Entering the retail media space has practically become a requirement for grocers to stay relevant with shoppers, competitive among retailers and connected with brand partners.

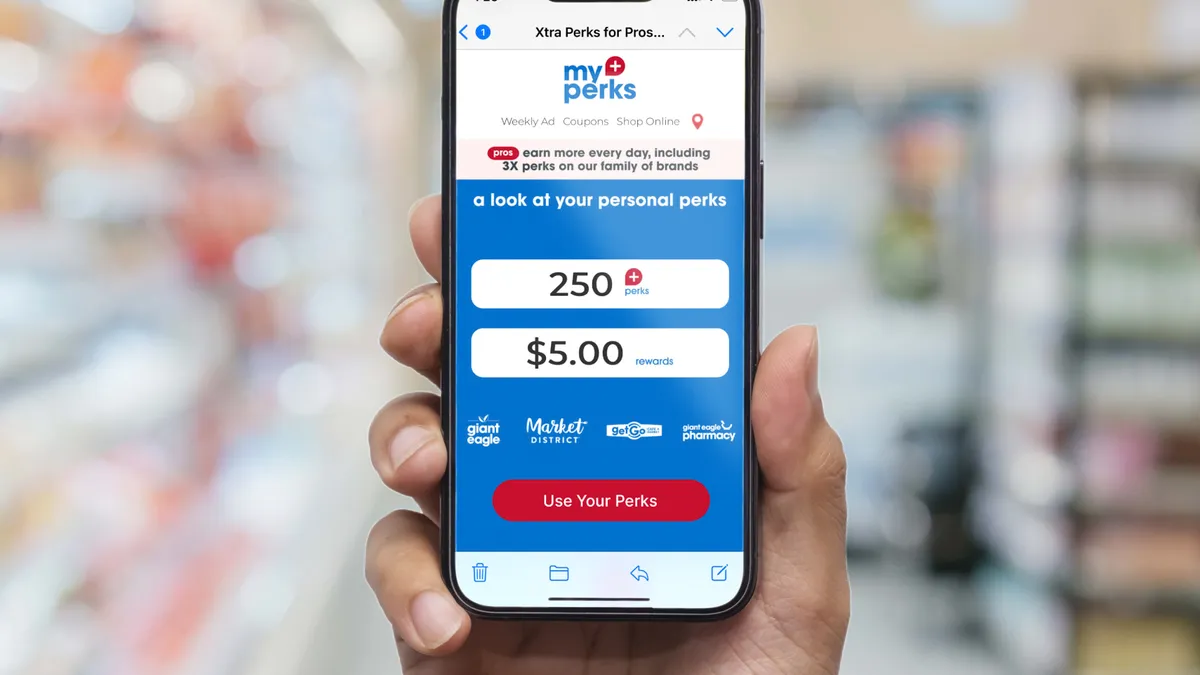

Numerous regional and specialty grocers have launched retail media networks, with Sprouts Farmers Market unveiling a platform based on Instacart’s Carrot Ads technology in May and Giant Eagle taking an almost unheard-of approach as a regional grocer by launching an entirely in-house network.

Meanwhile, national companies are paving the way for others, as Albertsons recently pushed for industry-wide metric standardization to make retail media more accessible and strengthen brand-grocer partnerships.

Third-party companies are also working overtime to establish their networks and offer real-time data. In February, Swiftly and Webstop partnered to bring more mobile solutions for retailers. And the Independent Grocers Alliance partnered with Ideal by Design House to bring independent grocers in on the retail media game.

But the acceleration of retail media isn’t solely for the online world.

Post-pandemic, grocers want to amp up the in-store experience again, and retail media promises to play a role to that end. Smart carts, interactive kiosks, digital screens and even aisle-roaming robots are becoming grocery staples.

The kiosks Wakefern rolled out to nearly 100 ShopRite and The Fresh Grocer stores in mid-May dispense product samples to entice shoppers. And smart carts, including those powered by Instacart and Veeve, allow shoppers to view deals, tally up prices and help locate products.

In 2022, retail media spend surpassed $40 billion, according to a December eMarketer report, and the firm expects advertisers will pour more than $45 billion into retail media ad spending this year. Bottom line: Retail media shows no signs of slowing down.

Here’s a roundup of what grocers have done in the retail media space so far in 2023, both in-store and online.