expectations,” Price said.

The now-scuttled Kroger-Albertsons merger underscores the challenges even the largest traditional grocers face as they try to hold their own against mass retailers and specialty grocers, said Scott Mushkin, CEO of R5 Capital.

The supermarket chains were looking not only to build scale to help them compete on price and gain leverage with suppliers but also to combine their financial resources to pay for the infrastructure they need to keep up with Walmart, Mushkin said. “You need tremendous amounts of cash flow to step up to the plate and do stuff like that,” he said.

Consumers will continue to focus on value

Last year grocers focused on demonstrating that they are committed to helping shoppers stretch their food budgets — and all signs point to that trend remaining a powerful force this year, according to experts.

“Everybody always says that inflation has fallen back to normal levels, but at the same time, food prices have gone up over the past four years,” said O’Grady, adding that people are buying less per trip and visiting more stores than they did before the pandemic as they look to restore the purchasing power they lost to inflation.

Bishop added shoppers typically place a higher premium on convenience than price when buying groceries online, but noted that retailers that charge less for groceries nevertheless have a distinct advantage because delivery makes it unnecessary for people to travel to the store to make purchases.

“I think price is playing an oversized role in the value equation right now, and customers are making trade-offs that you could view as sacrifices,” said Bishop. “They are still constrained on finances, and that’s leading them to change their buying behaviors, whether that’s what they buy or where they buy or how they buy.”

Price said he expects suppliers to focus heavily this year on ensuring that price-sensitive shoppers view their products as affordable.

“I think that while grocers will still have price-related positioning, there will be a lot of effort from brands and manufacturers to find better ways through retailers, and outside of that, to get discounts, promotions, offers and coupons in front of their customers who need them,” said Price.

2025 will be the year grocers become savvy with data management

As retailers ramp up technology and loyalty program investments to gather more customer information, “data is going to really mean the difference between life and death in the retail industry,” said Gary Hawkins, CEO of the Center for Advancing Retail & Technology.

“Retailers still suffer from all sorts of data quality issues, and it just wreaks havoc across the enterprise — everything from poor or only partial product descriptions, the wrong graphics accompanying a product, the wrong attributes on a product,” Hawkins said.

2025 will finally be the year grocers untangle the “giant hairball” of data to create a unified data foundation — what Hawkins likes to call “the digital core of a company.”

As grocers make cautious investments in technology that they can stack and game plan a significant return on investment, they will need to analyze data more quickly, whether for price accuracy, advertising decisions or other aspects of their businesses, said Anne Mezzenga, co-CEO of retail blog Omni Talk and a former Target executive.

Recent advances in AI pose a prime opportunity for retailers to test and adopt the technology to evaluate and interpret data, Mezzenga said.

“When it first came out, people were like, ‘Cool, how do I make up poems?’ with ChatGPT, but I think retailers have really started to encourage their employees to embrace Gen AI, so that processing this information that they’re getting is something a little bit more manageable,” Mezzenga said.

What will happen with tariffs?

A key question facing the grocery industry as 2025 gets underway is how the new tariffs President-elect Donald Trump has promised to impose on goods from outside the U.S. might impact grocery prices.

Tariffs — which economists describe as essentially a tax on imported goods — could push up prices just as grocers are working to bring down costs for inflation-weary shoppers, said Capri Brixey, a partner in the customer development practice at The Partnering Group who formerly worked for Coca-Cola and Kroger.

“You can upend [supply chain] resilience in a moment if you materially change the costs of doing business for organizations, and then we’re going to be right back in that inflationary space where we’re trying to keep up with the advancing costs of goods,” said Brixey.

Bobby Gibbs, a partner at Oliver Wyman, said grocers could try to take steps to bring down costs to help soften the blow of tariff-spurred price increases: “Absent clarity as to what’s going to happen in the medium term, it’s much easier to be adaptable in the short term with a promotion.”

The uncertainty grocers face about potential cost pressures remains a central issue for them, Bishop said.

“The biggest wildcard, or 800-pound gorilla, is what happens with the new administration and the enactment of policies that are still not well understood or formed, and the first- and second-order knock-off effects that those have” on what goods cost, he said.

Health and wellness needs are evolving

Health and wellness in the grocery aisles gained increased attention from consumers during the COVID-19 pandemic — but experts say the demand for healthy food products is evolving.

Greater transparency with food labels and recent repositioning of products around health and wellness attributes like “added protein” or “low sugar” are fueling awareness and desire by consumers to try to eat healthier, said Bishop.

This is leading suppliers to develop more products without sugar, such as no-sugar-added yogurts, Bishop said, adding that he expects to see more affordability and clarity around health benefits this year.

“Eating healthier has historically been more expensive. But today, consumers are looking more closely at what they’re putting in their bodies as a result of some of the [health] outcomes that they’re now living with as a result of not doing that before … It doesn’t necessarily mean it's a natural, organic lifestyle shift, but rather a shift toward better-for-you items,” Bishop said.

