Dive Brief:

- Instacart has slashed its valuation by nearly 40%, to around $24 billion, the company said on Thursday. It had posted a $39 billion valuation last year.

- The move comes amid slowing growth on Instacart’s marketplace and increasing competition from e-commerce companies like DoorDash. “We are confident in the strength of our business, but we are not immune to the market turbulence that has impacted leading technology companies both public and private,” Instacart said in a statement.

- The news comes shortly after Instacart updated its logo and expanded its business offerings to include a bundle of technology services for retailers.

Dive Insight:

In its statement, Instacart tried to frame its lowered valuation as reflecting market realities rather than a decline in the performance of its business. Other tech companies like DoorDash have seen their stocks decline recently as online sales slow more than two years into the pandemic.

The company also said the move will help it retain and recruit corporate talent. Its new equity awards available to employees could offer a higher financial upside, provided its value increases from this point. Instacart, which plans to launch an initial public offering but did not provide an updated timetable for that step this week, said it has $1 billion in cash and marketable securities on hand.

Markets aside, Instacart faces challenging conditions that are a far cry from 2020, when the company rode a tsunami of demand fueled by the global health crisis. U.S. sales growth on its marketplace has slowed considerably, up just 12.4% in 2021 compared to 237.5% the year before, according to data from Bloomberg Second Measure. Year-over-year sales on the marketplace have declined each month since November, which had a 6.1% decrease, according to the data, with sales down 5.7% in February, the last recorded month.

