A previous version of this story misstated the number of cities participating in the Amazon Prime Now program, as well as the number of cities that partner with local retailers. This version has been corrected.

For a growing number of supermarkets looking to sell boxes of cereal, bottles of laundry detergent, and even fresh produce online, partnering with third-party services like Instacart, Postmates, and Google Express offers an enticing proposition. With deep knowledge of consumer analytics and logistics, these providers can quickly get products into the hands of customers — sometimes, in as little as one hour.

For margin-starved retailers, these partnerships provide a shortcut to the e-commerce fast-lane. But they also present a unique set of challenges for grocers, industry analysts say. And no service better embodies these than an up-and-comer that just so happens to be run by the world’s largest online retailer: Amazon Prime Now.

The lure of unparalleled market reach

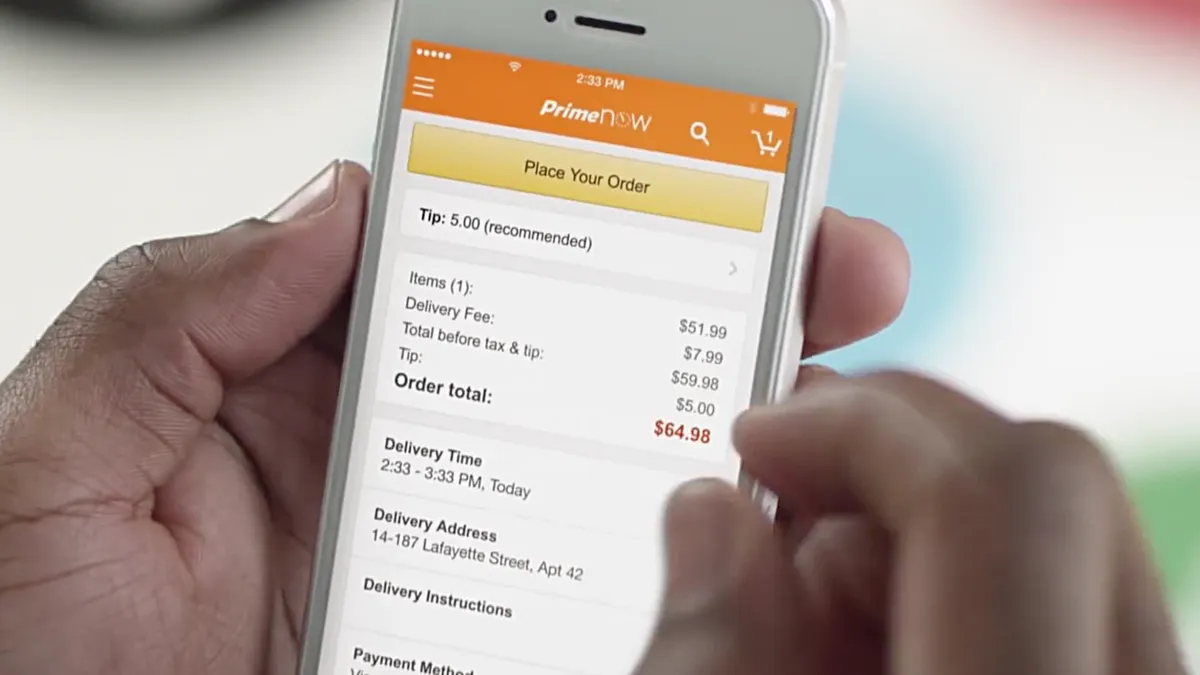

An outgrowth of the e-retail giant’s wildly popular Prime service, which offers expedited delivery on eligible items in exchange for a $99 yearly fee, Amazon Prime Now began partnering with local supermarkets in 2015 to offer one- and two-hour delivery on products gathered, in many cases, straight from store shelves. In New York, Prime Now customers can get speedy delivery of prepared foods from Gourmet Garage and Westside Market, while shoppers in Amazon’s hometown of Seattle can choose from more than 10,000 items available from PCC Natural Markets.