Organic items, though, are still expensive for many consumers, and “most people say price is a barrier to buying healthier food,” O’Grady said.

Grocers need to address affordability, accessibility and motivation to help people discover and stick with healthy eating habits, O’Grady said: “Imagine having seminars in your store, just 15 minutes on how to create a quick, easy meal.”

Private label will put serious pressure on CPGs

Private label growth dominated 2024 as grocers demonstrated that their store brand goods weren’t only a bargain, but also a high-quality offering. This momentum isn’t expected to slow in the new year, with industry analysts anticipating more curated and specialty approaches to grocers’ private label lines.

“I think what we’re going to see is retailers invest more intentionally in differentiated offers that focus on specific consumer segments,” said Diana Sheehan, principal and CEO of PDG Insights.

Sheehan highlighted Walmart’s launch last year of bettergoods, a trendy private label line with a wide variety of plant-based options: “That came out with intention, and that was a leap for [Walmart]. They have not really done that before, but they’re recognizing the growth in that space. And, in the interest [of] younger consumers and better-for-you, I think you’re going to see other retailers follow suit.”

Retailers like Costco and Aldi have had renowned private label lines for some time, but 2024 proved that any grocer can build out store brands, according to John Clear, senior director in the consumer and retail group at consulting firm Alvarez & Marsal. Sprouts Farmers Market, a specialty grocer that doesn’t carry a low-price image, successfully introduced a private brand that is “extremely strong in terms of affordability,” he noted.

Gibbs said he believes that growing private brand success, coupled with the emphasis on innovation across categories, may begin to hurt CPGs.

“Consumers have been learning that [grocer’s] private label products are good. And once you break brand affinity, it’s broken, and it’s harder for CPG companies to win back,” Gibbs said. He added that, looking ahead into 2025, private label will see a push in innovation as grocers and CPGs compete for consumer dollars.

Electronic shelf labels will hit mainstream adoption

Electronic shelf labels saw highs and lows last year, with the technology seemingly off to the races with Walmart’s announcement in June that it plans to bring ESLs to 2,300 stores by 2026 before it hit a major road bump when several U.S. senators publicly probed the usage of the technology at Kroger and Stop & Shop.

Retailers working on ESLs paused their efforts or continued them quietly as the technology was politicized last year, especially ahead of the presidential election, Clear said.

“There’s not really any evidence to show that ESLs are used for surge pricing or to gouge customers,” Clear said. “They exist all over the world, and it hasn’t happened. But I think [the political scrutiny] was a very timely thing to happen because everyone's so focused on pricing.”

But ESLs are in a prime position to take off in 2025, Clear and Mezzenga agree.

ESLs are “such a clear business case — and in most cases, they drive labor costs down and improve the shopper experience — that I really think that they’re going to make a comeback,” Clear said, noting that many companies Alvarez & Marsal speaks with said they are exploring the technology.

Mezzenga said ESLs provide opportunities to layer capabilities on top of their core function. Pick-to-light features can make it easier for consumers and workers to find products by flashing lights on the tags. The tags also do away with the need for workers to print and hang paper tags in addition to giving retailers a better view of pricing data, inventory and out-of-stocks.

