This story is part of a series on key trends that will affect grocers in 2024.

Grocers have been turning up the heat on their competition with restaurants for consumers’ meal dollars with their foodservice offerings, which can range from prepackaged options to hot or cold bars to made-to-order stations.

Giant Food, for example, is dedicating more space and cases to meal options in its new stores. While there’s some internal competition with the center aisles, Cynthia Volk, the retailer’s director of deli, bakery and foodservice, said she focuses more on external competitors.

“In the foodservice department, I’m not only looking at Whole Foods, Wegmans, Safeway, Harris Teeter [and] the other conventional grocery retailers, but I'm competing with restaurants. Now, when it comes to the assortment that we have it's either come here and grab an offering or maybe go to Chipotle,” Volk said.

Grocers have benefited from pandemic-related consumer behaviors, from consolidating shopping trips to eating out less often and becoming more comfortable with at-home meal prep. To nab more meal occasion spending, grocers have placed additional emphasis on offering restaurant-quality meals and in some cases designed spaces as meal destinations.

“Deli-prepared foods remain a bright spot in grocery retailing. As consumers balance cost versus convenience, prepared foods are hitting a sweet spot and are increasingly stepping up as true restaurant alternatives,” according to a December report from 210 Analytics.

As 2024 gets underway, here’s a look at how grocers define and spotlight “value” of foodservice to consumers.

Making foodservice stand out

When shoppers venture into a newly opened Giant Food location in Bethesda, Maryland, they’re greeted by a sushi counter instead of the usual produce department. At the counter, they can find prepackaged items like egg rolls, sushi and bao and also get made-to-order items.

Located at 5320 Zenith Overlook, the store also features the grocery chain’s 13th in-store Ledo Pizza Corner Shoppe along with several cases of ready-to-eat and ready-to-heat meal options.

While the square footage devoted to foodservice varies by store, Volk said the new Bethesda location is indicative of the growing emphasis that the grocer is placing on foodservice.

Other grocers are also giving foodservice a starring role in their floor plans and merchandising strategies.

For example, Wegmans — a grocer already well-known for its foodservice options — dedicates nearly an entire floor of its newly opened two-level store in Manhattan location to ready-to-eat, ready-to-heat and made-to-order selections. Northgate Market’s new Mercado concept in California, meanwhile, features food vendor stalls serving authentic Mexican cuisine such as tacos and tostadas and also has a fine-dining Mexican restaurant.

The overall aesthetics of a store can also play a major role in helping to attract consumers to the foodservice offerings and make meal options more appealing.

Cingari Family ShopRite, a family-owned Connecticut chain under the Wakefern grocery cooperative, is in the process of renovating its 12 locations and has noticed that foodservice sales are up 20% to 30% within three to four weeks after completing a store renovation, said Chef David Cingari, whose brother is the grocer’s president.

The products in the foodservice department don’t change, yet consumers seem more inclined to buy them in a more attractive space, Cingari said, noting that the renovations include new flooring, raised ceilings, cases with LED lighting and wood accents, and packaging that aim to have the stores resemble an “open-air market.”

“[When] you walk into a store that looks [great], that really just puts you in a different set of glasses. You feel better. You trusted the brand a little bit more. You're going to pick it up and try it,” he said.

When space in the foodservice cases allows, Cingari likes to keep the chain’s private label line separate from other brands to help the line stand out, he said.

Highlighting price

Signage throughout the new Giant Food store advertises deals and prices on foodservice items, from BOGO to the $10 family meal, which includes a chicken entree with the choice of two sides.

At the store’s smoked meats hot bar, a sign prominently announces the offerings are “$9.99 per pound,” and over at the sushi counter, paper and digital signage promote “$4.99 sushi every Wednesday.” Customers can also find “$9 deli meal combo” stickers on prepackaged wraps prompting them to also get a 20 oz. Coca-Cola product and a bag of chips.

