LAS VEGAS — The surge of online sales early in the pandemic made clear to many retailers the need to operate their own e-commerce sites and apps, and to fulfill more orders themselves in order to preserve margins, gather valuable data and put their brand front and center.

But as they navigate a more complex current environment, when demand isn’t at the red-hot level it was in 2020 yet is still significant enough to warrant offering a broad range of services, grocers are recognizing they still need online marketplaces.

So what does an online ecosystem that incorporates owned properties as well as third-party marketplaces, many of which are offering an expanded menu of services, look like? Matt Van Gilder, SpartanNash’s head of e-commerce and digital experience, summed it up in two words during a Groceryshop session on Wednesday: “It’s complicated.”

The grocer and distributor, which operates nearly 150 stores across several banners, has partnered with major online marketplaces Instacart and DoorDash. It can be a headache to have gig shoppers roaming store aisles, and the fact that the customers that come through these platforms can easily switch to other retailers isn’t ideal, Van Gilder said. But around 80% of the shoppers that these marketplaces serve up are new to SpartanNash, and the company relies on marketplaces to make last mile deliveries for its own online brand, Fast Lane, as well as for the white label service it offers to its distribution customers.

“I like to think of our relationship, if there was a status on Facebook with all those guys, it would be ‘it’s complicated,’” Van Gilder said.

Instacart, which rose to prominence as a marketplace and e-commerce provider following Amazon’s acquisition of Whole Foods Market in 2017, has seen in recent years competitors like DoorDash and Uber elbow their way in. DoorDash, in particular, has rapidly added grocers to its marketplace, and this week announced a few prominent additions, including Sprouts Farmers Market, Giant Eagle and Weis Markets. Weis is also utilizing DoorDash’s delivery service for its own e-commerce platform.

Tom Pickett, chief revenue officer with DoorDash, said grocers are opening up to the idea of listing their stores across multiple marketplaces. He compared the situation to the restaurant industry, where some of the major chains have broken off from exclusive agreements with delivery providers and listed across multiple ones.

“They often hit this mark where they say, ‘You know what, I just need the growth, and I feel like I'm leaving some customers on the sideline.’ And I think that’s the stage where we’re at in grocery right now,” Pickett said in an interview, noting that grocers that list on DoorDash can see incremental sales of 70% to 90% through the platform.

Grocers like Kroger, Sprouts, Grocery Outlet and Southeastern Grocers now list their products on two or more marketplaces. Albertsons is listed on Instacart, DoorDash, Shipt and Uber.

Not all of the platforms are alike in terms of the orders they serve up. Van Gilder said that orders from DoorDash users tend to be smaller than those that come from Instacart users, and are more focused on snacks and fill-in items. Christian Freese, head of grocery and new verticals with Uber, said in an interview that many Uber grocery users are located in urban markets and tend to order small baskets for speedy delivery. Uber recently rewrote the code for its grocery application and is rolling out new features like order-ahead capability.

Amid all this marketplace activity, retailers like SpartanNash are trying to figure out where their own e-commerce platforms fit in. With delivery, Fast Lane focuses mainly on orders that need to get to shoppers in two hours or longer, Van Gilder said. That gives company employees time to pick and assemble orders that provide stronger margins than marketplace orders. Faster deliveries, he noted, require more labor that the grocer can’t afford, and thus make more sense for platforms to fulfill.

“That's not something that a regional grocer can easily afford,” he said. “So you kind of have to look at that threshold of where does it make sense? Where is it profitable for us to invest and to use our own brand and build our own experience to connect with the customer, and then where does it help to partner with the marketplace?”

When it comes to quick delivery, even Kroger, the nation’s largest supermarket chain, is relying on marketplace provider Instacart.

The calculus of marketplace partnerships promises to become even more complicated as those companies expand the range of services they provide. DoorDash now offers its own 30-minute delivery service, which it can fulfill from retailer stores, as it does with Albertsons, or through its own dark stores, as it does with Loblaw in Canada. At the same time, DoorDash operates its own dark store-driven convenience delivery service, DashMart.

