A little more than a decade ago, Lowes Foods changed the way it sold groceries.

With more than 60 years in business, the North Carolina-based company had amassed dozens of supermarkets, some convenience stores and a discount banner. Internal research showed the regional grocer had a strong base of loyal shoppers who valued the company for running clean, convenient locations.

But those qualities alone weren’t going to help Lowes Foods succeed in an industry where traditional supermarkets faced a barrage of competitive threats from new as well as entrenched competitors. To stand out from the crowd, the company’s management team created a new type of store that sought to make grocery shopping more entertaining — a lot more entertaining.

Lowes opened restaurants, including a chicken joint, a craft beer bar and a spot that churned out house-made sausages. It gave these foodservice establishments clever names, such as Chicken Kitchen, The Beer Den and SausageWorks.

Stores added stations where shoppers could take their produce to be chopped, sliced, julienned or carved up any way they saw fit.

“Our go-to-market strategy is really not to be a traditional supermarket company,” said Tim Lowe, president of Lowes Foods. “Our go-to-market strategy is to be an entertainment company that intersects with people around great food experiences.”

The regional grocer’s differentiation strategy was expensive and time-consuming to execute, but Lowes’ leaders saw it as a sound strategic shift as an onslaught of supermarket competitors — including Walmart, Lidl, Publix and Wegmans — moved into its operating region.

A lot has changed in the past few years, and once again Lowes’ strategy risks falling out of touch. Along with increasing competition, the regional grocer has to appeal to shoppers who have been through a world-altering pandemic and over a year of record-high inflation. Many people adopted online shopping during the pandemic, and they expect to have that option available to them with just a few clicks or finger taps.

At the same time, Kroger’s acquisition of Albertsons, which is under regulatory review, underscores the growing power of the industry’s biggest players and their relentless drive to increase dominance. As Walmart, Amazon and the nation’s largest supermarket chains expand, they will continue to push the needle on digital innovation as a competitive advantage, in turn raising consumer expectations for the shopping experience, both online and offline.

Lowe, who held management roles at Supervalu, Meijer and Best Buy before coming to Lowes Foods in 2013, remains confident in the entertainment-focused approach that is now firmly a part of the regional grocer’s brand identity. But he believes that his company needs to embrace digital innovation not just to modernize that strategy but accelerate it as well.

Thinking digitally, Lowe said, is about more than thinking purely in terms of technology. Digital evolution is about considering how a grocer wants to be more convenient and more relevant for its shoppers, how best to use its workforce and run its operations more efficiently — and then how it can tie everything together as only digital can.

It’s about bringing omnichannel retailing — that often-used industry buzzword — to the forefront of business strategy in ways that make sense for shoppers, he noted.

Launching an omnichannel app

Much of Lowes Foods’ new omnichannel retailing approach is embodied in its recently refreshed app.

