Dive Brief:

- Instacart has halted its plans to go public in 2022 amid a rocky public market, according to The New York Times, which based its reporting on three anonymous sources “with knowledge of the situation.”

- Instacart is not withdrawing its confidential draft registration statement with the Securities and Exchange Commission, which it filed earlier this year, the Times noted. Instacart declined to comment to Grocery Dive on its IPO plans.

- CEO Fidji Simo said the grocery technology company has achieved its goal of becoming ready for the public markets and that the company is now awaiting “an open market window,” which is “highly unlikely” before the year ends, according to an internal memo to employees obtained by The Wall Street Journal.

Dive Insight:

After Instacart’s long-awaited filing earlier this year to move toward going public, the wait continues for the company to go public and start disclosing financials about the health of its business.

“We do not need a perfect market, we’re just looking for an open market window,” Simo wrote in the memo obtained by The Wall Street Journal, noting that there hasn’t been a tech IPO in the last 10 months.

Instacart was planning to make financial information public this week as part of its process toward going public, but those plans were paused, The New York Times noted. Still, Instacart is providing a glimpse into where it stands financially.

The company said in a statement to Grocery Dive that in the third quarter its revenue grew by more than 40% year-over-year and that both its net income and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) more than doubled from Q2.

“We are incredibly proud of the work our teams are doing to power the future of grocery with our retail partners, and our business has never been stronger. ... We remain focused on building for the long-term, and we are excited about the opportunity ahead," the statement said.

In the internal memo, Simo said she and Instacart Chief Financial Officer Nick Giovanni have met with more than 50 potential investors over the past six months and received positive feedback, according to The Wall Street Journal.

“These investors believe in us and want to invest in us, but also believe the market will not support new tech IPOs for now,” the memo said, per the report.

As macroeconomic pressures rise and investors struggle with issues like high inflation and rising interest rates, the IPO market has slowed in the latter half of this year.

The memo, per The Wall Street Journal, also announced Instacart is making two cash bonuses eligible to employees who started in or before 2021 and who are meeting or exceeding performance expectations.

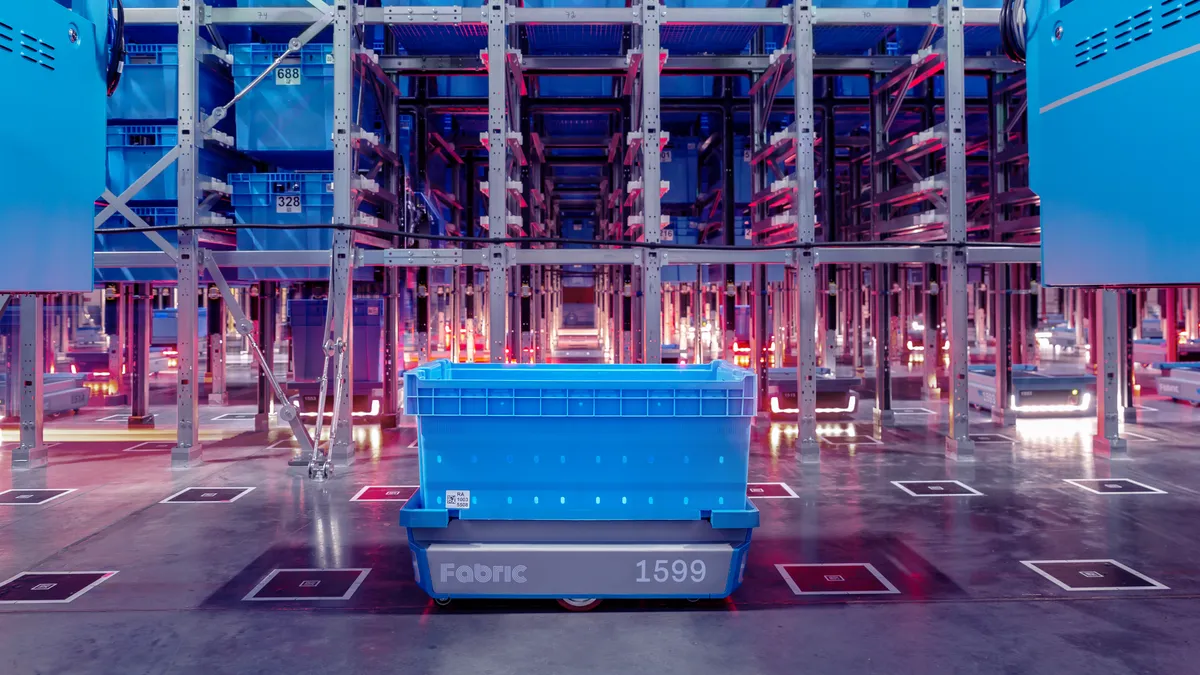

The company is facing rising competition from other third-party delivery providers like DoorDash and Uber and from retailers themselves as they seek more e-commerce control by bringing e-commerce fulfillment in-house. Earlier this month, Instacart reportedly cut its valuation to about $13 billion, marking the third time this year the company has taken that step.