Dive Brief:

- Instacart announced on Wednesday the launch of Instacart Platform, a suite of technologies and services for retailers that includes 15-minute delivery powered by "nano-fulfillment centers."

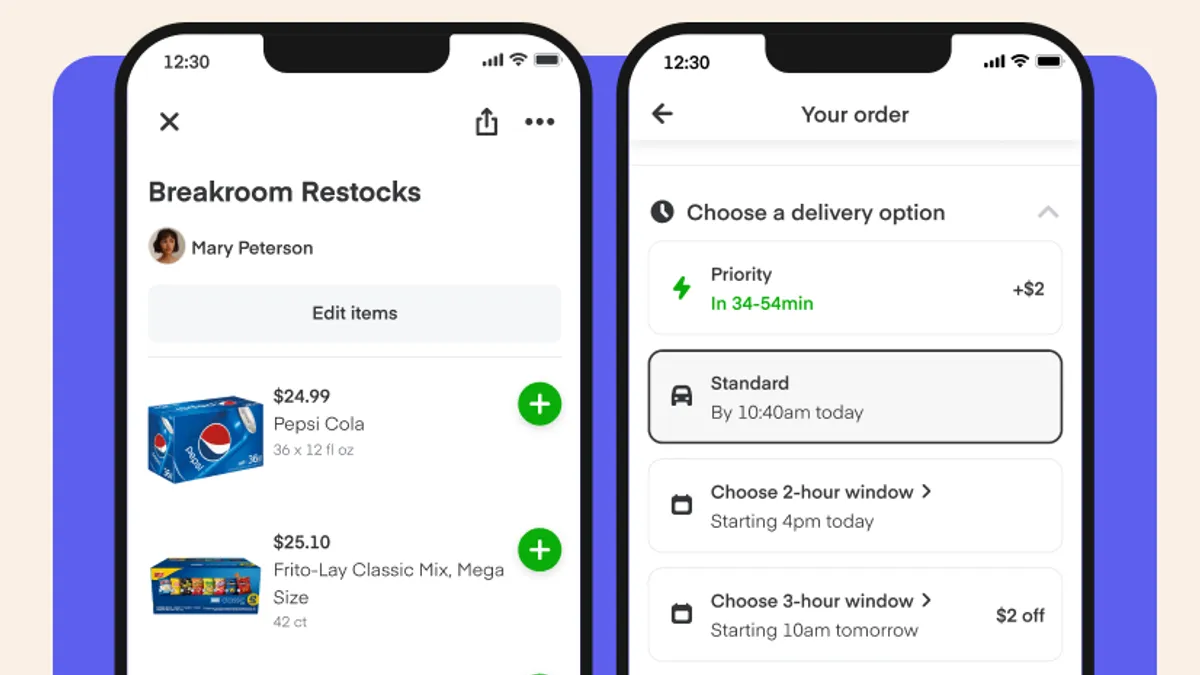

- The Platform suite includes existing services like e-commerce development as well as new tools like advertising solutions, data insights and its fulfillment service, "Carrot Warehouses," which will initially offer rapid delivery for Publix shoppers in Miami and Atlanta.

- The new platform expands Instacart's service offerings and unifies them under one umbrella as the e-commerce company looks to stay relevant with retailers.

Dive Insight:

As Instacart faces slowing growth, increasing competition and retailers becoming less reliant on its marketplace for online sales, the company is evolving its business strategy and trying to sell grocers on a suite of services that will help them navigate the costly, complex e-commerce landscape.

According to the company's announcement, Instacart is making available to retailers the full range of tools that have helped fuel its marketplace's rise over the past several years. It's also offering new services and technology, like dark stores, and bringing everything under its newly updated branding that accentuates its carrot logo.

In a blog post, Instacart CEO Fidji Simo called this latest development a "third act" for the company, building on its initial online push and its development of online storefronts and apps for retailers.

"The technologies required to power a grocery operation are only getting more complex as consumer needs continue to evolve," she wrote. "Our retailers expect us to simplify this complex landscape and help them build a technology advantage without distracting them from their core business."

The suite of technologies ranges across e-commerce storefronts, fulfillment, in-store technology like smart carts, advertising and data insights. Some of the capabilities are ones Instacart has offered for some time, while others are services Instacart previously announced as upcoming options. The company has built online storefronts and apps for years, fueled by its 2018 acquisition of Unata. Last year, Instacart added in-store smart carts and prepared foods management technology to its roster.

