This story is the second in a series on key trends that will impact grocers in 2023.

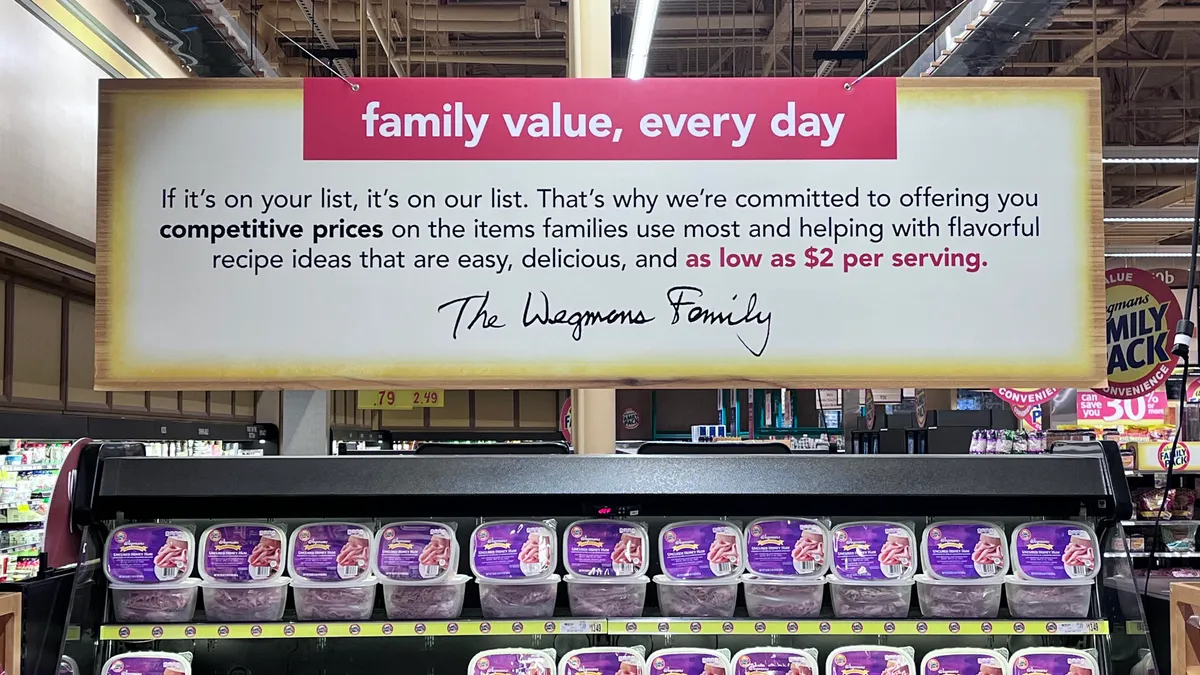

Hanging above a ham display in a Wegmans store in Maryland, a large sign highlighting the grocer chain’s focus on “family value, every day” encapsulates a central challenge facing retailers as 2023 gets underway: convincing shoppers exhausted by price hikes that supermarkets are intent on helping them save money.

Giant Food is also pressing ahead with a campaign that it hopes will demonstrate its commitment to holding down costs. The Mid-Atlantic grocery chain is using its loyalty program, Giant Flexible Rewards, along with related signage in its stores to guide shoppers to bargain-priced essentials. That effort includes letting members use fewer loyalty points to buy certain foods, like bacon, bread and sugar, than those goods would normally require.

“We know that customers are feeling the impact of their dollar being stretched and seeing things more expensive,” said Ryan Draude, director of loyalty and digital marketing for Giant. “We want to make sure that when they come to a Giant, they feel that they’re going to be rewarded and they can walk away with something that their engagement with us gave back to them … it’s really an emotional connection that we think that we're making with customers by investing in these type of programs.”

Grocers are being helped in their efforts to deliver savings to shoppers by the recent slowdown in inflation. But even as the annual growth rate for grocery prices has come down somewhat during the past few months after hitting multi-decade highs earlier in 2022, grocers are still confronting sharply elevated prices on a host of items, including center store staples, said Krishnakumar Davey, president of CPG and retail thought leadership for research firm IRI.

That means retailers face a balancing act in determining how to continue delivering meaningful price relief to shoppers while also managing their own finances, according to Davey.

