Editor's note: This story is part of a series on the trends that will shape the grocery industry in 2021. You can find all the articles on our trendline.

Having closed the book on one of the most tumultuous years in recent memory, grocers are now looking ahead to a 2021 filled with opportunity and uncertainty. Although the novel coronavirus pandemic that hit the U.S. last March has delivered a sales windfall to food retailers, it's unclear how consumers will respond once their communities, offices and schools open back up and they can dine inside restaurants once more. It's also unclear when, exactly, that will all happen as COVID-19 vaccines haltingly roll out across the U.S.

If 2020 was about quickly responding to a public health disaster, the theme for 2021 promises to be strategically managing their gains for long-term growth, industry experts say. Instead of retooling their supply chains to keep pace with record demand, retailers will focus more on merchandising and securing customer loyalty. Instead of racing to add e-commerce servers and delivery drivers, grocers will zero in on efficiency and make online shopping a better experience.

Here are a few of the top trends that promise to shape the grocery industry in 2021.

E-commerce gets a lot more 'seamless'

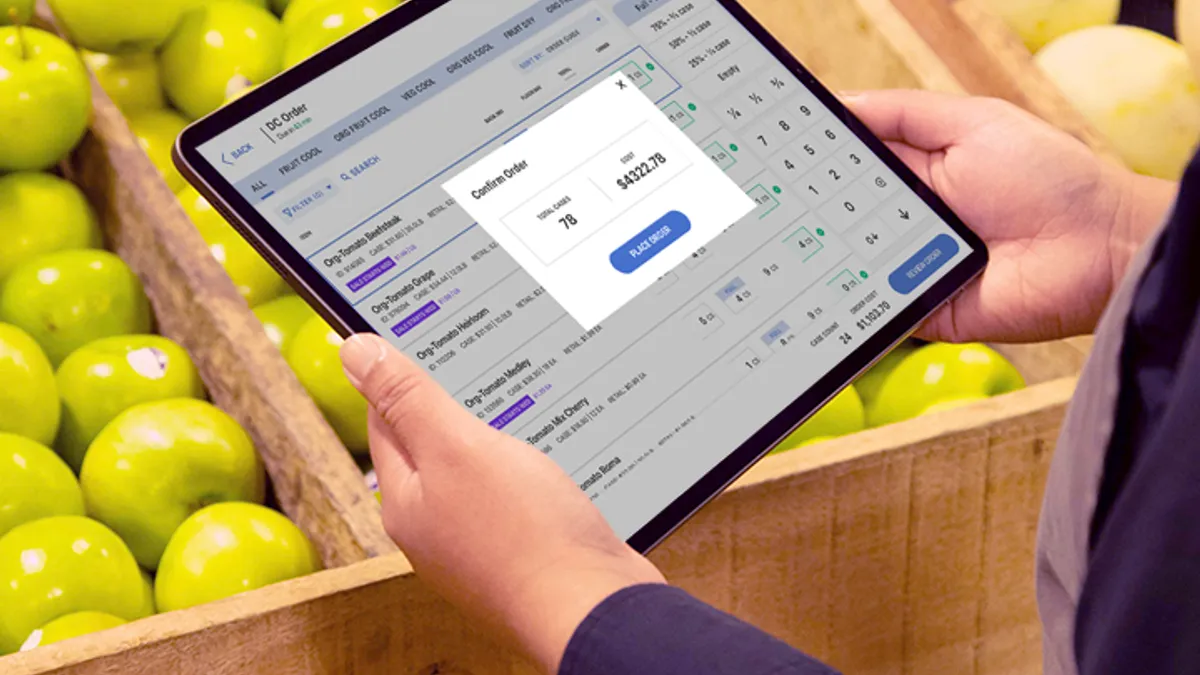

The long-forecast online grocery boom happened all at once in 2020. Now, experts say, it's time for grocers to improve their platforms and also make online order fulfillment more efficient.

Pickup, which emerged as consumers' favored e-commerce mode, is especially ripe for improvements given the high demand and the low-tech approach many retailers still take, said Tom Furphy, CEO and managing director of Consumer Equity Partners, which invests in retail technology.

“It’s a combination of ‘I’ve got products coming in and staged in the store in a way that’s more efficient’ and ‘I’ve got technology that allows them to pick through that more efficiently,’” he said.

Grocers are investing in order- and labor-management technology. They're also moving toward dedicated spaces, whether in-store pick areas or dark stores, that are optimized for order picking efficiency. Jordan Berke, a former e-commerce executive with Walmart China and founder of Tomorrow Retail Consulting, said he's advising grocers to stretch fulfillment capacity at stores by utilizing extra space and automation before pushing into a dark facility after that.

