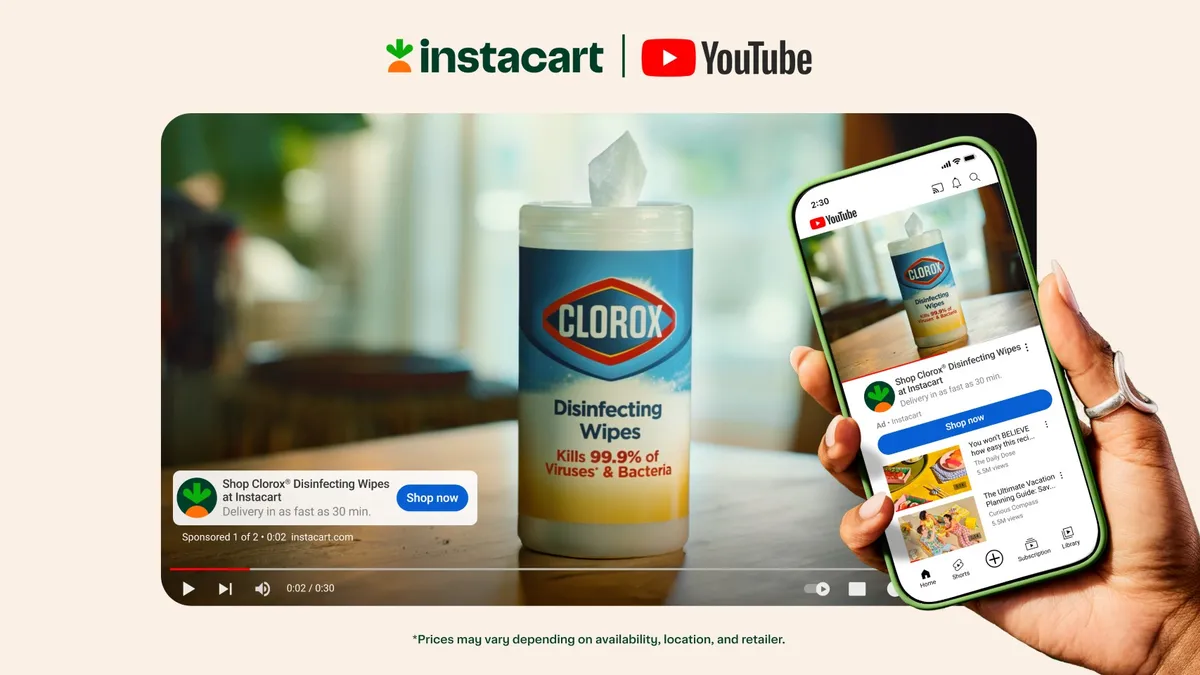

YouTube Shopping ads are about to get a boost from Instacart’s retail media muscle. Viewers of the Google-owned video site will soon start seeing messages from brands like Clorox that are targeted using Instacart first-party shopper data and include callouts to jump to the grocery delivery platform to place orders.

Clorox, a regular Instacart partner, and a number of Publicis Media clients are the first consumer packaged goods brands to test the integration, which is part of a growing movement among retail media networks to leverage their troves of first-party shopper data to power campaigns on offsite marketing channels. The news was announced as part of Instacart’s presence at the Cannes Lions festival celebrating international creativity in Cannes, France.

“This is really our first integration in shoppable video,” said Ali Miller, Instacart’s vice president of ads product, in an interview ahead of the festival. “It’s also an area where we got a lot of interest from our mutual CPG partners.”

Instacart has been pushing further into offsite advertising, or what Miller terms “retail-powered media,” since last year, when it linked with demand-side platform The Trade Desk and Roku. At CES in January, it announced it would begin working with Google Shopping ads in search, with YouTube providing a natural stepping stone into video, a more premium format. The company, which went public in September, additionally has deals in place with publishers like NBCUniversal and The New York Times.

YouTube allows advertisers on Instacart’s network to reach consumers during a variety of occasions, including scrolling on their phones, browsing the web or tuning in via a TV screen in their living room. For brands like Clorox, the goal is to more quickly convert a viewer from consideration to purchase with video creative, a concept that has gained newfound traction in the streaming and second-screening era.

Connected TV (CTV) has emerged as a competitive battleground for retail media networks that want to prove they can drive performance and transactions beyond sponsored search and display placements on their owned properties. YouTube’s CTV bets have become a focus of its overtures to Madison Avenue, though Instacart is taking a broad view through its collaboration with the platform.

“CTV is an incredible landscape and canvas to lean into, but we didn’t want to limit ourselves to one modality of consumer attention and interaction,” said Miller, who formerly worked at YouTube. “Our marketplace model can power a lot of flexibility.”

Venturing offsite

The YouTube Shopping integration launches in a limited pilot, and Miller emphasized that Instacart’s larger offsite push is still in its early stages. But offsite broadly is fueling retail media growth as the channel reaches a fresh stage of maturity.

Offsite programmatic retail media is forecast to generate $20 billion in sales this year, a leap over the $7.5 billion seen in 2023, according to Advertiser Perceptions. The researcher said offsite today is driving much of the category’s momentum. A separate report from WARC similarly found that the push into non-retail channels is giving a boost to the industry, which is expected to see its rate of growth cool in 2025 following a years-long hot streak.

For Instacart, cracking into offsite is a “logical step” to take after establishing a reputable on-platform advertising offering, according to Miller. Instacart in March received its first advertising accreditation from the Media Rating Council (MRC) for impression, click and viewability metrics across a number of formats, including shoppable video. Miller views the MRC stamp of approval as an advantage in a retail media landscape that has faced more pressing questions around trust and transparency after expanding rapidly during the pandemic.

Instacart sits at an interesting place in the retail media chain in that it delivers groceries from a roster of 1,500 retail partners, some of which operate their own ad networks, but doesn’t wield a traditional store footprint. That said, the company sees an opportunity in enabling what Miller called the “connected store” through offerings like its artificial intelligence-powered smart shopping carts that include screens that can run ads. Instacart also helps new retail media entrants in grocery monetize their fledgling advertising bets through a Carrot Ads platform that is pitched around lessening some of the need to invest in in-house sales and ad tech teams.

“This is part of the omnichannel journey,” said Miller of Instacart’s offsite strategy. “The vision of Instacart is to power every grocery transaction.”