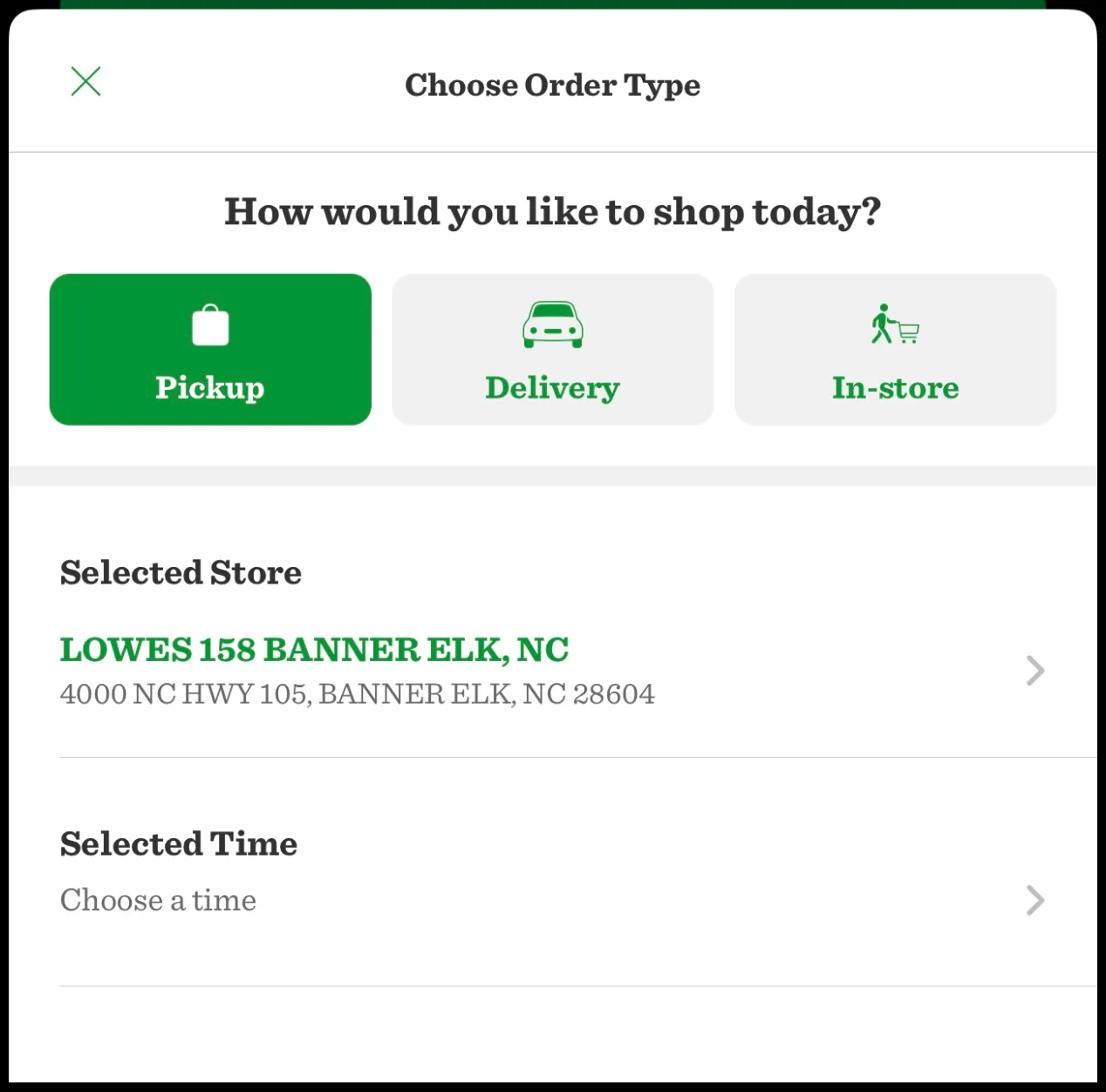

The app, which debuted last October, is a sharp departure from its predecessor. While the previous version was built to power e-commerce, the new app is built for use across shopping occasions. The enhanced technology includes three modes that customers can toggle between — in store, pickup and delivery — reflecting the different retailing channels shoppers use depending on their needs.

The app interface stays consistent across shopping modes. Instead of adding items to the store list, the one-click feature under the pickup portal adds a product to shoppers’ virtual carts. Lowes, which has offered e-commerce for more than 25 years, takes a service-focused approach to its Lowes Foods To Go online service, relying on its own employees to pick orders and call shoppers with updates.

The choose-your-path setup, which national retailers such as Albertsons and Target also use, underscores how important it has become for retailers to make it as easy as possible for customers to switch between different shopping channels.

“Omnichannel shoppers are worth a heck of a lot more than single channel shoppers,” said Nick Bertram, former president of The Giant Company who is now president and COO of FlashFood.

Under the in-store tab, users can clip digital coupons and locate the exact store aisle where items are located. A barcode scanner pulls up product information. A list-building tool lets customers add and check off items with one click, and the tool can be shared across users.

“My wife and I can go into the store and say, ‘Hey, let’s divide and conquer.’ I can take the app and head to one side of the store, while she heads to the other, and we can see what we’re each picking out as we work toward the middle,” Lowe said.

To promote exploration and build baskets, the app features products that are bundled together across themes and holidays — “collections,” as Lowe calls them. “Beer’s to You, Dad” was a recently promoted alcohol storefront timed to Father’s Day, while another played up selections from Lowes’ in-store cake shop, The Cakery, as well as other sweet treats.