As retailers explore more mature fulfillment strategies, they’re finding it makes more sense to do the picking and order assembly themselves and push pricier operations like delivery over to third-party providers, Berke said.

“The grocers are going to start to take over the picking because they know that is an area they have to be good at,” he said. “And when you're paying Instacart 10% of sales, when you could be picking it at 5% of sales ... you can't go forever at arbitrage.”

Bill Bishop, chief architect at Brick Meets Click, believes 2021 will be the year when "seamless integration of e-commerce" becomes a top priority for retailers. In addition to process improvements, he said grocers will implement more personalization technology and meal-planning tools that will make online shopping a more manageable — and perhaps even an enjoyable — experience.

The fight to retain meal dollars

Grocers got a major boost from consumers’ meal dollars when the pandemic stifled restaurants and spurred at-home cooking. But restaurants are going to grab many of those dollars back in 2021 as more people get vaccinated and communities reopen.

"The grocers are going to want to hold onto as much of that as possible,” said Tory Gundelach, senior vice president of retail insights with Kantar Consulting.

To fuel the at-home cooking surge and combat meal prep fatigue in 2020, retailers turned to technology to make shopping and meal prep easier. Kroger launched an artificial intelligence-based digital tool that suggests recipes based on tweeted photos of food items, while Hy-Vee, H-E-B, Schnuck Markets and many others added fresh meals, including restaurant selections, to online ordering.

With a post-pandemic future in sight, grocers should consider offering meal kits for dinner and boosting breakfast options, Gundelach said. Target, for one, now carries HelloFresh and Local Crate meal kits along with fresh meal-in-a-bag deals. Retailers have also added new contactless services like smoothie-making machines and salad robots.

Grocers are banking on long-term shifts in culinary habits and work-from-home routines to fuel interest, and Gundelach said customers who cooked during the pandemic will likely continue to explore at-home culinary experiences even as people return to bars and restaurants. But retailers will have to invest in innovative merchandising and offerings to keep shoppers interested.

“I think we'll see grocers lean into things like food inspiration to keep shoppers wanting to cook at home,” Gundelach said.

It’s showtime for Kroger

More than two years after announcing plans to build a network of robot-run fulfillment centers, Kroger and Ocado will begin opening those facilities in 2021, potentially giving the nation’s largest supermarket operator a leg up in handling the accelerated pace of e-commerce orders the industry is seeing.

The industry will be watching closely to see not only what's inside those voluminous customer fulfillment centers, but also how the companies will handle same-day delivery and pickup orders — two channels that have exploded since Kroger and Ocado first announced their tie-up.

“They’ve had to spend a lot to get the point that they are currently in, but 2021 is the year when I think they start to reap the rewards from some of these things and we start to see the impact this kind of automation can have on the industry,” said Neil Saunders, managing director of GlobalData Retail.

Kroger has launched numerous other initiatives that will be closely watched, said Jason Goldberg, chief commerce strategy officer at Publicis, including its partnership with Walgreens, digital marketplace and ghost kitchen pilot.

“Kroger is a special case, because they invested in a variety of things that are almost contradictory, and they’re not all going to pay off,” said Goldberg. “We don’t know if the future is going to be won by pickup from individual stores or if it’s going to be won by delivering groceries from a big fulfillment center, but the odds are if one of Kroger’s bets pays off really well, it’s going to be because the other one is less popular.”

Managing investor expectations after a boom year

Grocers grew accustomed to stellar sales growth as the pandemic drove customers to physical and online grocery channels at an unprecedented rate. But they will likely see those outsize gains, which have included triple-digit year-over-year increases in digital revenue, give way to more modest progress — or even negative results — if the nation is able to get the coronavirus under control during the coming year.

“That’s one of the key narratives that grocery stores will have to sell into Wall Street — explaining to them how the long-term trajectories of the businesses are actually very positive” even though the exceptional growth food retailers have been seeing is likely to subside, said Saunders. Investors “build certain expectations into their models … so we’re going to have to have a reset on those expectations.”

Goldberg said the fact that it will probably take months for the country to widely distribute COVID-19 vaccines will give grocers an opportunity to solidify connections with consumers, which could help them maintain at least some of the momentum that has made 2020 such a standout year.

“If anything, we’re probably more worried about comps and sales in 2022, because by then, hopefully, the health outlook will be a lot better and there’s likely to be a backlash where a lot of people are desperate to get back out to the restaurants," he said.

