A customer walks into a store not called Amazon Go and grabs an apple and a cucumber. He turns to a nearby screen and sees the items pop up alongside their prices. The same customer continues walking through the store selecting products while in each department an identical black screen, as if by magic, adds each selection to the running total.

When the customer is finished, he can pay with a credit card or with cash — or just walk out.

This is the experience, delivered through an immersive virtual reality walkthrough, that Israeli technology firm Trigo Vision presented to attendees at the recent Groceryshop conference in Las Vegas. The demo takes place in a small, unnamed store somewhere in Europe, according to company reps, and it depicts a shopping routine that the startup, which recently announced $22 million in venture funding, hopes to eventually bring to full-size supermarkets.

Other computer-vision outfits like Standard Cognition, Grabango, Sensei and Zippin are also developing cashierless technology similar to Amazon Go, which has dazzled customers since it went live in early 2018.

At the same time, self-checkout consoles and mobile checkout programs are evolving, while a new class of carts enabled with computer-vision technology are being tested on both coasts.

The race to a faster front end is officially underway in the supermarket industry.

"I think everybody knows this is coming," Will Glaser, founder and CEO of Grabango, which has installed its computer vision technology in two U.S. stores, told Grocery Dive. "A lot of retailers are trying to choose a partner and we're trying to choose partners, and you don't want to be left alone when the music stops. You want to have the way forward."

Beyond scan-and-go

While computer-vision firms work their way through scaling and testing, self-checkout and mobile checkout programs remain the preferred choice for retailers and consumers. Albertsons recently rolled out self-checkouts across its banner stores several years after phasing them out. The new machines, manufactured by Toshiba, allow stores and shoppers to customize their payment options, including mobile payments.

According to consulting firm Boston Retail Partners, 14% of retailers currently have a mobile scan-and-pay system installed and 39% plan to install one within the next two years. The firm also found in a recent survey that three-quarters of digital consumers aged 18 to 37 say they're more likely to choose a store with self-checkout over one that doesn't, while 67% said they'd do the same for a store that offers mobile scan-and-go.

Judging by the offerings on display at Groceryshop in Las Vegas, though, self-checkout and mobile checkout programs are poised to evolve.

Australia-based Tiliter made waves at the show with a camera attachment that automatically recognizes fresh produce, negating the need for customers to enter PLU codes or navigate a search menu. The system, CEO Marcel Herz said, can quickly weigh and identify fruits and vegetables and is able to tell the difference between different types of apples, grapes, pears and other produce.

Mobile checkout — also known as scan-and-go — could also be in for a facelift. Futureproof Retail, which debuted its technology inside Fairway Market stores in New York last year, now offers pop-up product recommendations tailored to customer preferences. Futureproof president Di Di Chan told Grocery Dive the recommendations, powered by food intelligence firm Halla, are intuitive and non-intrusive — a recommendation for cream cheese to go along with bagels, for instance. Futureproof is also powering an order-ahead deli tool for Fairway.

While some retailers like Meijer have rapidly scaled their mobile scan and checkout programs, others like Walmart have struggled to make the technology viable. Jamie Iannone, CEO of SamsClub.com, said the club's customers like its Scan & Go platform but want the experience to be as frictionless as possible. So the company is adding a machine learning component that lets customers quickly scan the whole product rather than just the barcode.

"It's pretty easy to tell paper towels from a case of soda. But telling lettuce from spinach is a fun engineering challenge," Iannone said during a presentation at Groceryshop.

Umer Sadiq, a former Amazon engineer, on the other hand, isn't a fan of scan-and-go technology. "It's putting pain on the consumer just to get automation done," he told Grocery Dive.

Down on mobile checkout but uninterested in developing a pricey alternative to his former employer's Go store, Sadiq and fellow ex-Amazonian Shariq Siddiqui along with former Googler Faisal Shifayat aimed for something in between. The three co-founded Veeve, which makes a "smart" shopping cart outfitted with cameras and a finely tuned scale that automatically recognizes and tallies up every product a shopper drops in. The carts, currently in test mode at a Seattle grocer Sadiq declined to name, identify customers via their loyalty card or a QR code and can track purchase histories and promote products on its screen based on where shoppers are in the store

Sadiq told Grocery Dive next-generation carts — which includes a solution from Caper that just raised $10 million — are scalable and ready for deployment in full-size supermarkets, in contrast to pricey Amazon Go-style technology, which has yet to open in a box larger than a few thousand square feet.

