This story is part of a series on key trends that will affect grocers in 2024.

While 2022 saw retail media emerge in the grocery industry, this past year marked this type of marketing becoming a necessity for grocers to connect with shoppers, remain competitive in the industry and please brand partners.

Regional and specialty retailers, such as Sprouts Farmers Market and Giant Eagle, joined national grocers in the retail media space. Across the board, grocers focused on omnichannel and digital capabilities for their retail media growth in 2023 — such Firework and The Fresh Market expanding their shoppable videos partnership and Dollar General’s retail media network linking with Meta to allow advertisers to reach shoppers through their social media profiles.

“I think retail media had the remarkable year that we all hoped and expected it would,” said Jordan Berke, a former Walmart e-commerce executive who is founder and CEO of Tomorrow Retail Consulting. “The leaders within the retail media market really became media moguls [and] they arrived at a level of quality in their advertising products, their analytics, in their services that rivals the Metas and Googles of the world.”

Between January and November of last year, ad spending by food brands hit $717 million, up from the $629 million recorded for the same period in 2022, according to an analysis from MediaRadar.

By the end of 2024, omnichannel retail media ad spend is projected to reach $59.98 billion, per Insider Intelligence’s October 2023 forecast.

But as in-store shopping has roared back to prominence, retailers are under pressure to bring retail media into the aisles and checkout lanes of their physical locations.

So despite omnichannel growth dominating retail media last year, industry experts anticipate grocers to shift focus to in-store retail media technologies in 2024. As a result, consumers can expect to see more digital screens, interactive kiosks and in-store app capabilities as part of an effort to further tie together the in-store experience with retail media’s reach.

The power of personalization

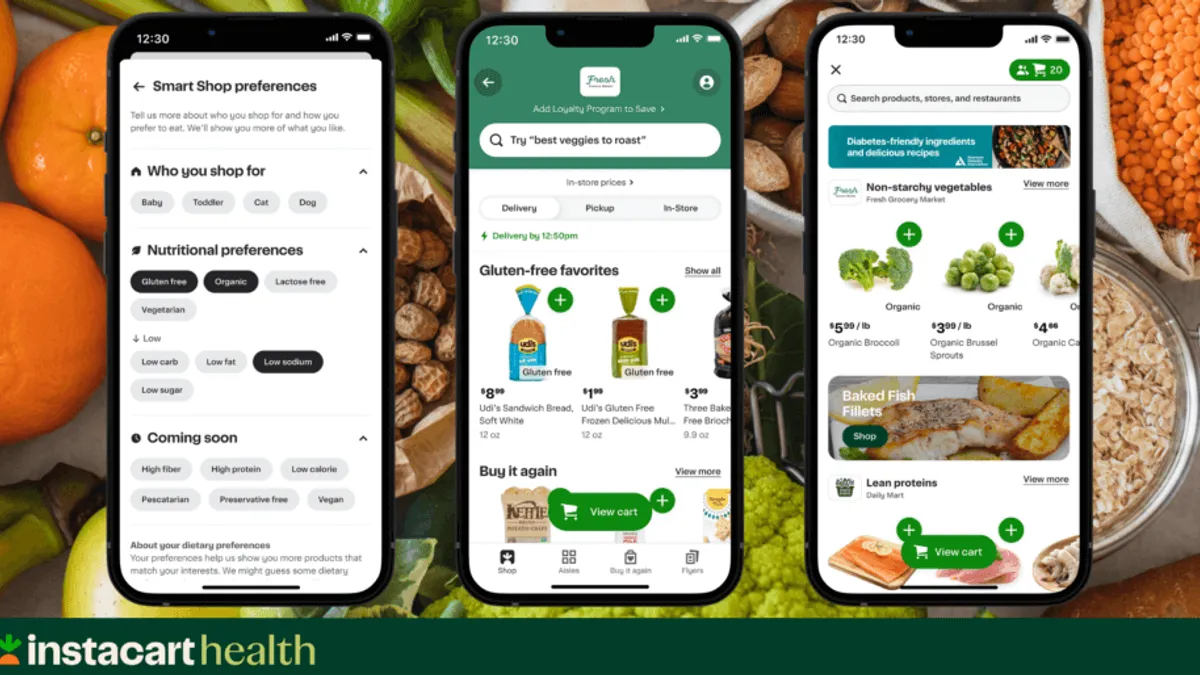

In addition to generating valuable additional revenue, connecting with consumers is a key reason retail media has become crucial for retailers. Grocers will work to replicate online personalization into targeted in-store shopping experiences for their customers in 2024, experts say.

