As the grocery industry deals with high-profile challenges such as tariffs on imported goods and bird flu, overall food inflation in 2025 is likely to move up even as prices of most goods stay in check, industry experts said Thursday during a briefing hosted by FMI — The Food Industry Association.

Data from the Bureau of Labor Statistics shows that about 80% of the foods and beverages that comprise the Consumer Price Index are headed to below-average inflation, suggesting that shoppers who are willing to be flexible should be able to keep their costs down this year despite shocks that have made it difficult to predict with certainty where conditions are headed, said Ricky Volpe, associate professor of agribusiness at California Polytechnic State University.

But upward pricing pressure on a few categories, such as eggs, beef and sweets, is likely to push food inflation to about 3.3% this year, over the historical average, Volpe said.

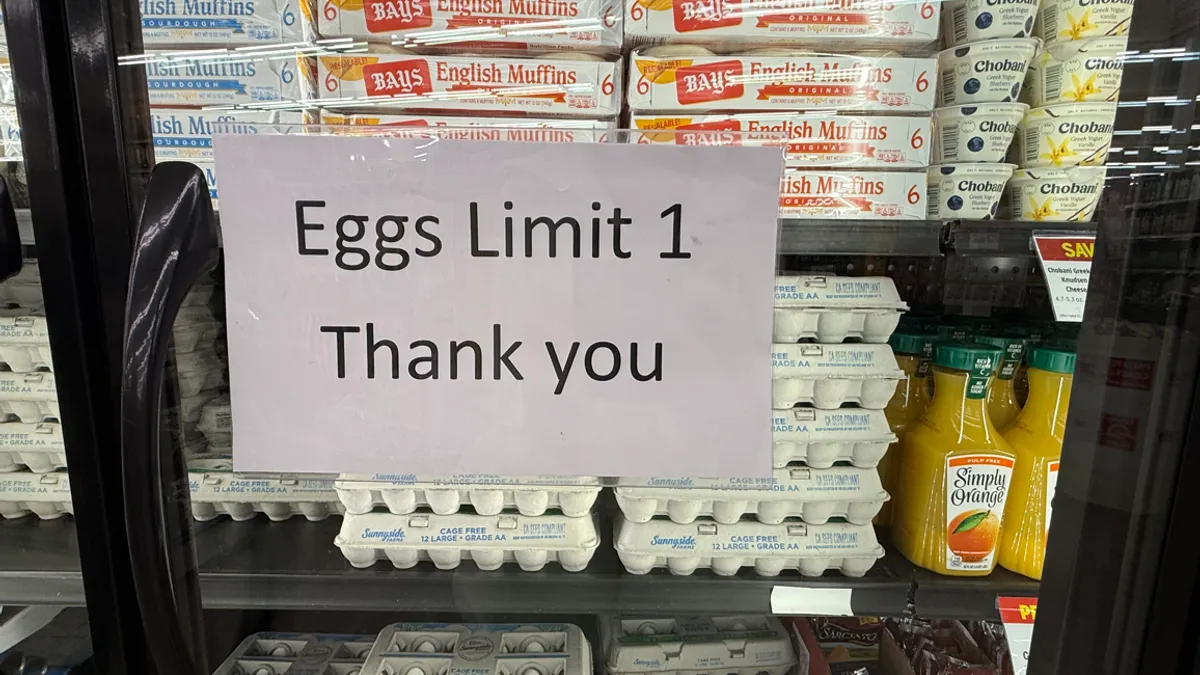

People’s willingness to make adjustments is extending to how they buy eggs, which are contributing heavily to food inflation as the staple product continues to face upward pressure from supply chain issues driven by bird flu. For example, shoppers are switching brands, shopping at multiple stores and moving from cage-free to conventional eggs to find ways to save money, said Andy Harig, vice president of tax, trade, sustainability and policy development at FMI.

“Consumers are nimble, and they’re bringing this flexibility to the egg situation. So they’re using all the tools in their toolbox,” Harig said.

On the other hand, demand for eggs tends to stay strong even as prices rise, owing to the fact that eggs are used for many popular foods. That has led them to play an outsize role in inflation, Volpe said.

Harig said that just a small group of foods is currently driving food inflation, noting that in addition to eggs, those goods include sugar, sweets and beef. Still, he pointed out that food inflation has remained below overall inflation in recent months.

Food inflation has recently ticked down against a backdrop of rising overall inflation. Food-at-home prices rose at a 1.9% annual clip in January, up from 1.8% in December. Overall inflation rose to 3% in January from 2.9% in December. The government is set to release inflation figures for February on Wednesday.

However, outlier categories like eggs, combined with the potential for tariffs to drive up the costs of imported foods, are positioned to gradually push prices back up, said Volpe.

Shoppers remain optimistic about their ability to maintain control over their costs, with 77% saying they feel in control of their grocery costs, according to FMI. Only about 40% feel their household finances will be better a year from now, however.

According to survey data FMI released on Friday, 54% of shoppers said they were extremely or very concerned about increased tariffs on imported foods, up 5 percentage points in January, before the Trump administration took office. Meanwhile, 51% of shoppers said they were worried about bird flu, an increase of 8 percentage points.

FMI President and CEO Leslie Sarasin said in a statement released Thursday that the trade group is “grateful” that President Donald Trump decided to pause tariffs on products covered by the U.S.-Mexico-Canada trade agreement until April 2. “We stand ready to work with the President and his team to make sure all Americans can access the groceries they need at prices that fit their budgets,” Sarasin said.

Harig pointed to data released in February by the Peterson Institute for International Economics that showed that the tariffs Trump announced at that time — 25% levies on most imports from Canada and Mexico combined with a 10% increase on tariffs on products from China and a 10% tariff on Canadian energy imports — would amount to a tax increase of more than $1,200 on the typical U.S. household.

Harig also noted that tariffs on goods other than foods can also have a substantial impact on the industry — and, by extension, on consumer prices. For example, he said that tariffs on steel and aluminum can affect the cost of products such as aluminum cans, store shelves, compactors and trucks as well as store construction.