Dive Brief:

- Instacart says it will start offering store pickup to retailers nationwide, according to a company release. The move follows a test the company ran for several months with Aldi, Publix, Tops Markets and Sprouts Farmers Market, among other retailers. The company will expand its pickup service with these retailers to around 200 stores in 25 markets, and will roll out the service to interested retailers throughout the rest of this year and next.

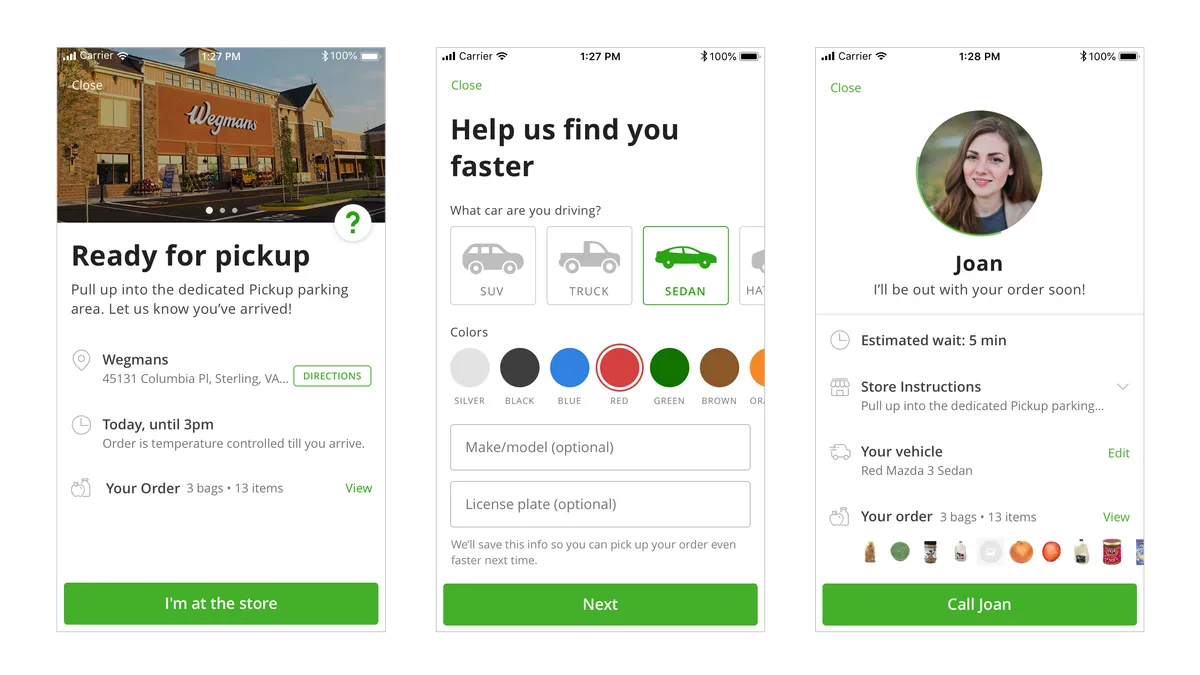

- Customers use the service by setting a pickup time in the Instacart app, then notifying shoppers when they're on their way. A personal shopper will then bring the groceries out to the shopper's car after they arrive. Fees vary by retailer, but Instacart is making the service free for its Instacart Express members.

- The e-commerce company recently secured $600 million in new funding and was valuated at $7.6 billion. It currently partners with more than 300 retailers and offers service to more than 15,000 stores across the U.S. and Canada.

Dive Insight:

Instacart raced out ahead with its online platform and last-mile delivery service following Amazon's acquisition of Whole Foods. The offering has caught on with a lot of retailers and their shoppers, but the technology company understands it needs to diversify in order to reach more customers and stay competitive with top players.

The company piloted its pickup program back in 2016, but now wants to scale it in line with shopper demand. According to a CoreSight Research survey of nearly 2,000 shoppers, 51% said they prefer store pickup while 45% prefer delivery.

So while many industry experts see delivery as the ultimate convenience play in e-commerce, store pickup is still preferred by a sizable chunk of shoppers right now. It also leverages what retailers consider their strongest asset — their stores.

Competitive pressure no doubt played a role in the decision. Walmart, most notably, has added store pickup at more than 2,000 stores. That free service has been a customer acquisition machine for the company, with 30% of shoppers who use the service reporting they're first-time Walmart shoppers, the company has said. A Packaged Facts report from last month found that, among store-pickup users, 42% visited Walmart most recently — three times the percentage of shoppers that identified Target, the runner-up.

Kroger has also rapidly deployed its pickup service — now called Grocery Pickup — to stores across the country, while Albertsons will have its Drive Up & Go program in 500 stores by the end of this year.

Offering pickup service shores up a competitive vulnerability for Instacart, and it may drive some growth for the company given its large footprint. But the big question is whether it will be enough to keep shoppers from straying to Walmart or Whole Foods. Both of those grocers offer the service for free — Whole Foods customers must be Prime members — while Instacart charges a fee that varies by retailer. Instacart Express members get pickup free, but that membership runs around $149 annually.

As grocery pickup keeps gaining steam, there are some who wonder if the future of the service will need to be free of fees to compete. Meanwhile, Instacart, on the heels of $600 million in new funding, will keep working to prove it's a valuable asset to retailers feeling the pressure to deliver the e-commerce goods.