“If I’m going to come in the store, you need to know me as well as you know me online,” said Anne Mezzenga, co-CEO of retail blog Omni Talk and a former Target executive.

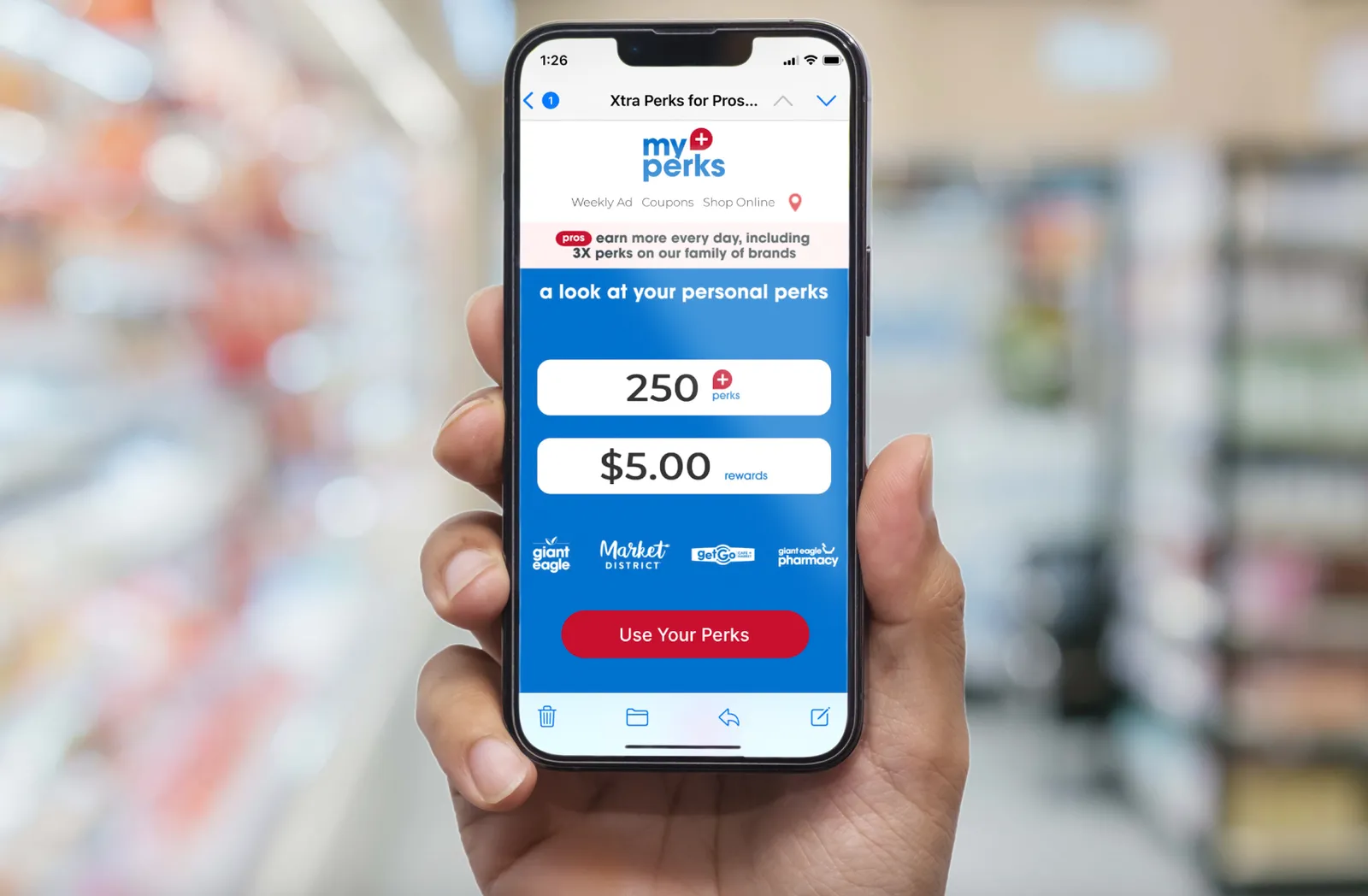

By making retailers’ apps an everyday utility, grocers can begin incentivizing customers to shop in-store, Berke said. He gave the example that only 22% of Kroger’s promotions are digital-only deals, according to his firm’s research, making the rest of its discounts targeted to customers shopping in person. That allows Kroger to monetize and personalize customers’ shopping trips, he said.

