LAS VEGAS — Grocers and cutting edge? When it comes to artificial intelligence, Deborah Weinswig, founder and CEO of Coresight Research, thinks so.

"I really applaud retail in terms of being cutting-edge on AI," she said during a panel at Groceryshop in Las Vegas. Retail leads both spending and adoption of AI, even ahead of the tech-heavy banking sector, according to data she cited from International Data Corporation. In 2018 retailers put $3.4 billion toward AI compared to $3.3 billion in banking.

Banking, manufacturing and healthcare also all trailed behind the retail industry's aggressive adoption rates of 54% over the next three years versus 41% for banking, 37% for healthcare and 14% for manufacturing. In the next 12 months alone, 41% of retailers plan to invest in AI and machine learning solutions, per a Coresight Research survey presented during the session.

With all these investments, however, will the opportunities grocers see with AI align with reality?

Alleviating pain points

Grocers believe AI can help alleviate some of the industry’s biggest pain points, including personalization, waste and checkout, Weinswig said.

When asked by Coresight how AI can best serve their business, top responses included drive sales and anticipate demand (71%), engage customers (70%), understand consumer behavior (70%), acquire customers (68%), offer highly personalized promotions (68%), assess existing competition (65%), optimize the supply chain (64%) and target consumer segments (60%).

"If you really think about how AI can best serve your business, it's really sales and anticipating demand, to understand what the customer wants and the pace at which they're going to consume," she said. "We can have our shelves stocked, but not too stocked."

"If you really think about how AI can best serve your business, it's really sales and anticipating demand."

Deborah Weinswig

Founder and CEO, Coresight Research

But what if tech companies were asked about what AI can really do for a grocer? Would the answers match? The answer appears to be yes. In a separate survey, Coresight spoke to many of the largest tech companies around the world, from Microsoft to IBM, on what they saw as the most compelling role of AI in grocery.

"It's all shockingly even," said Weinswig. "They look at it to really improve grocery in general."

Sales velocity, order optimization, assortment optimization and shrink all came in at 14%. Real-time replenishment eked above at 15% while limiting perishable items came out clearly ahead at 29%.

"Among the most compelling applications of AI are predicting purchase trends and patterns, fine tuning inventory replenishment and restocking, and determining what offers should be sent to whom and when they should be sent," Kamal Tahir, a digital innovation executive on the global retail strategy team at Salesforce, said in the survey.

One size does not fit all

Despite similar goals, food retailers need to consider different strategies when implementing AI into their infrastructure. Long gone are the days of the traditional supermarket. There are small formats, bulk warehouses, gourmet health markets and more.

Weinswig grouped grocers into four main categories: upmarkets, traditional supermarkets, mass merchants and value channels.

Coresight found that shoppers have higher expectations from upmarkets, including e-grocer Thrive Market, Fresh Thyme Farmers Market and Whole Foods. In these markets, AI is best used to drive premium experiences that connect with the shopper, she said. The growing consumer concern over food waste, for example, is an issue that Fresh Thyme looks to address with AI. The natural foods marketplace just announced a partnership yesterday with Afresh Technologies, which developed an AI-enabled solution to try to reduce waste.

At traditional stores like Kroger and Hy-Vee and value channels such as Aldi and Grocery Outlet, experience also remains the best use case for AI, but with varying tactics. For instance, value channels could use gamification, said Weinswig.

Kroger is one of the grocers heavily leaning into AI, from its collaboration with Nuro to test self-driving delivery cars to its developing partnership with Ocado. Michael Wilhite, vice president of data strategy at Kroger’s analytics arm 84.51, said during the session that the company also looks to use the technologies to improve personalization.

"Because of the frequency and cadence that our customers interact with us, as we get personalization right, we can really transform their experience in a much more speedy manner than other retailers can," he said.

"Price optimization is still where we’re looking for nirvana."

Deborah Weinswig

Founder and CEO, Coresight Research

For Kroger, its AI strategy must balance experience with operational efficiency. Wilhite noted that the company focuses 60% to 70% on experiences versus 30% to 40% on operations because of its scale. "Sometimes it is about removing costs, but often times it’s about creating a better environment for the customer when they're shopping," he said.