"I know Go has limitations," he said. "It does not scale with the store. What we did was put Go technology inside a cart."

Computer vision ramps up

Trigo Vision originally intended to make smart carts, as well. But the Tel Aviv-based company began meeting with executives at Shufersal, Israel's largest supermarket chain, who told the startup to focus instead on just-walk-out technology, arguing it would be a game-changer for shoppers. Trigo shifted its focus and now has a deal in place to scale its computer-vision system across Shufersal's 272 stores. The first retrofitted store — a 4,000-square-foot store in the heart of Tel Aviv — will go live with the technology in the second quarter of next year, Ran Peled, Trigo's vice president of marketing, told Grocery Dive.

Trigo Vision has reportedly begun piloting its cashierless technology with Tesco. Peled declined to confirm the news, but said the company is in talks with retailers in Europe as well as the U.S.

Trigo's technology relies on ceiling-mounted cameras, shelf weights and artificial intelligence-powered computing to track shoppers throughout the store, then process their payment as they walk out. Shoppers can also pay on the spot with cash or credit card. It offers a near facsimile of the Amazon Go experience, though the firm is also focused on perimeter departments and can process produce selections and deli items. Produce items rely on special bins equipped with weight sensors. Peled declined to elaborate how Trigo processes deli items, only noting that the company has "solved" the department.

The system can't operate in a full-size supermarket, however — at least not yet. According to Peled, the computing systems necessary to crunch all the data Trigo gathers inside a 40,000-square-foot store aren't yet available at a scale and price that makes sense. Peled said Trigo's system generates one terabyte of data every second.

"You essentially need a supercomputer in the back of every store," he said. "So you're waiting on companies like Nvidia and Intel to allow for a scalable deployment of supercomputers in the back of stores."

Peled said Trigo will become more scalable and cost-efficient than Amazon Go since it's focused on retrofitting onto existing stores. Peled estimates it will take Trigo five years to scale across the chain's collection of large and small stores.

Amazon, meanwhile, is reportedly preparing to open its largest Go store yet, a 10,400-square-foot location in Seattle's Capitol Hill neighborhood.

"We are running a marathon that will eventually bring us to the scale that everyone wants us to be at faster than others," said Peled. "We are focused on the big prize."

Grabango, on the other hand, isn't waiting around for technology to advance. Glaser said the company's skip-checkout program is currently running in a 2,000-square-foot store — reportedly a Giant Eagle GetGo convenience store in Pittsburgh — as well as a 40,000-square-foot supermarket Grabango declined to name. Glaser said the system can scale up to stores as large as 100,000 square feet, with up to a thousand customers inside.

Glaser said the company's system, which also relies on ceiling-mounted cameras and sensors, is decidedly less complex and less expensive than Amazon Go. It uses simpler algorithms on items like bottled water that can be easily recognized, thus using less computing power. If the system only returns an 85% confidence rating in recognizing a product, Glaser said, "only then do we run the fancy algorithm." Amazon Go, he noted, "is running the fancy algorithm all the time."

"They built it the very expensive way, and we built it in the cheapest way that works," he said.

There are other ways Grabango's system factors out complexity. Weighted items like produce are still processed by cashiers. The next step, Glaser said, is for consumers to be able to weigh and identify produce themselves in the department.

Glaser characterized Grabango's technology as ever-evolving and focused on offering shoppers a range of choices. Customers can choose to shop a store the traditional way or the fast-checkout way. They can pay via cash, credit card, food stamps or mobile payment.

"We don't want to force everyone into one bucket. We presume there will be a diversity of experience and diversity of tastes, and we serve all of them."

"I know Amazon Go has limitations. It does not scale with the store."

