From gourmet sandwiches to premade salads, The Save Mart Companies has done “a lot” of work to spice up its prepared foods, said Mark Van Buskirk, the grocery company’s senior vice president of merchandising and marketing.

The grocery company, which runs around 200 supermarkets in California and Northern Nevada under banners such as Save Mart, Lucky and FoodMaxx, has recently revamped its sandwich program and its behind-the-glass salads and grab-and-go salads, Van Buskirk said. Earlier this year, it also launched a gourmet sandwich line.

These changes aim to provide healthy alternatives for people in addition to “core basic programs” that focus on rotisserie chicken and fried chicken, said Van Buskirk.

“You can come in, pick something up and get a high-quality meal at a price that's a value relative to what you would pay if you were going to a restaurant,” Van Buskirk said.

Research from FMI—The Food Industry Association indicates that foodservice at grocery stores is increasingly replacing quick-service or fast-casual restaurant meals, said Rick Stein, the trade group’s vice president of fresh foods.

“We’re really seeing a renaissance in the foodservice department with retailers investing heavily in these departments after many closed during the COVID-19 pandemic,” Stein wrote in an email. “Retailers have invested in chefs and specialty staff, increased space allocation and enhanced variety in an effort to reenergize foodservice departments and make them more top-of-mind for consumers.”

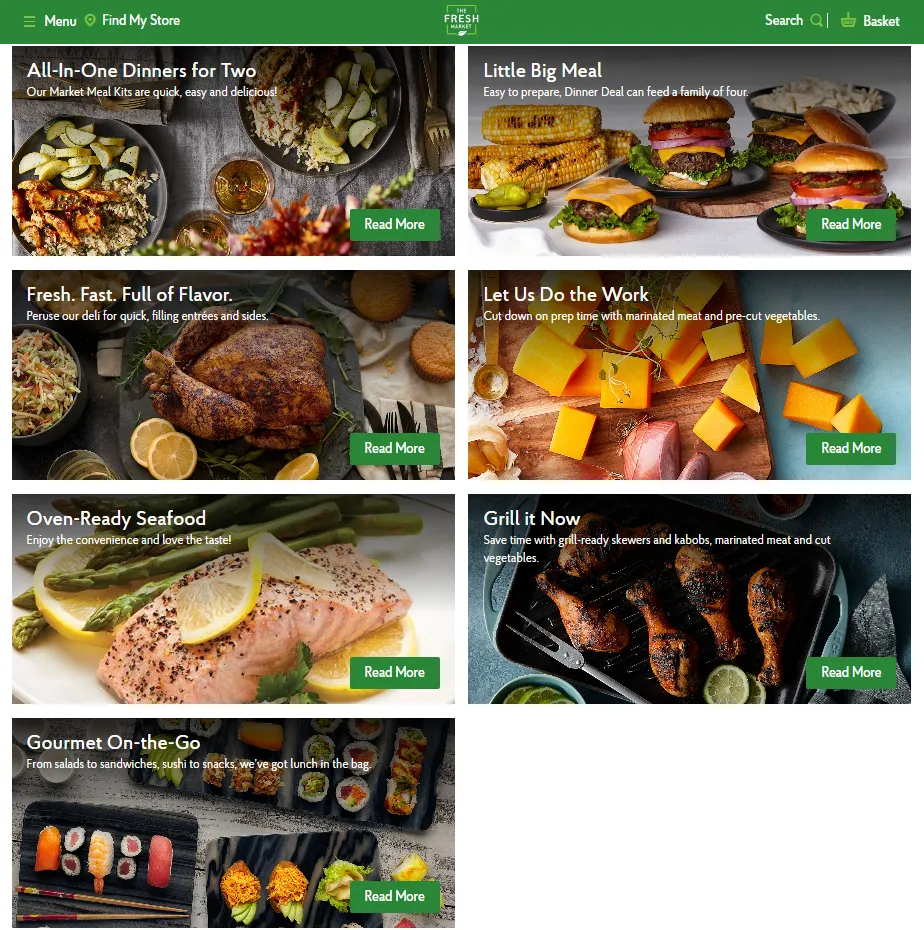

While some grocers are adding in-store restaurants, food halls and made-to-order stations, other grocers are focused on bringing their deli and pre-made meals up to par with restaurant fare.

But as competition grows from restaurant chains as well as convenience stores like Foxtrot, supermarkets are getting creative with offerings, deals, labor models and shopping experiences in order to differentiate beyond just price.

Deli-prepared takes a larger slice of shoppers’ dollars

September was a major month for deli-prepared offerings, with strong sales across pizza, soups and chili indicating consumers are choosing alternatives to home-cooked or restaurant meals, according to research from Circana.

“The strength of deli-prepared food continues to be very encouraging,” Jonna Parker, the fresh foods team lead at Circana, said in 210 Analytics’ latest report. “It reflects a marketplace in which consumers need a break from cooking every once in a while, but as part of the ongoing balancing act, it is deli that is increasingly winning those trips over restaurants.”

In September, deli-prepared foods generated $1.9 billion, seeing improved unit sales (0.1%) and dollar growth (2.7%) compared to the same time a year ago, according to Circana data cited by 210 Analytics.

Soups and chili saw the largest growth in sales and units in September compared to a year ago.