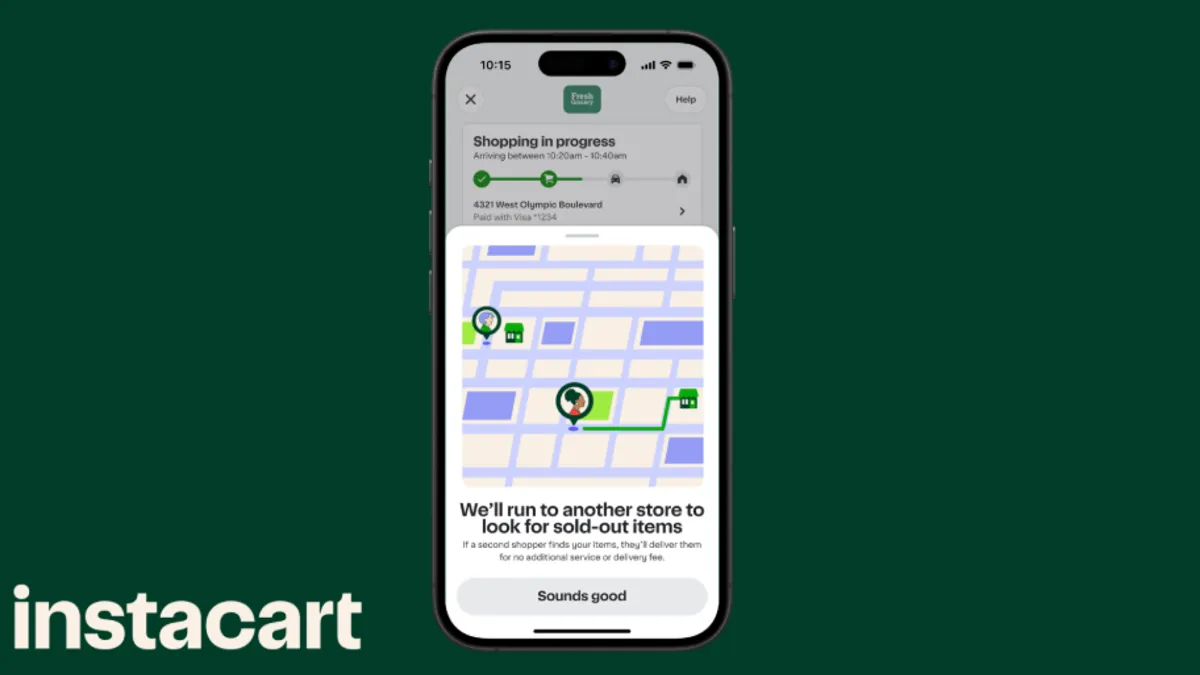

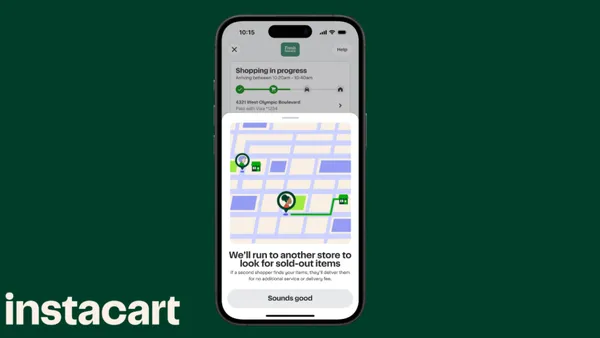

Grocer’s apps and other targeted ads are not restricted to a customer’s phone. Instacart began piloting ads on its Caper smart carts at Good Food Holdings banner stores earlier this month to show customers dynamic ads and promotions at the beginning of a shopping trip along with personalized recommendations based on real-time shopping behaviors.

However, the work on the customer’s end when accessing discounts and loyalty program benefits has to be minimal while the reward for using the app in-store has to be high, Mezzenga noted. She added that retailers can ensure a streamlined experience for customers by compiling all of the features onto one app, including linking membership cards and payment options as well as downloading receipts.

“Especially as retail media continues to better follow our experience from online to offline, I think the world of having to clip coupons or save them is going to have to go away,” Mezzenga said. “It’s going to have to get smarter, develop predictive behaviors so that it can serve [customers] the right kind of content so that [they] don’t have to lift a finger. [They] just scan the app and go.”

Using screens to grab shoppers’ attention

The addition of digital screens to replace traditional signage has picked up steam in recent years. Kroger, for example, added digital smart screens to 500 of its locations. This is the type of retail media initiative Berke believes will pick up steam throughout this year.

While digital screens are not as trackable, traceable or targetable as an app or e-commerce experiences, they offer grocers advantages over traditional signage, driving incremental sales and bringing in media revenue, Berke said.

Digital screens are “a dynamic surface where you can constantly curate your message and target your message, at least geographically and by daypart,” Berke noted. “They typically also get some type of data feed, which is at least [the] number of impressions [or] number of customers in the vicinity.”

Many of these digital smart screens also have a “mobile sniffer” or mobile tracker built into them, Berke said, which enables them to gather intel on how many mobile IDs were within the vicinity of a display.

