As grocers continue to seek solutions to bridge the gap between e-commerce’s operational costs and its affordability for shoppers, Amazon’s newly announced grocery subscription program has put a renewed spotlight on the role subscriptions can play.

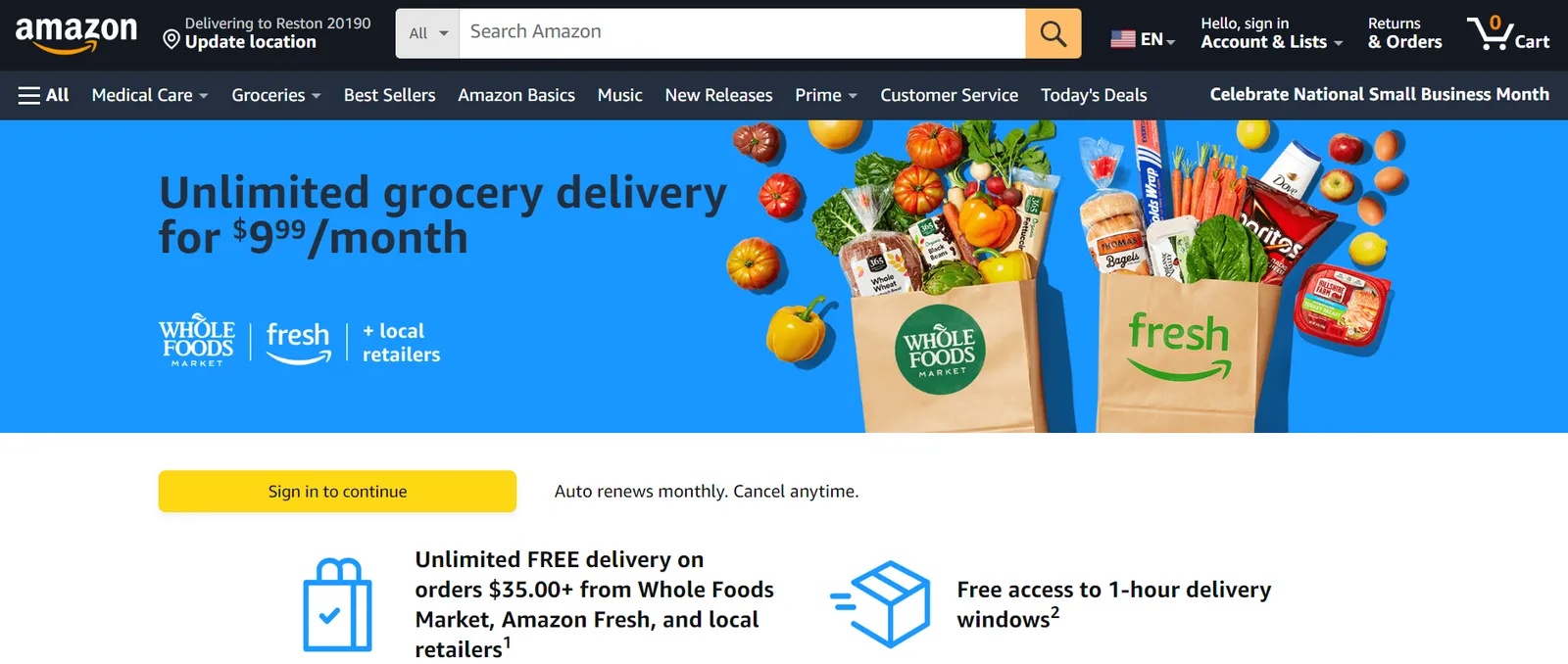

Amazon is positioning its newly announced grocery subscription, which costs $9.99 per month for Prime members or $4.99 per month for non-Prime members with an EBT card, as a “low, monthly fee” that “pays for itself” after one delivery per month.

“If you order once from Whole Foods a month, it pays for itself, or once from Amazon Fresh for orders under $40, it pays for itself,” Amazon CEO Andy Jassy told investors Tuesday.

