Dive Brief:

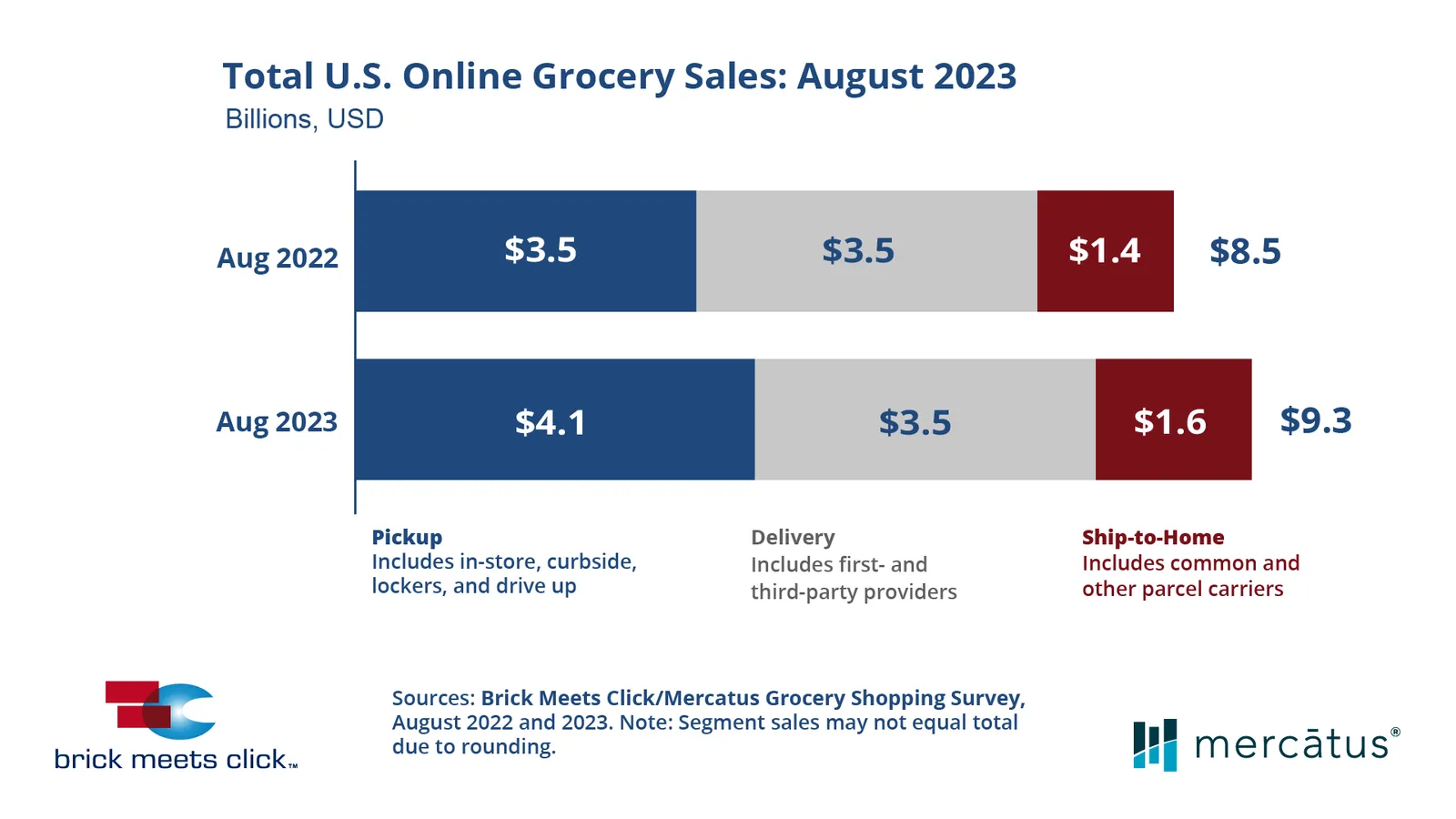

- Totaling $9.3 billion, August grocery e-commerce sales were stronger compared to last year with a roughly 9% year-over-year increase, according to the new monthly report conducted by Brick Meets Click and sponsored by Mercatus.

- Household demand was “strong” for both pickup and ship-to-home during the month, while delivery stalled in order volume. Pickup sales accounted for three-quarters of the year-over-year sales boost.

- Mass retailers, which include merchants like Target and Walmart, continued to draw more online grocery customers than supermarkets, the report noted.

Dive Insight:

For online grocery shopping, pickup is continuing to reign supreme among the three e-commerce channels studied by Brick Meets Click and Mercatus.

However, the robust competition posed by mass retailers is an ongoing challenge for traditional supermarkets to overcome as they look to capture online spending.

“For grocers, it is important to see the specific trends for each method,” Brick Meets Click Partner David Bishop said in a statement.

August sales for pickup ($4.1 billion) and ship-to-home ($1.6 billion) increased 17% and 14% year over year, respectively, while delivery ($3.5 billion) remained the same. The latest monthly findings are based on a survey conducted between Aug. 30-31 with 1,704 adults.

Among the monthly active user base, which grew nearly 5% during the month compared to a year ago, ship-to-home had the highest order growth (9%), followed by pickup (nearly 6%) and delivery (less than 1%).

Order volume growth was unevenly distributed across the channels with pickup and ship-to-home recording year-over-year gains of roughly 10% each while delivery slid nearly 5%.

Ship-to-home’s resurgence in order volume in August was boosted by Amazon’s pure-play segments, which includes the company’s marketplace and Subscribe & Save options, the report found.

Meanwhile, supermarkets are continuing to see a widening gap that favors mass retailers among monthly active users. Among those consumers, people who shop at mass retailers grew by almost 20% in August while those shopping at supermarkets shrunk by more than 10% compared to the prior year, with a similar result in order frequency happening for mass (low single-digit increase) and supermarkets (mid-single digit dip).

Mass retailers and supermarkets both saw “comparable gains” year over year in average order value.

The cross-shopping rate in August between the grocery channel, which includes supermarkets and hard discounters, and mass retailers hit the highest level to date and was more than twice the level recorded in August 2019, the report noted.

“Online customer loyalty is increasingly elusive, and grocers should focus on creating more seamless experiences that keep shoppers – especially the first timers coming back,” Sylvain Perrier, president and CEO of Mercatus, said in a statement.

Perrier said that providing personalized recommendations and promotions based on shopping history and personal preferences can help grocers strengthen their connections with customers and increase the likelihood of repeat business.