A “holistic experience” with digital

Lowes began exploring its app reset back in 2018, said Chad Petersen, senior vice president of e-commerce at Lowes Foods. The move was significant, entailing an overhaul of the company’s entire digital platform. And it was disrupted by the pandemic, which pushed millions of customers into online shopping, taxing grocers’ digital capabilities in the process.

But it was important for Lowes to develop a custom solution — a “true native app,” as Petersen calls it. The new platform, which was engineered by digital commerce provider Inmar, provides an infrastructure to which Lowes can add new features down the road.

In the not-too-distant future, Petersen and Lowe said, the Lowes Food app could include gamification, AI-fueled search, product stock visibility for e-commerce customers and more customizable shopping options across its restaurants and other service departments.

“That holistic experience is the direction and we and most regionals have to go, because you have to literally put your brand in that guest’s hand,” Petersen said.

Getting shoppers to use the app, however, posed a steep challenge. Instead of getting an automatic update, customers were required to download the new app and set a new password — steps that might seem small, Petersen said, but can be just out-of-the-way enough for shoppers to forgo.

To spur adoption, Lowes offered a special digital-only deal on a highly prized product: fresh eggs. In December, the grocer launched a $3-off deal on a dozen eggs in the app and provided promotional as well as logistical support for customers inside stores.

In every location, employees were on hand to help shoppers download and troubleshoot the new app. Stations that were typically used for product sampling became impromptu tech support desks.

“We didn’t just go out there with a digital coupon,” Lowe said. “We put together a whole playbook for our stores.”

Shoppers downloaded the app in droves. And the grocer took the opportunity not just to troubleshoot for customers but also to tell them about the app’s features and the benefits of being part of the company’s digital ecosystem.

The change, however, hasn’t sat well with customers who were accustomed to the previous app. On Apple’s App Store, the Lowes Foods app has a 2.2 out of 5 star rating based on more than 140 reviews.

- “I understand businesses and organizations need to refresh and update periodically … but the new version of the app is way too disorganized and frustrating,” one user wrote in a review.

- “I enjoy the new look but really miss the features of the old app,” wrote another.

The tepid response underscores the growing pains that can come with digital evolution.

Rob Weisberg, Inmar’s president of incentives and loyalty, said that consumers often get frustrated when companies make even small changes to frequently used technology, but that results improve as they get used to the updates. He said sales through Lowes’ platform so far have surpassed $100 million.

Lowe, meanwhile, acknowledged that Lowes’ consumers historically have been slow to adopt in-store digital features, making it important for his company not to try and push them too far out of their comfort zone.

“I’m a firm believer that you always want to be at step pace with a consumer and not be a Webvan where you got too far ahead of them,” Lowe said, referencing the early online grocery pioneer that flamed out more than 20 years ago.

Lowe declined to cite any data regarding customer usage and growth through the company app, but he said engagement has climbed back to where it was with the previous app. “We know that whenever guests engage with us digitally, they are more attuned to our brand, and they become more loyal to our brand.”

Building a testing ground for innovations

In addition to its new app, the regional grocer has added numerous digital features over the years in an effort to keep pace with shopper demands. Around half of Lowes’ stores have digital “shelf edge” screens that display product information, Lowe said, while around 85% of locations offer self-checkout machines.

There are numerous other tech upgrades that seem promising but require careful vetting. To help the company gauge where that line between innovation and shopper acceptance sits, last year Lowes opened an innovation store in Huntersville, North Carolina.

The store serves as a proving ground for new concepts, starting first with its size and location. It’s around 25,000 square feet, which is half the size of a typical Lowes store, and situated in the Charlotte metro area, a market Lowes is reentering after leaving more than 10 years ago.

Lowes’ foodservice concepts play a central role at the store, with five of the company’s proprietary restaurants on hand, allowing it to test its ability to enter new markets as a restaurant-grocery hybrid.

On the digital side, the Huntersville store features a few tech-enhanced checkout options. A scan-and-pay program lets shoppers log products as they shop using their phones. A hybrid front-end system has a single line that feeds into a "bullpen" area with both staffed checkout registers and self-checkout machines.

The innovation store — which Lowes refers to as a “shopping Swiss Army Knife” for the way it targets various shopping missions across grocery and foodservice — is testing digital menu boards that automatically update throughout the day, as well as an ordering and billing system that uses shoppers’ smartphones.