The number of grocers that have partnered with Amazon Prime Now is small. Out of the 30 metropolitan markets where Prime Now operates, only 10 include ordering options from local retailers. But many expect the partnerships to expand in the coming years — and quickly.

“This gives them a chance to dramatically extend their market reach, and do it in that short time frame without investing in brick-and-mortar,” Bill Bishop, longtime grocery consultant and chief architect at Brick Meets Click, told Food Dive.

Retailers, meanwhile, are eager to plug into one of the most sophisticated e-commerce systems around. They’re also keen on expanding their market reach through Amazon’s more than 65 million Prime subscribers.

"Grocers have some of the largest constraints with regards to being nimble and investing in technology."

Jerry Sheldon

Retail analyst with IHL Group

Early research shows that Prime shoppers are willing to shop their local grocers online. A survey of more than a thousand Prime customers conducted last year by financial services firm Cowen Group found that 70% buy Prime items multiple times a month, and nearly one third purchase items from a local store that had partnered with Prime Now. Also promising was the conversion of millennial shoppers: 33% of those 18 to 34 year olds who said they bought Prime products regularly also purchased goods from local grocers.

Supermarkets in Prime Now markets across the country — including Indianapolis, Dallas, Portland and Los Angeles — are signing on. In October, Fresh Thyme, a natural and organic grocer with locations in 10 states, announced a deal with Prime Now for its Indianapolis stores. Sprouts Farmers Market, the value-priced natural and organic retailer with more than 200 stores across the South and West Coast, recently said it was in talks with Amazon to expand following a successful trial in the Dallas market.

“Clearly, both parties are happy with the relationship,” Sprouts CFO Brad Lukow said at an investors conference in December.

Amanda Ip, communications manager for Amazon Prime Now, told Food Dive that the retailer is proud to align with strong, local brands.

"Since day one, we have been building the infrastructure to support superfast delivery—Prime Now is our fastest delivery method yet and is fueled by Amazon’s growing network of fulfillment centers," she said. "Through Prime Now, we offer the chance for local stores and restaurants to leverage Amazon’s technological expertise in last-mile delivery to sell their products to customers in select cities. Local stores also add to the vast selection of product offerings."

Given their razor-thin margins and limited investment capital, supermarkets see a great value in outsourcing online ordering and delivery.

“Grocers have some of the largest constraints with regards to being nimble and investing in technology,” Jerry Sheldon, retail analyst with IHL Group, told Food Dive. “So on one hand, this represents a big step up for them in terms of logistics and technology.”

“Hijacking” brand loyalty

On the other hand, sources said, retailers risk losing customer loyalty by outsourcing key capabilities to a separate company. Nimble platforms like those run by Instacart and Amazon Prime Now are building strong connections with consumers, while at the same time diluting the brand strength of supermarkets, noted Barb Stuckey, president of Mattson, an innovation firm that does food and beverage concept, brand, and product development. Consumers, she told Food Dive, are often more loyal to product brands than they are to retailers, making supermarkets interchangeable in the e-commerce space. Also, without close control of ordering and logistics, retailers can find themselves to blame for poor execution on the part of their service provider.

It all adds up to something she calls a “hijacking” of the user experience.

“It’s all building towards this future where supermarkets are just distribution centers for these online services,” Stuckey said.

The potential for loss of control is one of the reasons many retailers are keeping their e-commerce capabilities in-house. Some, like Kroger and Wal-Mart, have chosen to focus on saving customers time by offering in-store pickup of goods ordered online.

"There are certainly great things you can learn from them as a retailer, but at the end of the day it really is a deal with the devil."

Jerry Sheldon

Retail analyst with IHL Group

Brick Meets Click’s Bishop agreed that third-party services can take important capabilities away from retailers, and cautioned grocers to weigh the financial upside of their partnerships against any toll that might be exacted to brand loyalty.

“You have to ask, are you giving away too much of your customer relationship to them?” he said.