The subscription unlocks free grocery delivery on orders over $35 across Amazon Fresh, Whole Foods Market and grocery retailers on Amazon.com such as Cardenas Markets and Save Mart. It also covers one-hour delivery windows where available and 30-minute pickup and also gives priority access to recurring time slots for a weekly grocery order.

Amazon offering a subscription for grocery underscores how e-grocery is a low- to no-profit channel, GlobalData Managing Director Neil Saunders wrote in an email: “It is incredibly costly to service online orders, even for an expert in logistics like Amazon.”

As grocers are facing the headwinds of e-commerce growing more slowly now than predicted during the pandemic, they need to pass along at least some of the costs of e-grocery to consumers, said Brick Meets Click Partner David Bishop.

Anne Mezzenga, a Target veteran and co-CEO of retail blog Omni Talk, said it makes sense from Amazon’s perspective to see who’s willing to pay for a grocery-specific subscription. Mezzenga believes the subscription could be an attractive option for frequent online Whole Foods shoppers.

However, since most consumers in the U.S. are more familiar with their regional grocer than with Whole Foods or Amazon Fresh, other subscription options, she said, can provide a broader range of retail establishments and food options for the same monthly fee, such as Grubhub+, DashPass and Instacart+.

“The problem here for me is that Amazon is still so limited in what that $10 a month is getting you. From a customer's perspective, I think you’re not going to see the adoption that Amazon wants from the greater U.S. but there will certainly be some people that are willing to pay for it. And at that point, is it wrong for Amazon to charge those people?” Mezzenga said.

Along with selection, the quality of e-commerce fulfillment is also key for locking in subscribers — from where deliveries are left to how quickly and carefully they are fulfilled to packing hot and cold items correctly — as retailers seek to build relationships and loyalty among their customers, Mezzenga said.

Analysts said they are skeptical as to how successful this subscription will be for Amazon due to its ongoing challenges with solidifying its grocery business. The new subscription also follows a series of rapid e-grocery changes by the company, including raising then, a few months later, lowering order minimums for free delivery from Amazon Fresh. Quick changes can lead to consumers feeling uncertain about whether a company plans to stick with its latest offering, Bishop noted.

“You have to be careful about touching things so frequently that the customer then anticipates or expects that this is just going to be the way this retailer works. And that's not good for certainty,” Bishop said.

Analysts said the subscription is a move by Amazon to rightsize its grocery e-commerce business.

“The grocery subscription is an attempt to drive more volume through the business, especially via existing customers,” Saunders said. “Subscription schemes tend to increase loyalty, frequency and average spend as consumers try to get maximum value from them and switch some of their buying from other retailers.”

Having higher volume creates a virtuous cycle that improves staffing, service times and repeat orders, while lower volumes create a vicious cycle of staffing woes, longer fulfillment times and lowered customer satisfaction, Bishop said.

Subscriptions can also improve the perceived level of affordability for existing customers while tapping into incremental spend from locked-in users for retailers, he said, adding that they can encourage a single-order customer to become a two-order customer and improve retention for more frequent shoppers by dissuading them from shopping elsewhere.

“This is a necessary evil that more grocers will take up,” Bishop said.

Amazon, Target and Walmart have focused their subscription programs on delivery, but Brick Meets Click is urging grocers to focus on pickup when considering subscriptions, Bishop said.

Regional grocers and small grocers may have a tough time selling shoppers on an e-commerce subscription, however.

Their reliance on third-party providers that already have subscription programs, like Instacart and DoorDash, makes it tough to offer a unique service that incorporates delivery, he said. Unlike Walmart and Target, which have free pickup, regional grocers usually have a pickup fee that is sometimes scaled based on the amount spent or how quickly a customer wants to get their order, Bishop said.

By offering a pickup-focused subscription program, regionals can leverage their close proximities to customers as well as consumer trust in their services to drive sign-ups, he said.

“We've seen over time … that a customer who uses a service more often for a longer period of time spends more and makes more orders,” Bishop said.