Consumer-facing AI will grow

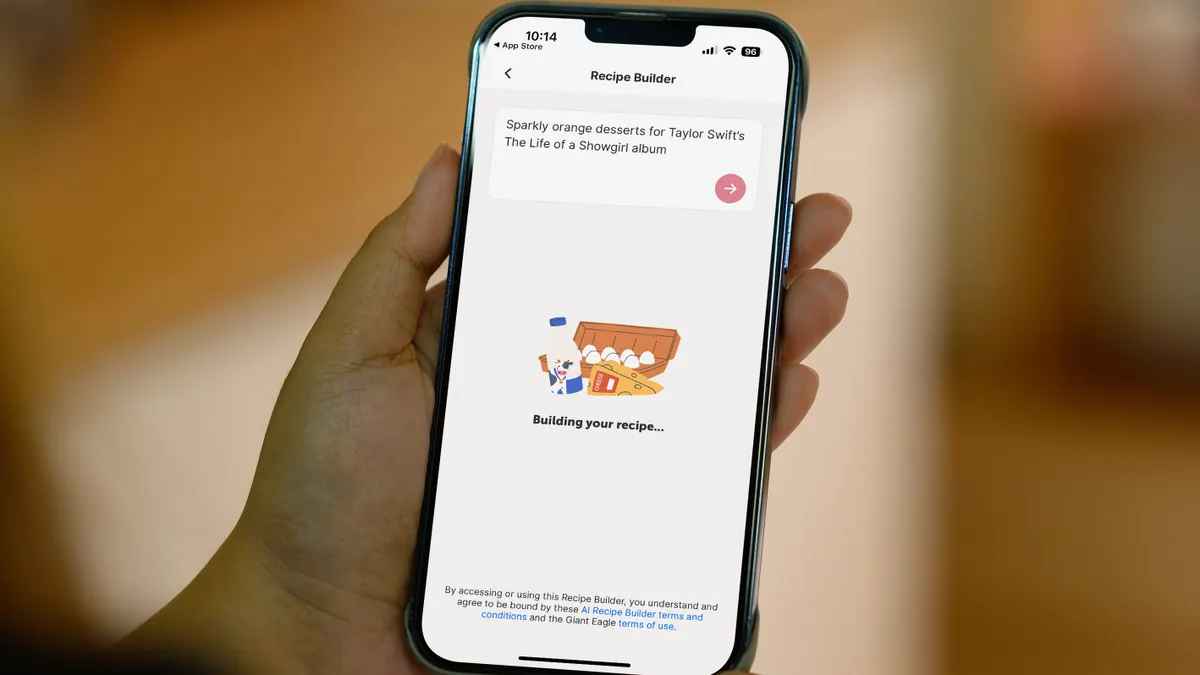

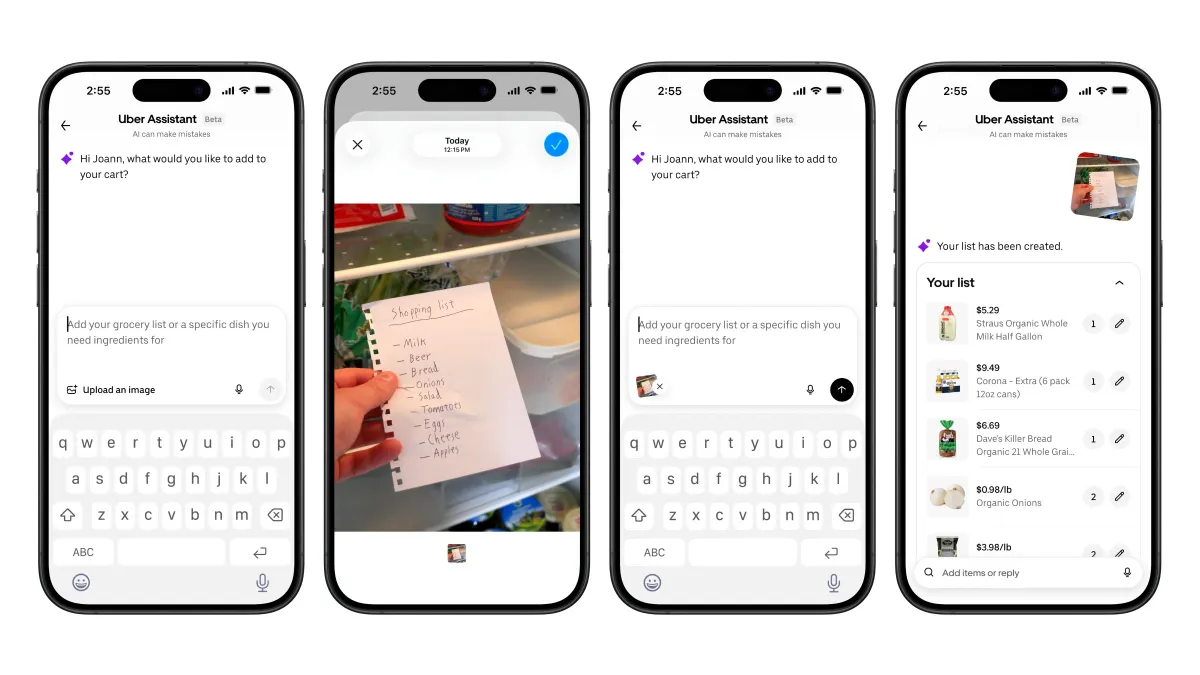

Last year saw grocers slowly but surely integrate artificial intelligence across their operations. They’re now tapping the technology to manage a broad range of tasks, including forecasting when fresh produce will be in stock, assisting with category management and bolstering retail media operations.

Moving into 2025, however, most experts anticipate grocers will tap AI in a more targeted way, with an emphasis on personalizing the shopping experience.

“I think generative AI and the opportunities to drive up personalization as it relates particularly to retailer loyalty programs will be big in 2025,” said Rachel Dalton, head of retail insights for consultancy firm Kantar. Dalton also added that an overall focus on personalization will improve the shopping experience in-store and online with, for example, Gen AI search functions.

Amanda Lai, director of food industry practice at McMillanDoolittle, also expects to see AI play a more prominent role in grocers’ personalization efforts, specifically when building out features like tailored recommendations. Though Lai doesn’t anticipate custom recommendation technology becoming “anything groundbreaking,” she predicts the technology will grow more customized for the user and faster as it continues building off existing capabilities.

According to Bishop, as AI technology continues to put relative products and recipes in front of consumers — primarily by gathering shopper data based on past purchases, search history or even users’ own account bios — grocers will see “improved sales and ultimately reduced costs because of the greater efficiencies driven by [AI].”