With Prime Now, there’s also what many analysts see as an elephant in the room: Amazon’s own ambitions in the grocery industry. The e-tailer is a large and growing competitor to supermarkets, offering many of the same products itself as those available through its retail partners. Those products are often competitively priced. The Prime Now landing page, where users can access retailer selections, is dominated by Amazon offerings — everything from frozen food to snacks and beverages. Customers who aren’t fiercely loyal to a retailer may be tempted to comparison shop, or just defect to Amazon.

With the continuing expansion of its Fresh service, which adds delivery of produce, meat, dairy and other perishable items for a $15 monthly fee, Amazon is also competing with grocers on the items that comprise the ever-important store perimeter.

Given all this, partnering with Amazon could amount to supporting the enemy.

“There are certainly great things you can learn from them as a retailer, but at the end of the day it really is a deal with the devil,” said Sheldon.

Sources agree that Amazon isn’t just a threat — it represents the threat facing supermarkets in the years to come. The online retailer is poised to gain massive ground in the $4.6 trillion grocery industry by leveraging numerous capabilities, including its large, loyal customer base; its sophisticated analytics; higher margins; and, of course, a robust distribution system honed through nearly two decades of online retailing.

Through its supermarket partnerships, Sheldon said, Amazon can gather valuable intel on how retailers, some of whom have decades of experience meeting shoppers’ needs, go to market.

“There are nuances of that business that, if you’re Amazon, you’ll eventually learn, but why not expedite the learning curve?” he said.

E-commerce partnerships are a two-way street

Not everyone is convinced, though, that partnering with Amazon is a losing proposition. Brick Meets Click’s Bishop said retailers should work with the company if they find it meets their short-term business goals But, he cautioned, they should take care to learn from the experience and develop a long-term e-commerce strategy that addresses the growing threat posed by Amazon and other e-tailers like Jet.com and Boxed.

“Since Amazon is going to be an increasing reality in the grocery market, how do you as a retailer define the strategy that allows you to be successful, and in effect exist inside this market where Amazon is big — and will only get bigger?” Bishop said.

One retailer that’s found success partnering with e-commerce providers is Seattle’s PCC Natural Markets. In 2015, the natural and organic co-op, which operates eleven stores in the city’s metropolitan area, allied with Instacart to offer home delivery on thousands of store products listed online. The following year, in an effort to expand its reach, PCC partnered with Prime Now.

“The growth of online delivery tells us that this is something shoppers are clamoring for, both our existing customers and also new ones."

Elizabeth Pontefract

VP of strategy for PCC Natural Markets

Both platforms offer thousands of products gleaned from nearby PCC stores, ranging from fresh produce to prepared foods and CPGs. Instacart contractors are able to shop most of the retailer’s stores, then deliver directly to the consumer. Prime Now, on the other hand, embeds workers at three locations that offer the co-op’s greatest selection of products. Workers receive orders, pull products from the shelves, and then assemble orders in a special staging area inside the store. After everything is boxed up and ready, Prime Now drivers swoop in to make the delivery.

PCC’s VP of Strategy Elizabeth Pontefract told Food Dive the company decided to partner with two e-commerce providers in order to maximize its delivery coverage and give its customers a choice of platform. Online ordering represents just under 5% of the co-op’s sales currently, and Pontefract said she expects sales to grow in the next few years.

“The growth of online delivery tells us that this is something shoppers are clamoring for, both our existing customers and also new ones,” she said.

Ultimately, Pontefract said, PCC — along with Amazon, Instacart and even the customers — are still in the learning stages with online shopping. She characterized the experience as a two-way street. Amazon is learning how to provide better service and logistics to grocery shoppers, while PCC is learning more about logistics and customer analytics. The partnership also helps PCC’s in-store operations, like when Prime Now workers inform the retailer of out-of-stocks.

As for Amazon’s long-term ambitions in the grocery space, Pontefract said she’s unconcerned.

“Amazon is going to grow whether or not we’re a partner of theirs,” she said. “We are not going to slow them down or speed them up. In the interim, they are one of the best service providers in our market and for our customers.”