Entrees accounted for the largest chunk of deli prepared sales in September

“In today’s marketplace, the ultimate value is the combination of price with elements such as convenience, health, taste and experience” — areas that are already strong for grocery deli-prepared foods, Parker said.

FMI’s research also found that the uptick in deli-prepared foods is being driven by hybrid work’s impact on consumer meal habits, Stein said. Generational shopping habits are also influencing deli-prepared sales.

“We do see that Gen Zers and Millennials consume grocery deli-prepared foods more often and both report they expect to increase foodservice purchases in the future,” Stein said.

More than half of shoppers recently surveyed by FMI say grocery deli-prepared foods represent a good value compared to eating out at a quick-service or fast-casual restaurant or ordering takeout, Stein said.

High inflation constricting consumer spending, consumers mixing scratch preparation with prepared meal items and cooking fatigue are top factors driving the heightened prepared foods interest, Stein said.

Catering to consumer desires around meals

With department displays that carry messages like “Rah, Rah, Rotisserie” and “Made with love for later,” ShopRite’s “Fresh to Table” concept emphasizes high-quality ingredients in a one-stop meal shop.

The recently developed department spotlights ready-to-cook, ready-to-heat and ready-to-eat options alongside private label items. A ShopRite store in Warminster, Pennsylvania, recently became the seventh location to debut the Fresh to Table concept this year.

Winn-Dixie and Meijer are also spotlighting ready-to-cook, ready-to-heat and ready-to-eat options while Food Lion’s recent upgrades at nearly 50 stores in three North Carolina metro areas include an expanded product assortment focused on offering a variety of “affordable and easy meal solutions.”

Promoting affordability is a prime marketing tactic for grocers amid ongoing high food prices. A Giant Food store in Washington, D.C., for example, offers deli meal combos in a display case near the store’s entrance and exit. These include $9 for a salad, 20-ounce Coca-Cola product and a bag of chips, or $8 for half of a sub sandwich plus a drink and chips.

Shoppers are thinking about more than just price and quality, Stein said, adding that convenience, entertainment and health and well-being are also factoring into shoppers’ definition of value.

Limited-time offers — already popular among convenience stores — are another tactic grocers have used recently to drum up excitement. Publix, for one, sold a Nashville hot chicken sandwich at its deli departments from the beginning of April until the end of June.

Grocers are also increasingly zeroing in on the caliber of their offerings. At a Metropolitan Market store in West Seattle, shoppers can build their own fresh poke bowls for $18 a pound. The store’s poke bar, which is situated near its checkout stands, includes a variety of fresh fish options, rice and accompaniments like seaweed, cucumber and wasabi.

The Save Mart Companies, meanwhile, is looking to capture meal dollars by offering deals as well as improved quality. The company’s “extensive” hot prepared foods program, which includes rotisserie chicken, meatloaf, barbecued ribs, chicken pot pie and hot turkey breasts, allows consumers to bundle items, Van Buskirk said.

“I would put our chicken tender up against anybody's chicken tender in the marketplace,” said Van Buskirk.

Some grocers are emphasizing global flavors to drive meal spending. Meijer put out a call this summer for more food manufacturers for Frederik's by Meijer, its global flavors-focused private label food line that includes frozen and refrigerated meals like pizza, pasta and Greek feta salad, noting that the brand has become a “customer favorite” since its launch two years ago.

Others are getting tech-savvy to innovate their self-serve options. In March, Schnuck Markets debuted a technology-driven salad bar designed by Picadeli of Sweden at a store in Missouri. The Picadeli units, which feature covers that stay closed except when customers take items, use artificial intelligence to track sales patterns and determine when to order products and also feature digital tags with product descriptions.

Customers have praised the units’ selection and food safety, Schnucks Vice President of Deli and Prepared Foods Geoff Wexler wrote in an email. Following an “overwhelmingly positive” response, Wexler said the grocer accelerated the expansion and now has the Picadeli “smart salad bars” in 51 Schnucks and Eatwell Market locations.

Finding recipes for labor model success

Grocers looking to capture the essence of restaurant dining can model their staffing after those establishments.

Wegmans, which is renowned among consumers and the industry for its foodservice, has an executive chef heading up a culinary staff at each of its stores. Recent openings included a culinary staff of 95 workers at a store Reston, Virginia, and staff of 105 at a location in Alexandria, Virginia.

Wegmans’ career website details its culinary team career path opportunities, which include prep cook, line cook, lead cook, sous chef and executive chef roles.

The grocery chain also has a culinary management trainee position for people to learn “how to impact culinary standards while mastering core recipes, techniques and other skills you’ll need to become a Sous Chef.”

Similarly, Dom’s Kitchen & Market in Chicago incorporates restaurant nomenclature into its staffing hierarchy for The Kitchen — its collection of prepared food and fresh meal stations — with titles like sous chef, said Dom’s CEO Don Fitzgerald.

Dom’s recently tapped Chef James Klewin, who has over two decades of culinary experience, as its executive chef and director of culinary and Alain Balandra Uy, a veteran hospitality leader, as its director of hospitality, Fitzgerald noted.

Instead of feeling like department managers, Dom’s wants its culinary and hospitality leaders to bring the “restaurant experience and feel” to their roles and to the company’s stores, Fitzgerald said.

Sam Silverstein and Jeff Wells contributed reporting.