The Huntersville location is also a testing ground for electronic shelf labels (ESLs), which are positioned throughout the store. Lowes is also testing ESLs, which allow retailers to quickly update prices and other information for shoppers, at its three standalone liquor stores.

All of these digital features are expensive and complex to implement. Yet they carry the strategic appeal of helping retailers save on labor as well as connecting across store systems and shoppers’ devices, which in turn produces valuable data that companies can use to further hone their operations.

Customers aren’t always comfortable with the innovative changes that technology provides, however. For instance, Lowe said that shoppers at the Huntersville store have expressed frustration that they cannot see the traditional red-sale tags calling out from shelves. So the grocer recently began reintroducing the familiar sales tags to accompany the ESLs.

“I’ve got sale opportunities everywhere,” Lowe said, “but to the customer nothing was on sale.”

Creating a consistent experience across channels

Lowe frequently invokes Disney when he talks about the grocer’s omnichannel journey. To him, the entertainment company deftly weaves together its digital and physical assets in a way that’s not just compelling but feels consistent across all of its properties, from theme parks and retail stores to movies and games.

“The Disney halo” is how Lowe refers to the company’s reach and ability to connect with consumers.

“How do we get that type of loyal engagement to where, when people engage with our brand, whether it’s digitally or otherwise, they still feel like they’re in our store?”

Lowes’ management team knows it cannot answer questions like this through intuition alone. To this end, the company has built an operational infrastructure over the years that tries to effectively identify, pilot, tweak and scale digital opportunities.

Like most other grocers, Lowes studies consumer data churned out by research firms. But it also polls its shoppers frequently, walks with them as they shop stores, and visits with them in their homes to collect the qualitative insights that the company president said are vital to understanding their wants and needs.

"I’m a firm believer that you always want to be at step pace with a consumer and not be a Webvan where you got too far ahead of them."

Tim Lowe

President, Lowes Foods

Through its research, for example, Lowes learned that visitors to its Beer Den in-store bars wanted a communal experience — not just a place to drink and zone out. Hence, the company doesn’t put up TV screens in that area of the store. Customers who want to watch a game can hop on the store’s WiFi and stream away.

Lowes also adjusted its corporate structure and how teams manage projects. Digital initiatives aren’t overseen by information technology employees but by managers across various departments.

“We have to have defined business owners that are responsible for the outcome of what each digital asset is going to produce for the consumer as well as for the hosts within our stores,” Lowe said. “And they’re responsible for basically taking that from the entry point all the way to full maturity.”

Lowe said he works to make sure that workers across departments are collaborating on digital initiatives and that “fiefdoms” don’t arise. “I hate it whenever walls come up because then we don’t get to see from the true perspective of what it means to the business and ultimately what it means for our hosts as well as for our guests.”

Following a digital roadmap

As the company’s digital tools and the technology that supports them become more sophisticated, Petersen said Lowes has hired tech-savvy workers from outside of the grocery industry.

Within the past few years, Lowes has established a “digital product management practice” with workers who collaborate with software developers on development, manage projects after they go live and then work on upgrades when the time is right. Lowes’ e-commerce team recently established a department focused on enhancing digital promotions and merchandising.

“As the [technology] infrastructure gets more robust,” Petersen said, “it’s important that regionals figure out how to staff it affordably with the types of subject matter experts so that you can maximize those digital products.

“Because what was happening in the past — and this is not uncommon in the industry — is you implement a platform and you’re already moving on to the next thing and you’re not curating and maximizing the functionality.”

From automated e-commerce fulfillment equipment to the fast-evolving field of AI-fueled search programs, industry technology is advancing at a blistering pace. And Lowes, as a mid-sized grocer surrounded by giants, has to pick its shots carefully.

Lowe and Petersen said that one of the biggest challenges they face is keeping their teams from chasing after tech fads — or “shiny pennies,” as they call them. This is the reason management has created a digital roadmap that spells out where the company hopes its tech initiatives will carry the business.

Prioritizing outcomes, Lowe said, allows the grocer’s teams to focus their efforts and keep the shopper experience at the forefront of all endeavors.

“What I think so many people miss is that it’s not just digital in a vacuum. It’s digital plus human experience,” Lowe said. “So how do you use digital to increase engagement — not just to be able to simply remove yourself or remove a human from the process?