Dive Brief:

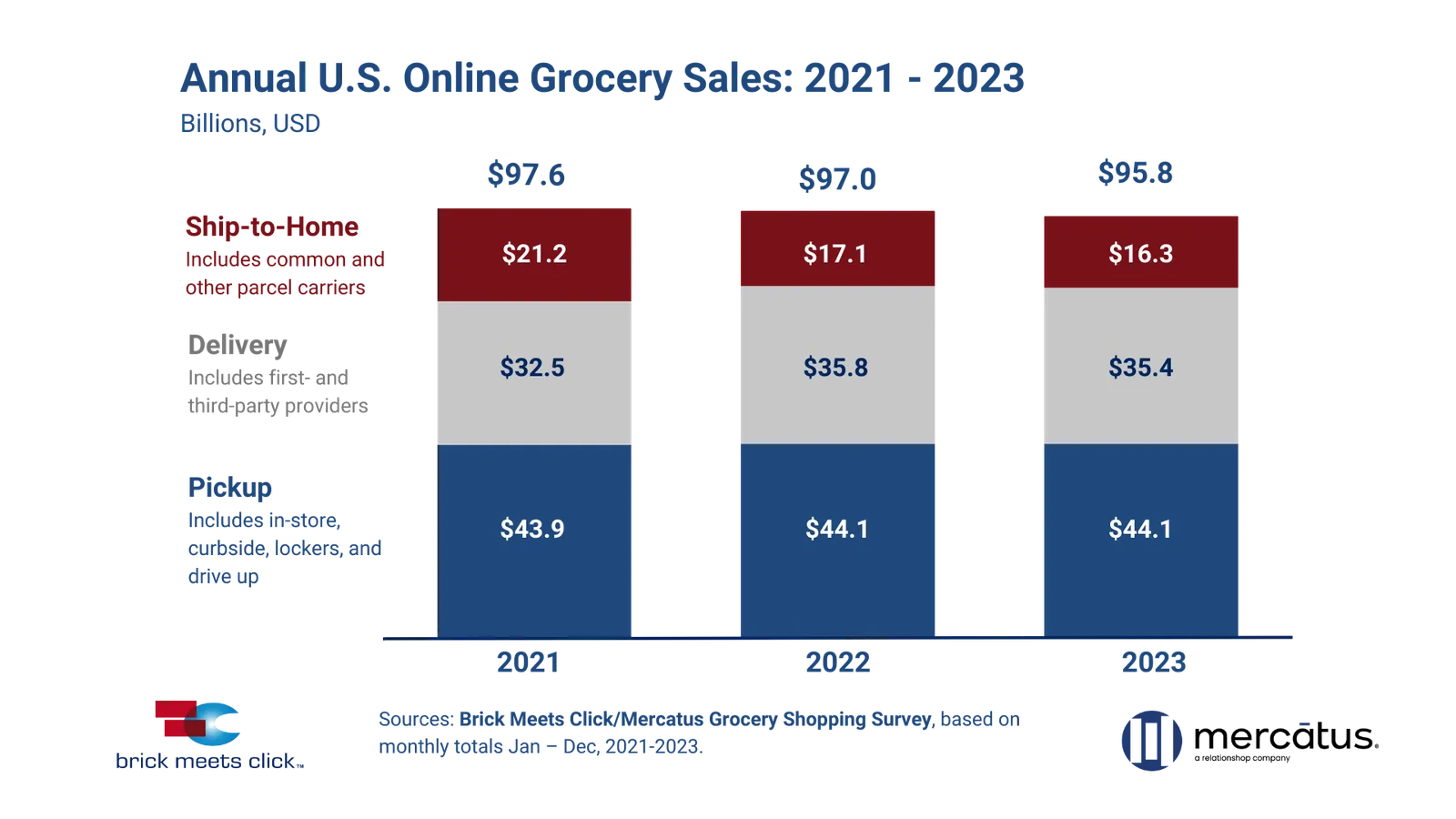

- In 2023, grocery e-commerce sales in the U.S. totaled $95.8 billion, down 1.2% from the year before and down 1.8% on a two-year stack, according to new research from Brick Meets Click and sponsored by Mercatus.

- A slowdown in order frequency by online grocery shoppers mainly fueled the year-over-year sales decline, the firms said, noting that order frequency among monthly active users shrunk in 2023 for the second consecutive year.

- E-commerce accounted for 12.5% of total grocery spending in 2023, down 0.18% year-over-year, based on the last week of spending in each month of the year across all retail formats.

Dive Insight:

A second consecutive year of declining e-commerce sales growth underscores the complexity grocers face in navigating this digital channel.

Indeed, while many companies in 2021 were trying to manage unprecedented growth driven by the COVID-19 pandemic, in 2023 grocers approached online grocery more holistically as shoppers prioritized in-person shopping and sought out low prices. These days, many companies talk about omnichannel shopping as the future of the industry.

Brick Meets Click’s results show that most consumers still prioritize online services that most grocers can fulfill from their stores. While ship-to-home’s e-commerce share and total sales have contracted each year from 2021 to 2023, pickup and delivery have both managed to maintain the sales and share bumps they gained in 2022. And while delivery saw expanded availability as competition increased among third-party marketplace providers, the channel still saw a small year-over-year sales dip of around 1%.

Regular users of online grocery shopping appear to have locked in their preferences. Average order value, not adjusted for price inflation, rose 3% in aggregate for all three e-commerce methods, and the overall monthly active user base grew 2% year-over-year in 2023, the firms found. However, there was an increase (1.72%) in the share of that user base who chose to use one e-commerce option — pickup, delivery or ship-to-home — exclusively, per the research. In 2023, 70% of monthly active users relied on one method.

With $44.1 billion in sales in 2023, pickup continued to claim the biggest share (46%) of grocery e-commerce sales, followed by delivery, which totaled $35.4 billion and accounted for just shy of 37% of sales.

“These annual results show that 2023 was very challenging for grocery retailing as higher prices chipped away at household purchasing power even though inflation has slowed considerably since its peak in 2022,” David Bishop, partner at Brick Meets Click, said in a statement. “Despite the challenges, Pickup continues to prove its appeal to shoppers, even without the benefits of expanded availability and/or aggressive promotions that aided Delivery in 2023.”

The multi-year analysis is based on more than 21,000 survey responses collected each year during 2021, 2022 and 2023.

As consumer preferences seemingly solidify for grocery e-commerce channels, Brick Meets Click and Mercatus continued to highlight how mass retailers and hard discounters like Walmart are posing stiff competition to supermarkets.

Mass retailers saw their monthly active user bases grow by 15% while hard discounters increased theirs by 12%. The number of active users that rely on supermarkets shrunk by 4%, the firms noted. The share of monthly active users engaging with mass retailers and hard discounters last year increased from 2022 while shrinking year-over-year for supermarkets.

As a result of these consumer behaviors, mass retailers boosted their share of grocery e-commerce sales to 45%, up 4.6%, while supermarkets recorded a contraction of 3.9% to 29%.

"As Walmart grabs market share through its price leadership and omnichannel strategies, regional grocers find themselves in a precarious position. To remain competitive, they must intensify their efforts in improving customer engagement, offering tailored personalization, and building loyalty,” Mercatus Global Chief Growth Officer Mark Fairhurst said in a statement.

Fairhurst urged grocers to focus on providing a seamless and highly personalized shopping experience to retain customers and slowly pull more in.

“[It] is not just about weathering the storm of price inflation and intense competition, but about thriving in it,” Fairhurst said.

Clarification: This story has been updated to clarify the number of respondents and timing of the Brick Meets Click surveys that the report is based on.