At the start of the year, Grocery Dive released its annual trends forecast, including expert predictions for the grocery industry in 2024. Professionals expected a focus on enhancing value retailing, omnichannel strategies, and improving in-store experiences, along with an emphasis on utilizing physical stores for e-commerce fulfillment.

Analysts flagged as key players to watch Kroger and Albertsons, which were then enmeshed in their ultimately unsuccessful quest to merge, and Walmart.

As 2024 proceeded, grocers faced heightened political and public scrutiny, from legislators questioning the usage of electronic shelf labels to presidential candidates spotlighting high food costs. With the year coming to a close, the Kroger-Albertsons saga has seen a major twist with Albertsons calling off the merger and suing Kroger after two judges blocked the deal.

With the year almost over and as the Grocery Dive team works on our trend predictions for 2025 — set to publish in early January — the team has revisited our 2024 prognostications and graded them based on how events actually panned out.

Prediction: Grocers will keep ramping up in-store experiences

Grade: A-

The past year saw grocers take a mixed approach to how to make their brick-and-mortar stores stand out.

Some embarked on new store formats, like Publix, which continued to roll outa bigger and bolder store prototype that aims to bundle aspects of a specialty banner with a traditional grocery shopping experience. Sam’s Club made a major play on the in-store innovation front with a Scan & Go-only location in the Dallas area that boasts a large sushi island, a pizza-making robot and several e-commerce fulfillment tools.

SpartanNash started piloting a new store format that focuses on fresh products, convenience and value, from prepared food options to a beef jerky bar to a spotlight on the produce department.

While ghost kitchens have largely failed to come alive after a brief burst of popularity during the COVID-19 pandemic, grocers and retailers are continuing to add in-store restaurants and fast-casual options. This year, Walmart opened fast-casual dining experiences inside stores in partnership with several brands including Crave Hot Dogs & BBQ, Mr. Gatti’s Pizza and Knuckies Franchise Company LLC.

Prediction: Retailers will take a more sophisticated approach to omnichannel

Grade: A

The grocery industry pushed aggressively on the omnichannel front in 2024 as retailers embraced technology for in-store experiences and refined their approach to serving shoppers online.

Electronic shelf labels made strong inroads among grocers, highlighted by Walmart’s June announcement that it intends to bring the digital tech to 2,300 locations by 2026 following a test at a single store in Texas. ESLs also evolved significantly, as a growing number of retailers began using pick-to-light capabilities on certain models of the tags to help employees and shoppers find items on store shelves.

Instacart focused on tapping retailers’ growing interest in more closely integrating their online and in-store operations. The grocery technology company brought its Caper Cart smart carts to more retailers while also improving the carts’ utility by adding games and personalized coupons. In May, the company indicated that it sees smart carts as a powerful growth driver, in part because of their ability to present digital advertisements to shoppers as they walk through stores.

Prediction: E-commerce fulfillment will center on stores

Grade: B+

Grocery e-commerce posted a strong performance in 2024. November saw an all-time high of 77.8 million households purchasing groceries online, a figure that exceeded the previous record high set in April 2020, the first full month of the COVID-19 pandemic, according to data from Brick Meets Click and Mercatus.

Despite e-commerce’s overall resilience, traditional grocers struggled to keep up with Walmart. The mass retailer captured a significant amount of grocery e-commerce spending throughout the year and grabbed a record-high share of 37% in the second quarter.

As far as in-store e-commerce fulfillment was concerned, however, no groundbreaking progress occurred in 2024. There were some advances — perhaps most notably the arrival in some stores of electronic shelf labels with flashing lights to help guide associates to items from online orders — but developing e-commerce capabilities in stores wasn’t a primary focus for grocers this year.

Prediction: This is the year retail media starts to grow up

Grade: B

Retail media continued to gain momentum in the grocery industry throughout 2024.Yet, grocers’ growing efforts to take advantage of their troves of data about shopping trends brought added focus to the costs and complexities they face in doing so.

An increasing number of regional grocers entered the retail media arena, using tie-ups with third-party technology companies to go up against national retailers like Walmart and Kroger. For example, Northeast Grocery, owner of the Price Chopper/Market 32 and Tops Friendly Markets, launched a retail media network in conjunction with Inmar Intelligence in July. Also that month, Homeland Stores launched a retail media partnership with Quad/Graphics Inc. ShopRite, meanwhile, is working with Grocery TV to deliver health and wellness messaging and advertising to pharmacy customers.

But as they step further into the digital media space, grocers are grappling with challenges that accompany their growing role in collecting and handling large amounts of data, including personal shopper details. In September, the Interactive Advertising Bureau released a set of definitions and measurement standards to help retailers navigate their roles as information stewards.

AI will become a co-pilot for grocers and consumers

Grade: B

There’s no doubt grocers furthered their use of artificial intelligence in 2024, but to call the capability a “co-pilot” for retailers at this stage would be an overstatement.

Some AI capabilities are flashier and visible to customers — like Tally the aisle-scanning robot — but most AI tools go unnoticed by shoppers. Primarily, AI was integrated into existing store operations this year and focused on improving product forecasting, predicting shopper demand and minimizing food waste.