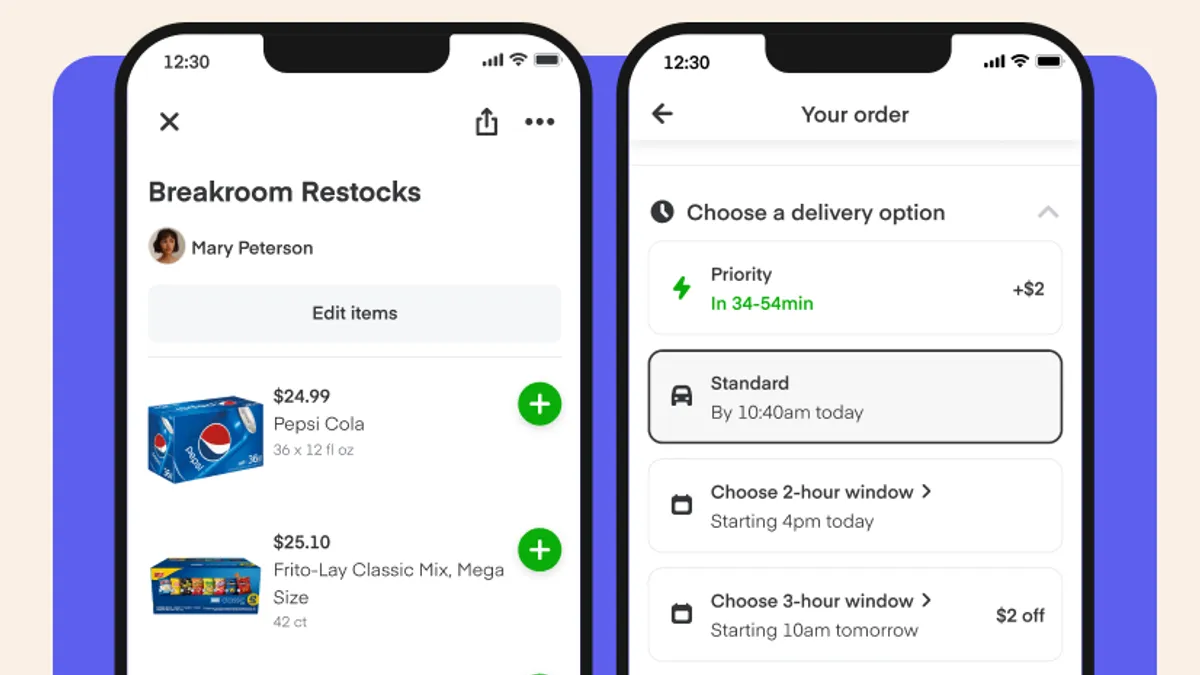

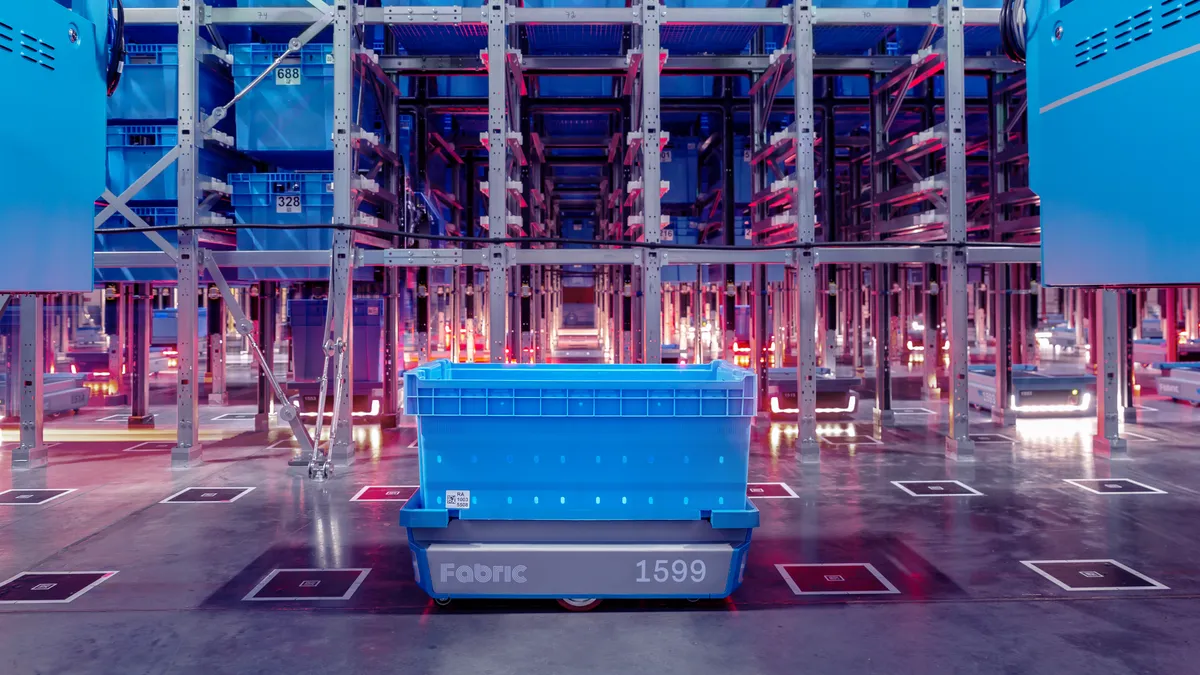

Instacart has adjusted its operations over the past several years. This week, the company unveiled Instacart Platform, a bundle of technology services for retailers that includes digital ads, consumer insights, e-commerce storefronts and rapid delivery via “nano” warehouses.

The Platform, which Instacart positioned as offering its marketplace toolbox to retailers, is aimed squarely at small and mid-sized retailers trying to keep pace with large chains in offering digital services. "The technologies required to power a grocery operation are only getting more complex as consumer needs continue to evolve," Instacart CEO Fidji Simo wrote in a blog post on Wednesday.

However, unlike just a few years ago when Instacart was about the only major e-commerce solution grocers could turn to, these days retailers have a bevy of tech providers to choose from across all five of the service areas Instacart mapped out.

Instacart recently updated its logo and launched an expansion of shoppable recipes. It has also partnered with major grocers like Kroger, Ahold Delhaize and Publix to offer delivery in under an hour from company stores.

Although Instacart’s marketplace sales have slowed considerably, it's still a major force in online grocery sales. According to YipitData cited by Bloomberg, the company accounts for 52% of the grocery delivery market as of December.