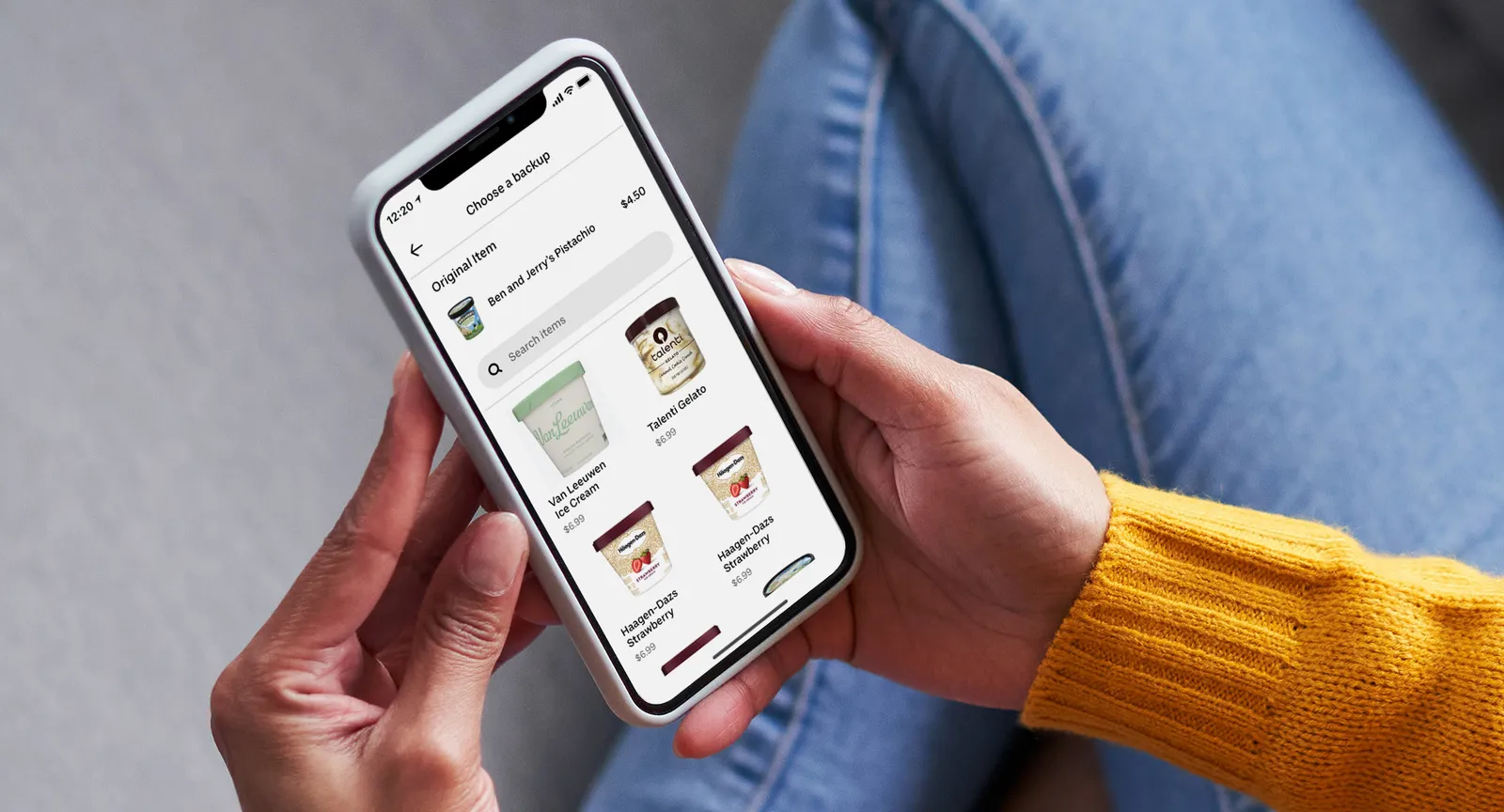

Instacart, meanwhile, has expanded into a range of retail services that go well beyond its legacy e-commerce enablement, including smart carts, digital ads and electronic shelf labels. The company, which rolled out a suite of tools this week centered on in-store shopping, is staking its future on becoming an all-in-one provider for retailers looking to incorporate digital across their operations.

“We don't think that the future is people having to choose between online and store. We think the future is bringing those two things together in a really seamless way,” said David McIntosh, Instacart’s vice president of platform and technology, in a recent interview.

Correction: An earlier version of this story reported that SpartanNash has partnerships with Shipt and Uber, based on what Van Gilder said during the Groceryshop session. A representative from SpartanNash noted, however, that the company does not in fact have partnerships with those companies.