Dive Brief:

- Chef'd has suspended operations after spending most of its cash and failing to secure additional funding, according to The Wall Street Journal.

- The paper, citing an email from the company's chief technology officer, said Chef'd had "ceased all operations until our investors and lenders decide the final fate of the company.” Employees were ordered to stop working.

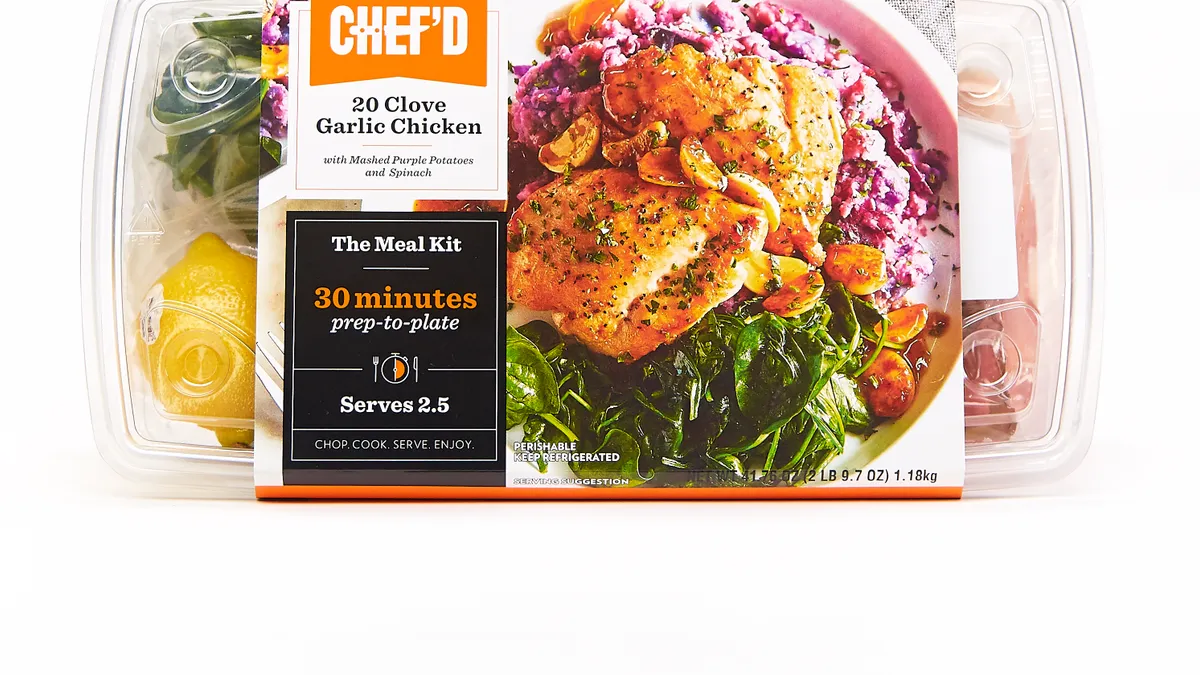

- Chef'd, one of the first makers of the preportioned meals to sell its kits in stores, struggled with high shipping costs and difficulties managing multiple recipes that made it hard to generate a profit, The Wall Street Journal reported. In recent months, Chef'd lost a number of executives and fell behind on paying its bills.

Dive Insight:

The meal kit market has become saturated with more than 150 companies competing nationally, regionally and locally, according to Packaged Facts.

While some meal kit suppliers like HelloFresh have generated strong growth, and others scored lucrative takeover deals from grocers, including Plated being purchased by Albertsons and Home Chef getting snapped up by Kroger, there has been mounting evidence that the hyper-competitive space was ripe for a shakeout. Data from Second Measure indicated that meal kit growth delivery is slowing, posting a year-over-year sales increase of 10% in March for major meal kit companies. Chef'd was such a distant player that it didn't even register in the firm's top eight meal kits by share of U.S. sales.

The meal kits space is notoriously expensive, with many firms facing high marketing expenses as they work to attract and retain customers, many of whom flee after just a few times using the service. There also has been growing evidence that investors, concerned by high operating costs and the lack of a clear path to profitability, are reluctant to invest further in meal kits, a factor that ultimately contributed to the demise of Chef'd.

The California meal kit firm appeared to have a number of advantages working in its favor, at least initially. It was one of the first to recognize the need to sell its products online as well as in stores. It also struck a series of partnerships with CPG companies like Coca-Cola, Campbell Soup and Smithfield Foods to incorporate its products. Campbell Soup and Smithfield both invested in the company in a bid to broaden their reach into the online marketplace.

To help boost their brand exposure and find additional sources of revenue, other meal kits have started striking partnerships with retailers to carry their products. HelloFresh announced in June it would sell its kits at nearly 600 Giant and Stop & Shop stores owned by Dutch grocer Ahold Delhaize, and Blue Apron launched a pilot program with wholesaler Costco a month earlier. Blue Apron, which has struggled with its own problems, including executive turnover and high operating costs, warned prior to its IPO last year that it "may be unable to achieve or sustain profitability."

Given the challenges Chef'd was facing with its operations and shrinking cash supply, coupled with the intrinsic difficulties embedded in the meal kit space, the potential loss of the Los Angeles company is hardly a surprise. It follows in the footsteps of Sprig, SpoonRocket and Maple Food. As the meal kit space continues to mature and grow, Chef'd is unlikely to be the last.