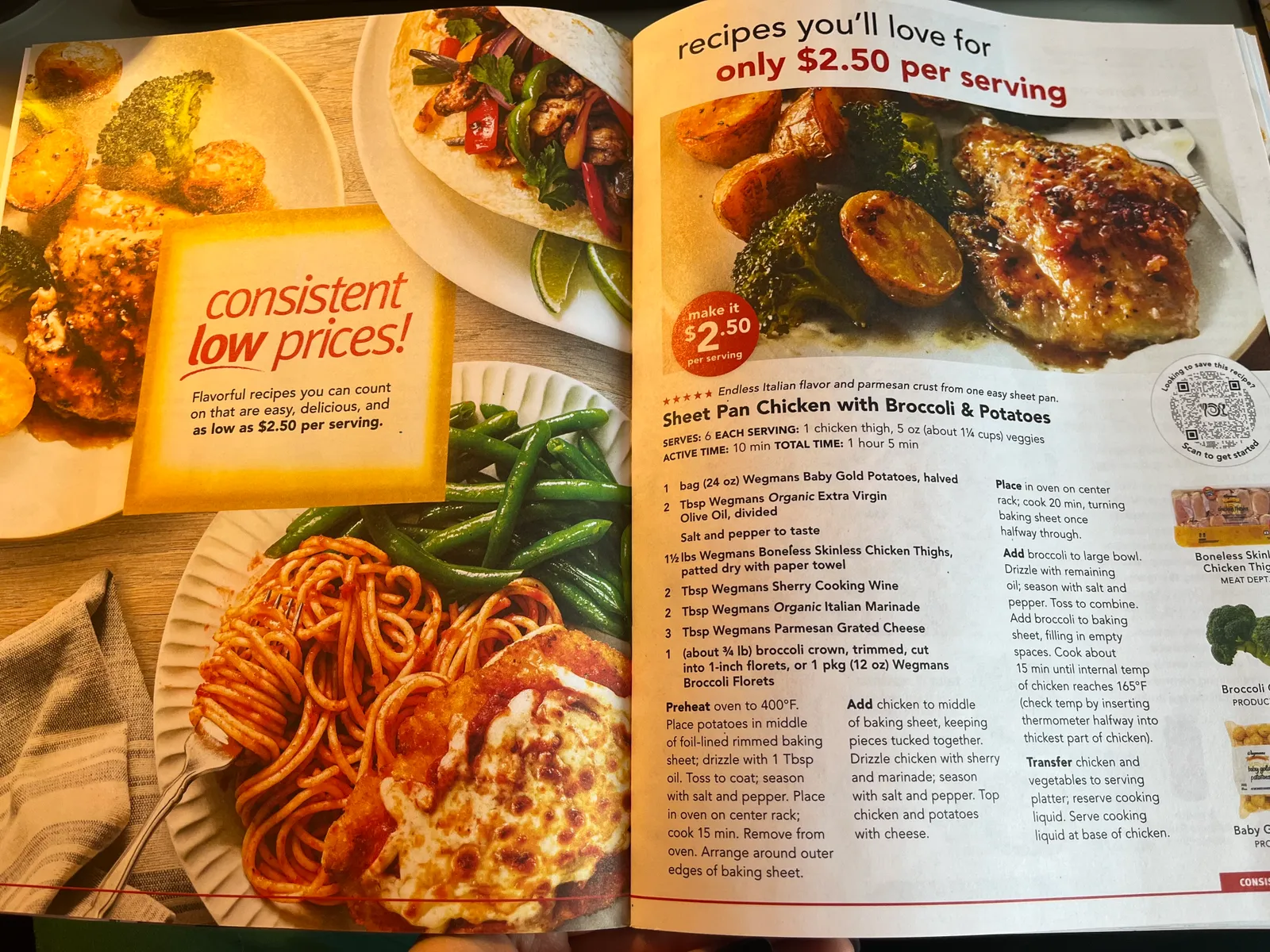

Similarly, Wegmans’ winter 2024 magazine spotlights value right on the cover, with a message telling shoppers to “make it $2.50 per serving.” For many of the recipes and meal offerings throughout the magazine, the family-owned grocery chain promotes their low per-serving cost, ranging from $2.50 up to $7.50 for sheet pan salmon with tomatoes and capers.

Shoppers are increasingly using a combination of scratch cooking with semi- or fully-prepared items, like a rotisserie chicken, a pre-packaged salad or ready-to-heat mashed potatoes, to create “hybrid” meals, according to research last fall by FMI – The Food Industry Association. The hybrid meal approach is one that FMI predicts will continue in 2024.

Leaning into that trend, the magazine’s recipes spotlight cook-in-bag chicken, ready-to-heat chicken parmesan and ready-to-heat meatloaf options that people can use to streamline meal prep.

While salad season typically doesn’t extend to the winter, sales of Cingari Family ShopRite’s line of fresh daily-made packaged salads have been “on fire” recently, Cingari said, noting that the price — which is less than what many salad chains charge — is a draw for some customers.

“It's way more successful than we expected it to be at this point, which is super exciting,” Cingari said about the salads.

Providing a range

At the newly opened Giant Food store, signage highlights a $7 “walking taco” meal deal that includes a small cup of chili from Ben’s Chili Bowl, a bag of chips and a beverage. Customers can put the chili on the chips and use the chip bag as a bowl for the walking taco. “This is my direct competition to a Chipotle,” said Volk.

“If you go shopping for clothes and you see an outfit on a mannequin — I'm trying to do for my customers [with a] curated assortment," Volk said.

The walking taco is just one of several options at the Giant store aiming to appeal to convenience and customization. Individually packaged proteins and sides, including proteins from the grocer’s smoker section, allow shoppers to determine serving sizes and personalize their meals with mix-and-match items.

Tapping more into the value of convenience, Giant has two-serving, prepackaged “combo meals” that include a protein with sides. For those, Volk said Giant Food is “constantly looking at new flavor profiles on rotating seasonal flavors.”

While Giant offers both, data for deli pre-prepared foods indicate that consumers are gravitating toward choosing their sides and entrees. Unit sales of entrees and sides were both up roughly 2% in 2023, while combo meals were down almost 30%, according to Circana data cited by 210 Analytics.

Customization with serving sizes and flavors as well as time-saving options are key elements that make grocery foodservice attractive to consumers, Volk said.

“To pay an inexpensive price for something that you don't enjoy is not a good value, so meeting price and quality to me, in my mind, that's what defines ‘value’ to an individual,” Volk said.