In a changing grocery business that rewards investment and innovation, many independent grocers are in danger of being left behind.

But that’s not how John Ross, the CEO of IGA, sees it. To him, independents have distinct operational strengths and overlap with many of the biggest consumer trends. They specialize in local products, can personalize their assortment and offer top-notch in-store experiences. They can be as nimble as a hotshot tech startup, able to bring in new products and promotions without having to cut through any red tape.

In fact, he told Grocery Dive, many small grocers are just a few key functionalities away from becoming major competitors in the markets where they operate.

“Independents are unique in their ability to adapt,” he said. “At a large chain store, if you like a special kind of peanut butter, they might not have the authority, the autonomy to bring that in and service your needs.”

Two of those functionalities are high-quality data and e-commerce capabilities. And Ross — who was named to the grocer's top post last year from data and software firm Inmar Promotion Network and before that served in a variety of positions across retail, including as the chief marketing officer at The Home Depot — is uniquely suited to bring IGA’s 1,100 member stores into the new age.

Stores in the company’s network, Ross said, have long operated a patchwork of point-of-sale systems and other technologies that produced an unwieldy trove of data — or none at all. Over the past few years, IGA has labored to standardize data capture across the chain. Ross said the company is now able to capture between 70% and 80% of stores’ live, uniform data.

Once retailers unlock customer data, a lot of doors get opened, Ross said. Store operators can gain valuable insights that will help them merchandise their offerings better. And IGA can aggregate knowledge across its network, then help members understand and utilize the results they’ve collected in their stores.

“Once you get the data flowing and it’s consistent, and you can start comparing stores against the average, magic starts to happen,” Ross said.

Having completed a lot of what Ross calls the “heavy lifting” of data standardization and collection, IGA and its network will soon start delivering data to stores in ways that are digestible and actionable.

“We start with data collection, then we move to insights, and then insights lead to action, and that’s the phase we’re in,” Ross said.

Bringing stores online

One could argue that standardizing data is table stakes for grocers these days, and larger competitors have more sophisticated operations up and running. But Ross says data collection will help unlock independents’ true potential and help them compete, as a collective, on the same scale as much larger retailers.

“This allows an independent chain to act much more cohesively like a national chain,” Ross said.

Store owners say they’re excited about the possibilities. Nakul Patel, owner of Mount Plymouth IGA in Sorrento, Florida, said he competes with chains like Publix and Walmart that have superior technology and data. He said he’s struggled to keep up in recent years but sees cleaner data as a tool that can help him compete on the same level.

“I was feeling like I wanted to be out of the grocery industry a little while ago, but now I’m really back into it and feeling more energetic about it,” he told Grocery Dive.