Berke recently visited Amazon Fresh’s revamped location in Woodland Hills, California, and noted how the store embraced the use of digital screens. The screens serve a dual purpose of guiding customers through store sections and also showcasing ad media, he said.

Amazon integrated its media inventory into its demand-side platform (DSP), which allows advertisers to go into the platform and bid on media, including screens in Amazon Fresh stores, Berke explained.

“If the retailer is using the screens effectively, they can help the user get navigational guidance from the screen. [So] it can be used for other reasons other than media,” Berke said.

Balancing in-store retail media with other shopping enhancements

Retail media, both in-store and online, is still in its early stages as retailers continue to experiment with different technologies for advertising.

While digital screens and app integrations are the most popular examples of in-store retail media right now, they’re not the only integrations that are happening. Wakefern placed tech-enabled, interactive sampling kiosks in nearly 100 ShopRite and The Fresh Grocer stores. Shoppers can receive a product sample by scanning in with their phone, allowing the system to gather data and see if that trial led to a purchase.

According to Mezzenga, retailers should invest in the media that gives them the most intel on the shopper through all points of the shopping trip

As grocers explore in-store retail media technology, experts caution retailers not to lose sight of the value of investing in digital solutions that enhance the traditional shopping experience without ads.

John Clear, senior director at consulting firm Alvarez & Marsal, noted the benefits of electronic shelf labels (ESLs). ESLs can automatically handle once time-consuming tasks like checking shelves for out-of-stock items and updating prices, allowing for staff members to focus on assisting customers, Mezzenga added.

Amazon Fresh, Schnuck Markets, Hy-Vee and Dom’s Kitchen & Market are just a few of the retailers that have installed ESLs in their stores.

“[ESLs] has a really clear ROI for the retailer and now has a really clear value proposition now that more people are using it,” Clear said. “And I think that makes much more sense for people to lean into in terms of mitigating costs, because labor costs are not going away. And so if we can mitigate your labor costs there, make your in-store experience better, and then you can drive sales that way.”