“The reality is prices have gone up quite a bit from [retailers’] perspectives,” Davey said, but “they know that the consumer cannot keep spending, so they are trying to amp up their value messaging and trying to provide value where they can.”

Center store prices have been rising rapidly

Prices for center store items — which according to IRI comprise about three-quarters of sales in the grocery industry — rose at a 14.9% annual clip in November, a level that was the fastest recorded through that point in 2022. Center store inflation came in at 8.1% in January 2022 and rose steadily throughout the year, according to statistics from IRI.

By comparison, prices for perimeter items rose in November at an 8.1% annual pace, the slowest rate seen over the first 11 months of last year, IRI reported.

Fuel for trucks has also remained expensive, contributing to the costs retailers, CPG suppliers and other companies in the supply chain must either absorb or pass on to consumers, Davey noted. Nationwide, the average cost price of a gallon of on-highway diesel was $4.55 during the week that ended Jan. 9, 89 cents above where it stood a year ago, according to the U.S. Energy Information Administration.

“[Retailers] know that the consumer cannot keep spending, so they are trying to amp up their value messaging and trying to provide value where they can.”

Krishnakumar Davey

President of CPG and retail thought leadership, IRI

Retailers have increased their focus on private label goods to combat inflation. But Davey noted that even though store brands have gained market share, growth in that area has recently stabilized.

In addition, promotions — which are typically driven by product manufacturers — have slowed since the start of the pandemic in 2020, and CPG companies have so far seen little reason to step them up in a concerted way despite inflation, Davey said.

In a reflection of that, Conagra Brands, which sells products under brands like Duncan Hines, Birds Eye and Pam, has seen strong consumer demand for its goods and does not plan to increase promotions anytime soon, President and CEO Sean Connolly said during an earnings call last week.

The company will consider “surgical” promotions, such as seasonal deals “that are emotionally important to our consumers,” but believes it does not have to cut into its margins to maintain sales momentum, Connolly said.

“The ongoing durability of demand is a testament to the strength of our portfolio and demonstrates how [Conagra] has positioned our brands to continue to resonate with consumers even in an inflationary environment,” Connolly said during the call. The company’s top-line revenue growth during its fiscal second quarter, which ended Nov. 27, 2022, helped Conagra generate margins close to what it saw before the pandemic, Connolly added.

When evaluating potential promotions, food manufacturers are looking for evidence that an investment in cutting the price of a particular product was necessary to boost shopper interest in that item, said Sean Turner, co-founder and chief technology officer of Swiftly, which provides digital loyalty technology to retailers. CPG companies also want to see how promotions affect sales of other items, Turner said.

“Brands are trying to get more sophisticated” in how they direct promotions at shoppers, said Turner. “A brand doesn’t want to subsidize a purchase that would have happened, had they not subsidized it.”

Retailers are also increasingly looking to personalization technology to communicate their commitment to cutting prices to consumers, analysts said.

“Above the line, there's base prices and mass messaging and below the line, it's personalized pricing using the loyalty program and personalized promotions, and we've seen the importance of the impact of personalization grow [from] 2019 to today,” said Erich Kahner, director of strategy and insights for North America at retail data science firm Dunnhumby.

Davey said the digital investments retailers have made in recent years to build e-commerce capabilities and deal with labor shortages are providing them with a strong foundation for delivering customized offers to shoppers as inflation runs its course.

“Grocers have accelerated their investments in technology, and they are trying to make things more accessible to consumers” by taking advantage of those systems, he said.

Is a price war looming for grocers?

Arun Sundaram, an analyst for CFRA Research who follows food manufacturers and retailers, said he expects inflation to taper further in the coming months and ignite competition among grocers reducing prices in order to lure shoppers.

Efforts by grocers to generate revenue in the face of declining prices will also make it difficult for grocers to maintain comparable store sales, especially as they start to lap price increases made last year during the later months of 2023, he added.

Grocers will need to push sales volume up to make up for the revenue pressures they are likely to face as prices flatten or even come down in some cases, Sundaram said. Grocery inflation, which spent much of 2022 well above 10%, could come down to the low single-digit range a year from now, which could push grocers to boost their efforts to use lower prices to drive sales, he predicted.

“A year from today, the competitive environment will intensify even more,” said Sundaram. “I think you'll see retailers race to cut prices and try to get more shoppers to come to their stores.”