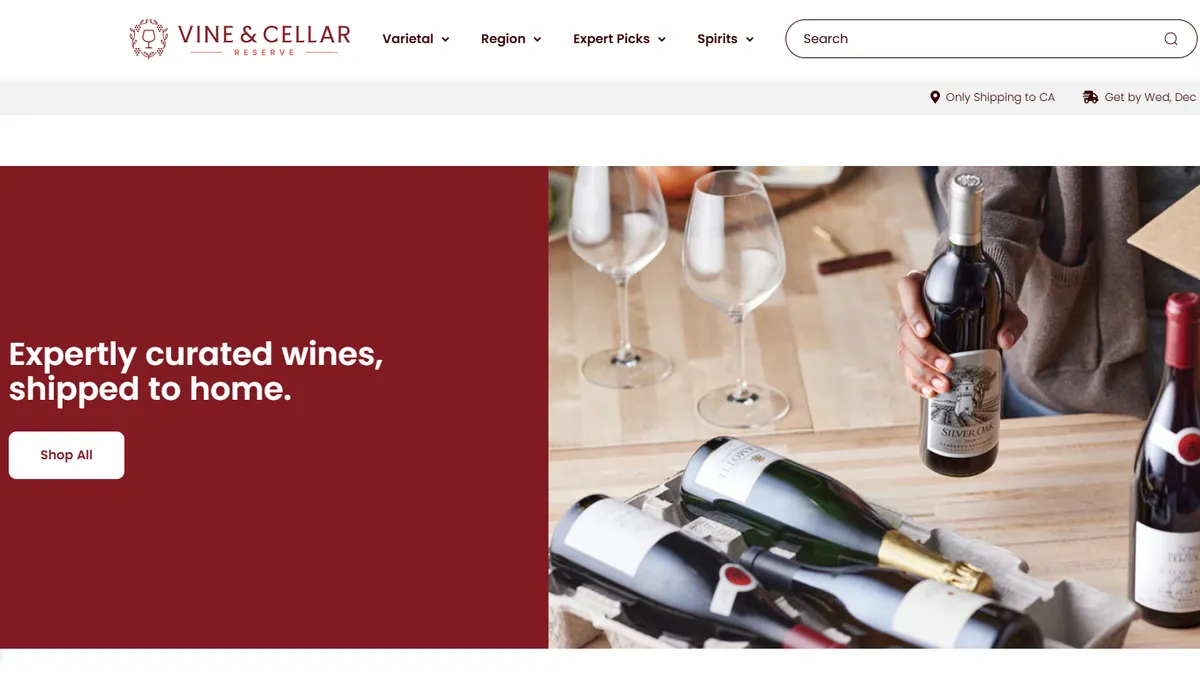

Experts predicted AI’s use in 2024 would be to further personalization for shoppers, and while this wasn’t the technology’s main focus this year, it did come into play. Albertsons, for example, is now using AI-driven product discovery and recommendation software in its direct-to-consumer wine shipping platform, Vine & Cellar. The feature is available at a number of its banners in California.

Walmart is poised for a really big year

Grade: A

Walmart has long been a powerful player in the grocery industry, and the mass retailer used the past year to further cement its dominant position.

The company expanded its private label grocery portfolio, refined its Neighborhood Market format and attracted more higher-income shoppers amid peoples’ continuing quest to save money on groceries. Walmart’s final earnings report of the year underscored the company’s success in the grocery sector, with strong shopper demand for food helping to power robust same-store sales growth.

Notably, Walmart’s heavy focus on grocery sales set it apart from rival Target. Walmart topped analysts’ expectations during the third quarter of the year, helped by its grocery business. Meanwhile, Target — which doesn’t give groceries the same level of prominence in its stores, posted results for the period that disappointed investors.

Walmart also flexed its muscles in e-commerce as it used its technology and heft to steal online market share from traditional grocers throughout 2024. The company also opened or upgraded several high-tech sorting and packaging facilities.

Prediction: Value retailing is here to stay

Grade: A-

Consumer concern about high grocery prices and inflation continued in 2024 even as inflation hovered close to pre-COVID-19 levels.

Grocers waged pricing battles over holiday meals — especially Thanksgiving — and turned to digital promotions and coupons to serve up personalized offers. In August, Instacart linked up with Ibotta to provide digital coupons in August and announced in October that it added location-based coupons to its smart carts.

2024 was also a big year for private label across food categories, from newly launched brands to expanded lines. Kroger, Walmart and Grocery Outlet were among the several retailers that debuted private brands.

Prediction: All eyes on the Kroger-Albertsons merger

Grade: A

The industry remained glued to the Kroger-Albertsons merger saga throughout this year — and there was no shortage of drama.

At the start of 2024, the grocers got hit with three lawsuits — a federal one from the Federal Trade Commission and two state-level ones — aiming to block the merger. After the companies announced a revised divestiture plan and defended their merger deal during three trials, federal and Washington state judges blocked the deal in December. Hours after those court decisions, Albertsons announced it was ending the deal and suing Kroger for allegedly mismanaging the merger process. Kroger has denied Albertsons’ accusations.

The merger review seemed to drag on at various points — the judge handling the federal case didn’t issue her ruling until nearly three months after closing arguments in the proceeding — and it’s hardly surprising that the merger fell apart. Yet the audaciousness of Kroger and Albertsons’ audaciousness in attempting to merge in the first place — and to continue to push for the deal even as consumers, workers and politicians heaped on criticism — had many wondering if there was a chance the grocers could somehow pull it off.

After all, the goals Kroger and Albertsons said they were seeking to achieve by combining — such as gaining more scale to compete against players like Walmart and Costco as well as developing a unified retail media platform for CPGs — haven’t gone anywhere.