UPDATE: May 21, 2021: Instacart announced on Friday it is now delivering from 4,000 additional 7-Eleven stores. With the expansion, Instacart now offers delivery from nearly 6,000 7-Eleven stores across 33 states and Washington, D.C., reaching roughly 60 million U.S. households.

Additionally, shoppers in California, Florida, Idaho, Illinois, Missouri, New York, Ohio and the District of Columbia can now get alcohol delivery in 30 minutes from 7-Eleven via Instacart. The e-commerce firm noted it plans to add more states and stores in the coming months.

Expanding its 7-Eleven partnership is part of Instacart’s plans to respond to rising customer demand for convenience orders through its platform, which have increased more than 350% since August, Chris Rogers, vice president of retail at Instacart, said in a statement.

Dive Brief:

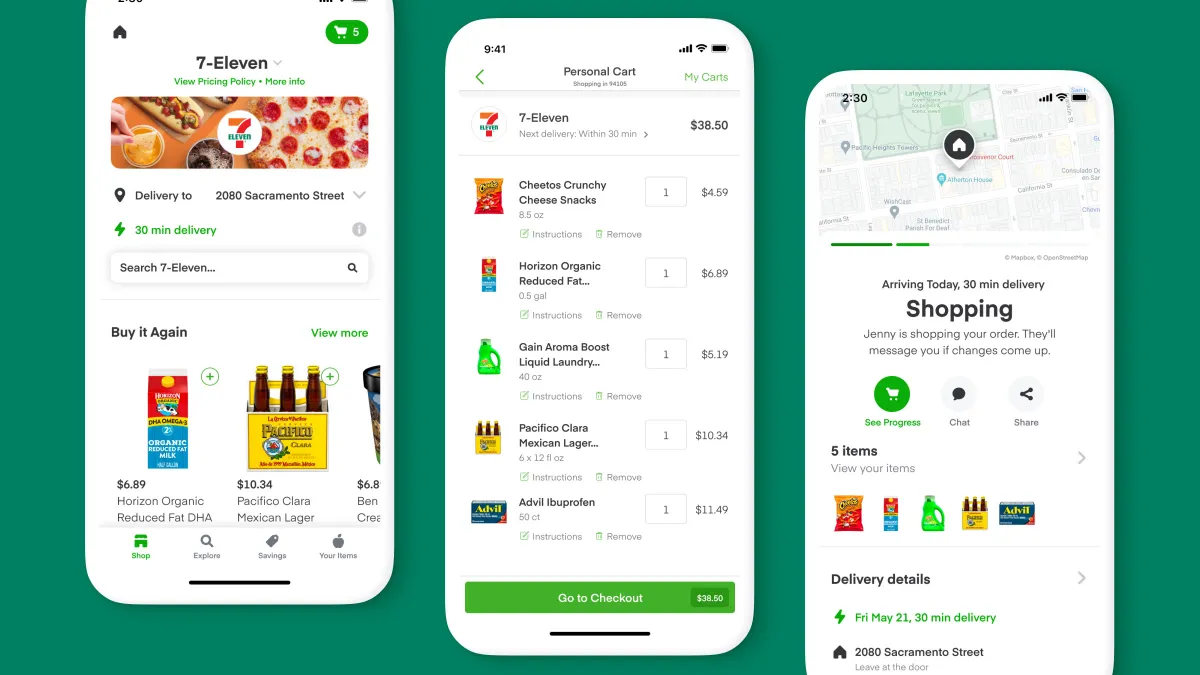

- Instacart announced Thursday it will begin offering delivery from 7-Eleven stores, marking the first convenience-store tie-up for the grocery-focused tech firm.

- Instacart will initially offer delivery of milk, bread eggs, alcohol and other staples in as little as 30 minutes from 750 7-Eleven stores in the Dallas, Miami, Baltimore and Washington, D.C. metro areas, with plans to eventually expand to more than 7,000 locations.

- Delivery from the round-the-clock convenience chain will operate from 8 a.m. to 10 p.m., with expanded delivery windows launching soon.

Dive Insight:

Instacart is moving into a channel that’s undergone a dramatic digital shift over the past several months. Convenience stores have long relied on their physical locations to sell snacks and smokes, but the pandemic, along with their widening assortment of food and beverage options, are quickly pushing them online.

7-Eleven is a prime example of this shift. Just over a year ago, the chain only offered delivery from 200 locations. By August of this year, it offered delivery from around 1,300 cities through third-party firms like DoorDash and Uber Eats.

Through Instacart, 7-Eleven will be able to reach an even larger pool of shoppers, including the millions that have signed up with Instacart this year.

“The convenience channel is going through, I believe, the same online shift that we’ve seen in the grocery channel,” Nilam Ganenthiran, Instacart’s president, said in an interview. “I think convenience is definitely having its e-commerce moment right now.”

When it comes to food and beverage, 7-Eleven and other c-stores mainly fulfill fill-in orders and impulse buys. That hasn’t rattled grocery stores in the past, but the ease of getting a gallon of milk, eggs and a case of beer online from retailers like 7-Eleven could pose more of a threat to food retailers going forward. Convenience chains are upping their foodservice game and offering more specialty items that overlap with grocers.

Convenience chains also gain visibility with customers by getting added to the marketplace platforms that Instacart, DoorDash and other delivery firms operate.

Ganenthiran declined to say if Instacart will partner up with more convenience chains. But given the company’s vast delivery network and the digital shift going on in the channel, it’s not hard to imagine more c-stores plugging in with Instacart.

Instacart has been one of the biggest beneficiaries of pandemic-fueled online grocery demand, with growth rates surging more than 500% and average basket size increasing 35% this spring, Ganenthiran said. The company has seen even faster growth in its pickup service, which it has expanded to 1,400 additional stores since March 1, he noted.

DoorDash, meanwhile, added convenience companies like 7-Eleven and Wawa to its service in April, and this summer opened its own online convenience store, DashMart. Last month, DoorDash announced new grocery partnerships and the addition of grocery delivery to its app.