Loyalty programs evolve

Grocers have long discussed evolving their loyalty schemes beyond basic points-based programs. But 2020 appears to have finally tipped the scale as Amazon’s grocery stores — and with them, its sprawling Prime program — went up in markets around the country and Walmart unveiled its own premium loyalty program, Walmart+.

Paid membership programs promise to shore up customer loyalty as e-commerce makes it easy for shoppers to stray from their established grocers. Hy-Vee Plus includes a personal shopping service, free delivery and a dedicated customer help line. Grocers could also hold special events for members, give first access to new products and tie in discounts with other companies, said Gary Hawkins, a loyalty expert and CEO of the Center for Advancing Retail & Technology.

Membership dues aren’t necessary for grocers refreshing their loyalty programs, said Bishop with Brick Meets Click. Look for grocers to start offering unique perks tied to their brand identity, he said, pointing to Ohio’s Dorothy Lane Market, which emphasizes its local appeal by offering discounts at area businesses like dance studios and landscapers.

“Loyalty is no longer just discounts and points,” he said. “It's really a way to reach out of your customers, and then use whatever is unique in your personality as a brand.”

Health gets personalized

Many consumers tended closely to their health in 2020 as they watched a deadly virus sweep across the globe. That heightened awareness, coupled with advances in personalization technology, set the table for grocers to establish custom wellness programs that promise to fully integrate food shopping with personal health.

Grocers have long offered dietitian counseling and have boosted health marketing over the years. But personalized health promises to deliver tailored diet plans, product recommendations and help shoppers more easily navigate stores and online platforms.

The movement reflects the growing focus on preventive medicine and the role food plays in that, with Kroger notably saying it plans to closely integrate its grocery selection with healthcare guidance and resources.

With health records increasingly going digital, Hawkins said retailers can potentially access more consumer health information than ever. They could also tap into information fed through wearable devices like the Apple Watch — all with shoppers’ permission, of course. In a recent paper, he highlighted Carnival Cruise Line's Ocean Medallion program, which uses personal information to, among other perks, alert restaurant staff to dietary preferences and allergies.

Amazon's breakout year in grocery

Amazon shows no signs of slowing its march in grocery after it spent last year introducing new store formats and improving its in-store and online shopping technology.

The e-commerce powerhouse debuted two new store formats, welcomed millions of new customers to its online grocery service and rolled out pickup to all Whole Foods stores. Grocers should expect Amazon to continue expanding its physical grocery footprint in 2021, with sources noting it has signed at least 100 leases so far for new Amazon Fresh locations.

“I’m really nervous for the regionals because I think that 2021 is just going to be a crazy year for Amazon grocery,” Anne Mezzenga, co-CEO of retail blog Omni Talk, said.

Mezzenga said she expects Amazon to take more of the slice of the Gen Z shoppers who care about convenience as more stores open. Meanwhile, Whole Foods, which already has an established customer history, will likely serve as a testing ground for new products, services and technology, she said.

In addition to scaling and refining its grocery footprint, Mezzenga predicts Amazon will couple its grocery stores with healthcare hubs, continuing its recent foray into healthcare and the pharmacy business. “It is very realistic that they could put a healthcare hub in [an Amazon Fresh store] and if not a healthcare hub, maybe a pharmacy first and then doing minute clinics,” she said.

More healthcare options integrated into physical retail could help Amazon in its growing competition with Walmart, which unveiled Walmart+ in September and plans to expand its own health centers.

M&A comes out of hibernation

Grocers are likely to turn their focus to post-pandemic planning in 2021, shifting from reacting to virus-induced challenges to determining how to move forward on longer-term solutions in areas like e-commerce.

“No two retailers are taking the same approach yet acquisitions, the ‘buy’ side of the equation, will become even more attractive as struggling brands and retailers become desirable targets,” Carol Spieckerman, president of retail consulting firm Spieckerman Retail, wrote in an email.

In the years prior to the pandemic, acquisitions had been ramping up with larger grocers expanding their regional clout as smaller players cashed out. Booming sales promise to raise acquisition costs and keep struggling players afloat, and could mean more cross-industry deals like Albertsons' acquisition of Plated and H-E-B's acquisition of Favor.

The rapid pace of e-commerce development in 2021 could lead to more deals like Ahold Delhaize's tie-up with FreshDirect. Retailers may also scoop up service providers that can give them a leg-up in key technologies. Spieckerman pointed out that Canada's Loblaws recently acquired technology and talent from digital marketing and analytics company Eyereturn Marketing, which promises to boost its in-house data capabilities and tech bench.

“Acqui-hiring” — acquiring a company to recruit employees — will likely continue as retailers compete more aggressively with technology companies for labor, Spieckerman said.