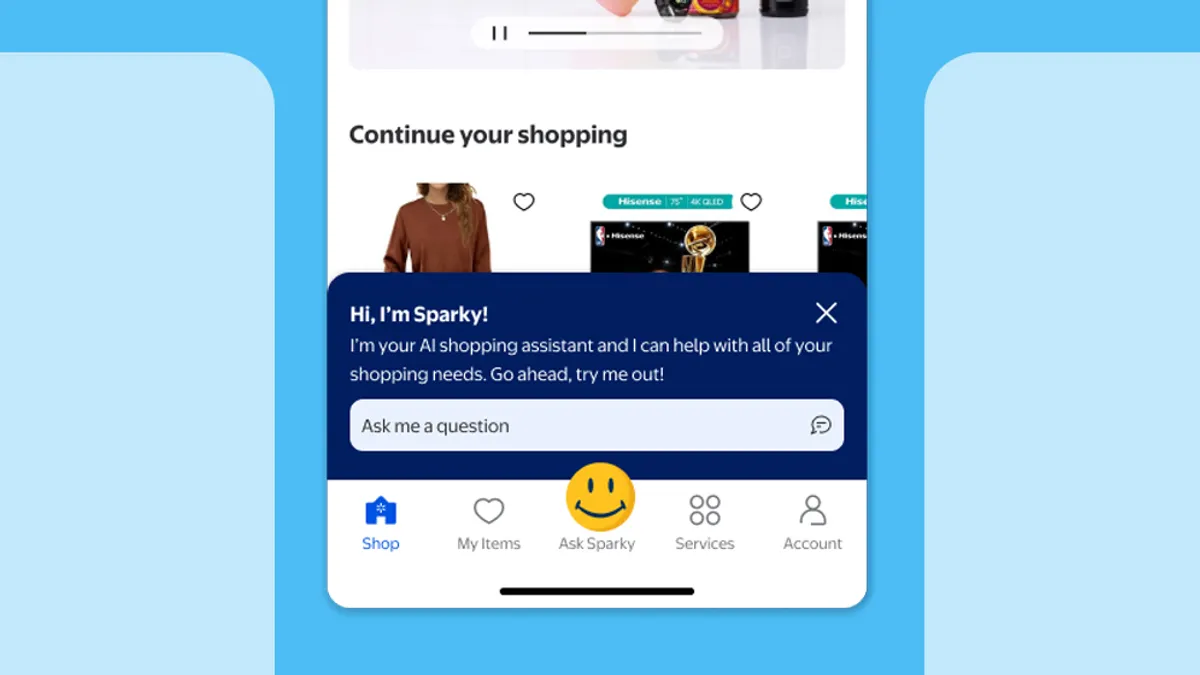

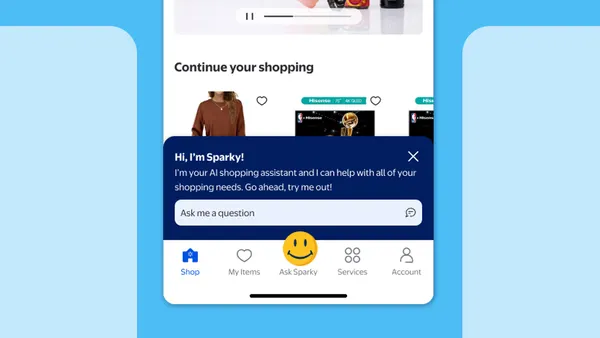

On the flip side, Coresight's research showed companies such as Costco, Walmart or Target have different needs in terms of AI. "As we think about mass merchants, because of the size of boxes, we really need AI to drive efficiency," she said. "We know how challenging grocery margins are. This is where there can be a significant opportunity to take out costs."

Operational efficiencies include inventory handling and monitoring, pricing optimization, dynamic pricing and assortment optimization.

"Price optimization is still where we're looking for nirvana," said Weinswig. Some retailers continue to take a peek out their windows, adjusting prices depending on the store across the street, but that's not typically the smartest option. That's where AI can step in.

Weinswig cited a case study where retail strategy and analytics firm Precima used AI to optimize pricing models for European supermarket chain Jumbo, helping the retailer figure out which items to promote at what price tag and how much inventory to allocate. With their help, Jumbo saw up to a 300 basis points increase in year-over-year sales.

"It's not always about lowering price. It may be about raising prices. It just depends on the market you're in," she said.

Build versus buy

With fancy new technologies comes limitations, and AI brings with it concerns over cost and accuracy, Weinswig said. It carries a hefty price tag and questions over whether a grocer should build the supporting infrastructure or buy it.

"It's actually easier for retailers who are earlier in the journey because a lot of startups are trying to provide [full] solutions," said 84.51’s Wilhite. That option allows grocers to just outsource all of the tech to another company.

For Kroger, which has put significant focus on technology over the last several years, gaining efficient AI capabilities is more complicated.

"The challenge with our ecosystem is that we have so many components that are built up. We're looking to fill gaps, to find the right kind of partnerships that can provide a specific service," said Wilhite. The best partners, he said, are ones that are purpose-built.

Wilhite also noted the company has spent significant time incrementally leveraging AI in its day-to-day approaches within the operational infrastructure of a traditional grocery store to be more efficient, he said. "But we have to take some of these big swings to the fences as well."

That big swing came in the form of its large investment in Ocado, announced in May 2018. Some critics have since doubted the move, questioning the large investment and the two- to three-year time frame it will take to get the automated sheds up and running.

"It's so hard to understand what the grocery environment will be once these sheds are up and running," Wilhite said. "Yes, that's true, but you can also die by incrementalism."