UPDATE: April 14, 2022: Instacart announced on Thursday it has expanded online shopping with Grocery Outlet and now offers delivery across nearly 400 stores — the vast majority of the discount grocers' fleet — in California, Oregon, Washington and Pennsylvania.

Long hesitant to try e-commerce due to its unique operating model, Grocery Outlet's nationwide e-commerce rollout with Instacart follows a six-month delivery pilot between the two companies at 68 California stores.

“Following positive results from our pilot, we recently completed a rollout to nearly all stores. While it’s only been a few weeks since the rollout, we are pleased with the smooth execution and the favorable response from Independent Operators and customers so far,” Grocery Outlet CEO Eric Lindberg said in the announcement.

Grocery Outlet executives said during its fourth-quarter earnings call in March that the Instacart partnership would expand nationwide and shared that Grocery Outlet will also begin piloting a loyalty app this summer.

Dive Brief:

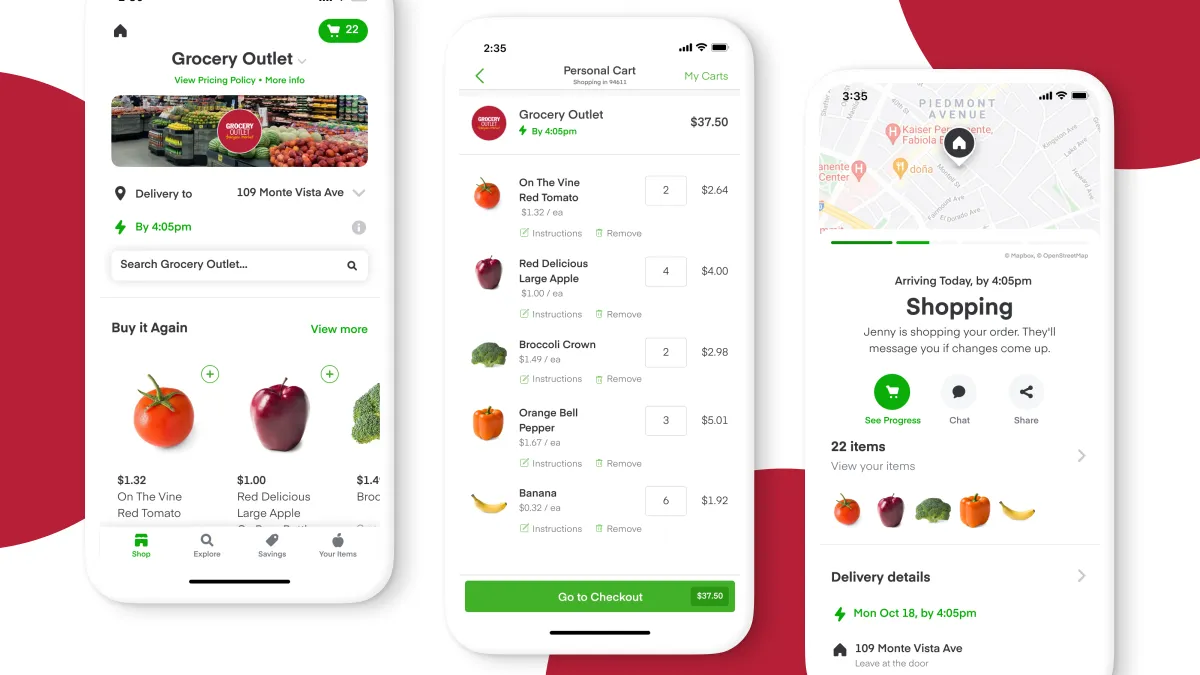

- Grocery Outlet has teamed up with Instacart to make its e-commerce debut, according to an emailed press release on Thursday.

- The discount grocer is offering same-day delivery from 68 stores in California — roughly 17% of its fleet — through a six-month pilot with the e-commerce provider. Instacart's workers will pick and deliver the orders.

- The announcement follows the supermarket chain's disclosure in August that it was in talks with technology companies to start testing online shopping.

Dive Insight:

Consumers pushing for convenient shopping options and the possibilities of reaching new shoppers online helped spur Grocery Outlet's decision to venture into e-commerce after long resisting such a move, CEO Eric Lindberg said in the announcement.

“We think it’s important to make our great-value products available across another platform and to a greater audience, introducing Grocery Outlet to customers who may not have shopped with us before," Lindberg said in a statement. "Consumers are telling us that convenience is more important than ever — and we are listening."

While executives said during the grocer’s second-quarter earnings call in August that they were exploring pickup opportunities, the Instacart partnership only mentioned delivery and it's unclear if the grocer sees potential in pickup, which has continued to be a popular e-commerce method this year. RJ Sheedy, Grocery Outlet's president, said during the earnings call that e-commerce tests would assess several factors, including alignment with the grocer's "unique model," operational and technical considerations, and total market opportunity.

Executives had previously pushed back on questions about online shopping, with Lindberg telling investors during an earnings call in May that it was hard to predict consumer trends and behavior during such a "very volatile time" and that the grocer was sticking to its long-term model.

The announcement with Instacart stresses the grocer will still keep the "treasure hunt experience" that it has long pointed to as a strength. While e-commerce can get pricey with fees, tips and markups, Grocery Outlet and Instacart are positioning their partnership as a way to serve customers who want fast service and affordability.

In a note to investors, Jefferies analyst Randal Konik praised the online shopping pilot, saying it better aligns Grocery Outlet with its peers and should help the company acquire more shoppers and build larger baskets.

"Other Value Retailers, such as Aldi, Family Dollar, and Five Below have partnered with Instacart... and they have witnessed success from the initiative," he wrote.

The move comes at a time when the low-margin grocery industry continues to weather financial pressures from the pandemic, including supply chain woes, inflation driving up costs and trip consolidation by shoppers. For Q2, Grocery Outlet's comparable-store sales were down 10% compared to last year’s Q2, and its net sales decreased 3.5% to $775.5 million, while earnings before interest, taxes, depreciation and amortization dipped 15.7%, to $50.8 million.

Jeff Wells contributed reporting to this story.