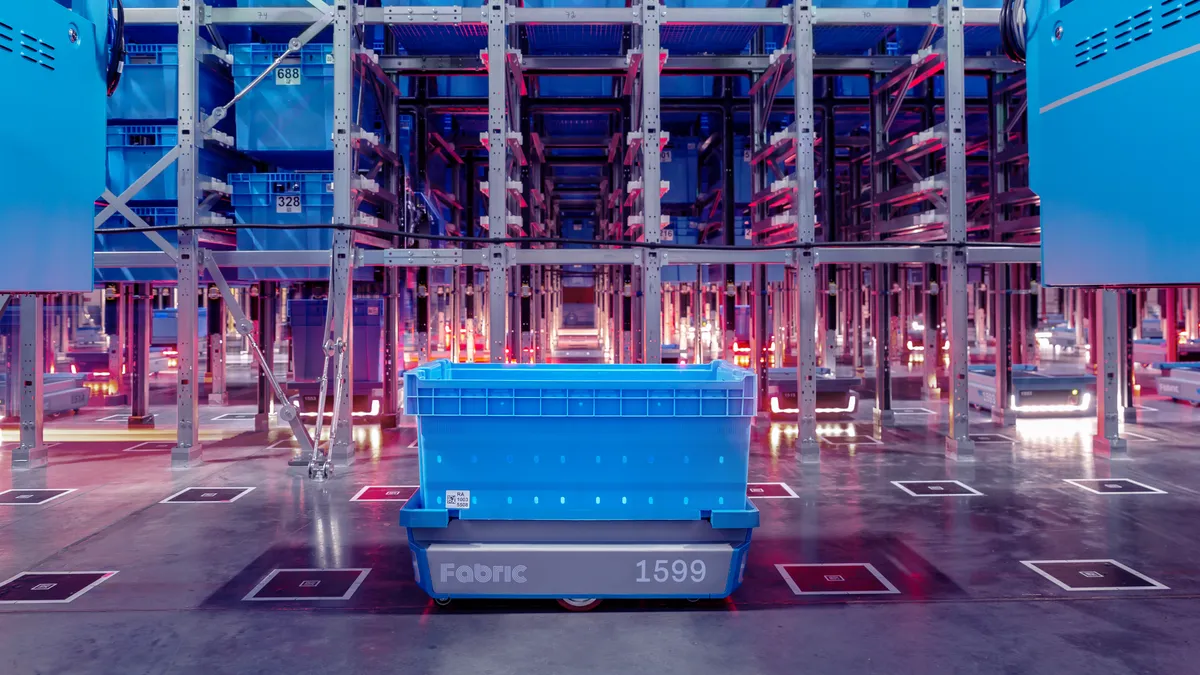

Instacart said its 15-minute delivery service, which nods to the growing popularity of rapid fulfillment that companies like Gopuff have capitalized on, will become available to Publix customers in Atlanta and Miami "over the coming months." The ultrafast delivery service is supported by the new nano-fulfillment centers, or NFCs, Instacart is offering to build for retailers, along with offering floor plan design, automation services and operational support.

The new Publix facilities will be attached to company stores and are not affiliated with Fabric, the automated fulfillment company Instacart partnered with last year, The Financial Times reported on Wednesday.

Instacart's new ads service offers retailers access to the products, technology and sales resources that have built its own advertising business. The service "unlocks new monetization capabilities, including revenue share models," according to the announcement, and is currently piloting with Schnuck Markets, Good Food Holdings, Plum Markets and other retailers, and will roll out to additional retailers this year.

Instacart's new "insights" tool tracks out of stocks, sales by geography, buying trends and other areas across grocers' e-commerce platforms. It is currently being used by Key Foods.

The three new tools — Carrot Ads, Carrot Warehouses and Carrot Insights — are branded in line with Instacart's recently updated logo, which accentuates its carrot icon.

By deepening its service offerings, Instacart is bowing to retailers' desire to establish new e-commerce properties and not just rely on the company's marketplace for sales. Some regional grocers have recently launched their own branded delivery services, and numerous others are pushing into digital ad sales, online memberships, third-party marketplaces and other services.

As retailers turn to alternative software and technology firms, and as companies like DoorDash encroach on Instacart's dominance, analysts have speculated that the company could become a retailer in its own right. Instacart has denied plans to become a retailer and has continually stated its role is as a "retail enablement platform."

Instacart's marketplace boomed at the start of the pandemic as retailers scrambled to reach online customers and customers found convenience with browsing different retailers in one place. That growth has slowed considerably as shoppers have returned to stores. According to data from Bloomberg Second Measure, Instacart's U.S. sales grew just 12.4% in 2021 from the prior year after increasing more than 237.5% year-over-year in 2020.

Simo wrote that Instacart has found retailers want to build deeper relationships with customers and in order to help with that, Instacart has to look beyond its marketplace app.