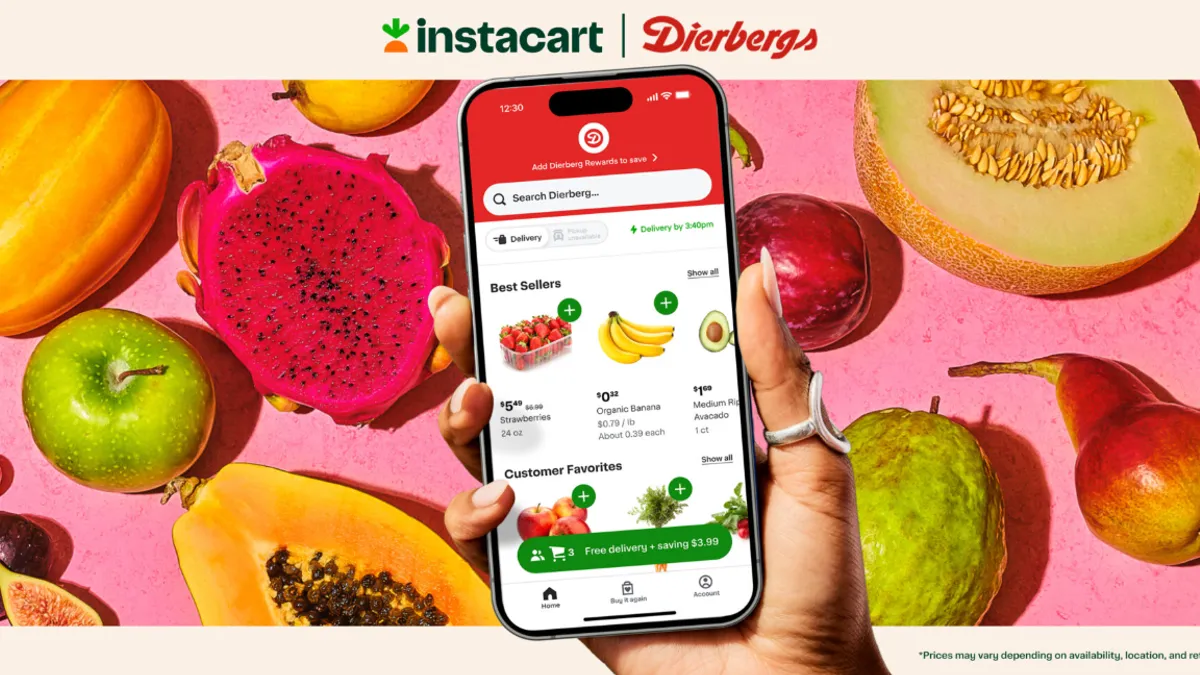

Another area of innovation Ross has targeted is e-commerce. IGA is currently testing platforms and fulfillment solutions from several vendors, with the goal of figuring out which one works best for its member stores. It’s a situation where, according to him, IGA’s store diversity allows the organization to rigorously test out options.

“We don’t have to go out and spend millions of dollars on a single platform and if we made a mistake, we throw that all away,” he said. “We can use our independents as our testing and learning laboratories.”

“We don’t have to go out and spend millions of dollars on a single platform and if we made a mistake, we throw that all away. We can use our independents as our testing and learning laboratories.”

John Ross

CEO of IGA

As with data collection, e-commerce offers a way for independents to unlock their inherent value, Ross said. He also sees some of the key capabilities stores have — including a localized assortment, high customer loyalty and the ability to draw a wider range of products from their wholesalers — as advantages that can level the playing field with larger competitors.

More and more members are offering online shopping, Ross said, particularly over the past year as Amazon’s acquisition of Whole Foods rippled through the industry. As e-commerce advances, stores will gain further insights that will inform their digital as well as in-store operations.

“When you get into e-commerce, all of a sudden everything shoppers buy, tried to buy and searched for — all that data accumulates,” Ross said. “Over time, it makes you really smart and it allows you to customize your assortment in-store. It allows you to anticipate changes in what your shoppers are looking for.”

Left behind or surging ahead?

However, industry analysts are skeptical of independents’ ability to compete on speed, price and assortment. Walmart and Whole Foods offer free pickup from hundreds of stores across the country, while numerous others offer on-demand home delivery. A report issued last week by Deutsche Bank stated that the largest players, including Walmart and Amazon, will gain e-commerce share through their ability to expand and innovate, while smaller players will lose ground.

Keith Anderson, senior vice president with e-commerce consulting firm Profitero, said independent grocers need to sell their products online in order to retain customers. Beyond being a defensive move, he doesn’t see much opportunity for stores to make gains against large chains.

“It’s going to be hard to offer a comparable customer experience,” Anderson told Grocery Dive. “You definitely won’t be able to match the economics, and you’re certainly not going to gain any advantages as a result of doing it.”

Meanwhile, Ross said he’s encouraged by research showing loyal customers frequently boost their basket size online. He also sees moving online as a necessity for member stores — not just because they need to defend their positions, but because it’s an extension of the convenience and service they’ve long provided.

Beyond data points and online shopping, Ross wants to continue playing up IGA’s ability to share knowledge across the network with regular updates, conferences and more. Operators often have really creative ideas that can inspire others. He pointed to an independent retailer that recently began providing custom-made prepared meals to a local gym and its members.

If IGA stores can effectively test and share knowledge across the company network, he said, they can operate at mass scale while still keeping their personalized touch.

“That’s what makes independents so cool is that entrepreneurial spirit that comes up from the stores,” Ross said. “You can see this idea that you never thought of before and go, ‘That’s really clever. Is it working?’ And if it’s working, let’s copy and paste it across the chain.”