Umer Sadiq

Co-founder of Veeve and former Amazon engineer

Selling the experience

While checkout innovations vary in their approach, they're all focused on securing loyalty and crafting a more compelling shopping trip. Experience is the main motivator for the retailers Trigo Vision has spoken with. Traditional supermarkets, which have lost customers to discounters, specialty players and other competitors, are looking for an edge, Peled said.

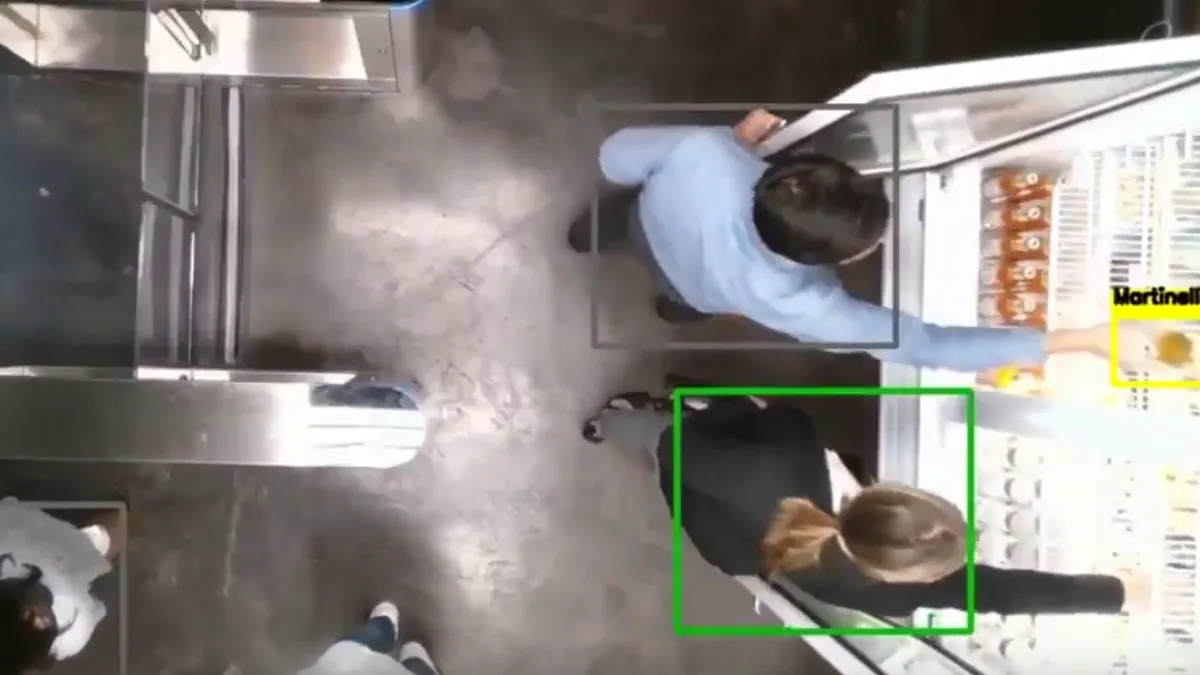

Technology firms are also selling retailers on cost benefits like reduced shrink. Because Grabango's system can detect products placed inside customers' pockets, Glaser said, it can prevent consumer theft and employee "sweethearting" — the practice of employees passing products free-of-charge to customers.

"When you know where everything is in the store and you know where everybody is in the store, shoplifting becomes really difficult," he said.

Kate Hogenson, a consumer loyalty expert and senior consultant with Kobie Marketing, told Grocery Dive removing friction at checkout can deepen consumers' emotional loyalty with a retailer. But retailers that have the most success are the ones that walk consumers through the new technology. As an example, she cited employees posted at the front of Amazon Go stores she's visited in her hometown of Chicago. The workers show customers how to download the app needed to enter the store and offer to answer any questions.

Tying any new checkout technology directly to a company's loyalty program is also crucial, she said, noting Starbucks' updated ordering and discovery app.

"Retailers think it's all about comfort and convenience, but if customers aren't familiar with the technology then it can't be either of those things," Hogenson said.