In recent years, Kroger’s health and wellness division, Kroger Health, has carved out a reputation in the grocery industry as a leader in nutrition, health and wellness efforts.

Building off Kroger’s supermarket business, Kroger Health aims to provide customers with a range of health and wellness services and tools, from proprietary nutritional food product ratings to pharmacy services and in-store clinics.

The company has positioned its efforts as a win both for customers navigating a complex healthcare industry and for its bottom line.

“We know that grocery customers who are also pharmacy customers are more loyal to Kroger and spend more with us,” Kroger CEO and Chairman Rodney McMullen recently told investors. “While the pharmacy industry is going through a period of transformation and disruption, we have a unique opportunity to help our customers live healthier lives and grow share.”

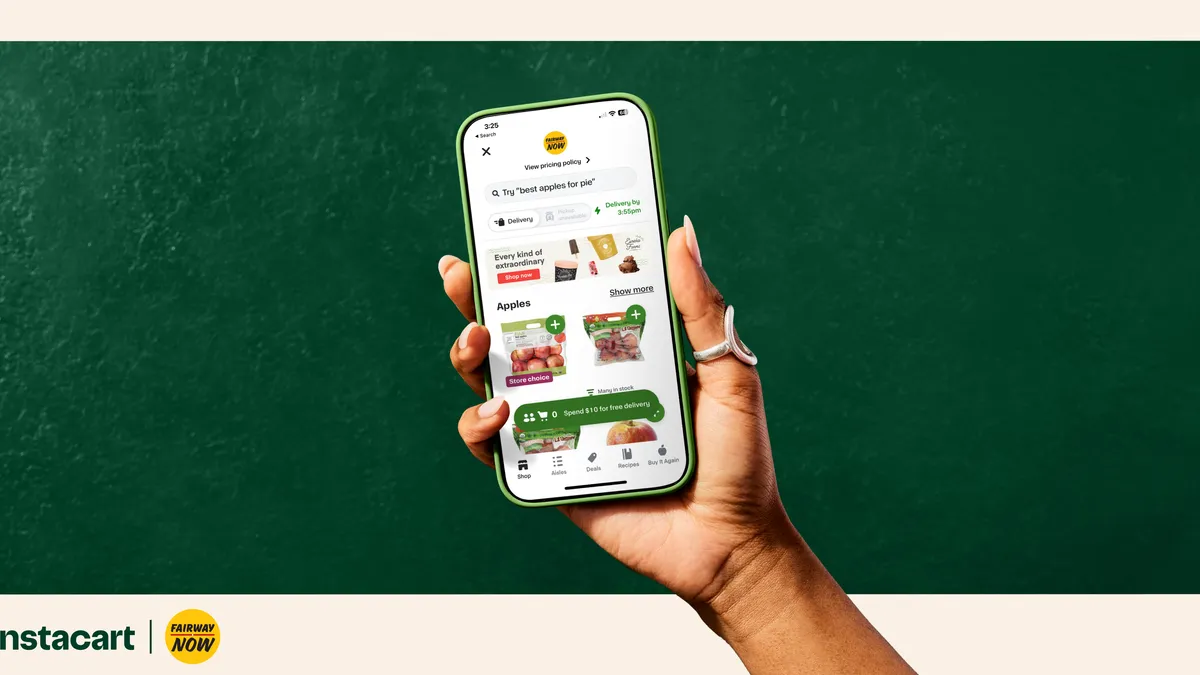

Kroger is also forging a focus on healthcare in the grocery industry as other companies in the space, from Instacart to regional chain Heinen’s, ramp up their personalized health and wellness efforts for grocery consumers.

But the intersection of groceries and health is a tricky place to operate. Kroger Health straddles an inherent tension between its focus on wellness and health and being part of a company that’s in the business of selling groceries, from organic apples to sugary yogurts.

In addition, Kroger Health faces challenges ranging from regulatory hurdles to technology woes as it pushes forward with its strategy, according to interviews with several Kroger Health executives.

One piece of that strategy is OptUp, a tool in Kroger’s app that allows people to scan product barcodes and see a proprietary nutrition rating for the item along with recommendations for items with better ratings. OptUp also provides an overall purchasing score, which Kroger calls the “basket score,” allowing each user to see insights on how the nutrition of their purchases compares over different periods of time.

The tool aims to simplify grocery shopping by giving customers a convenient way to digest a nutrition label and understand it holistically, said Laura Brown, Kroger Health’s director of nutrition, noting that the algorithm is trained “to think statistically like a registered dietitian.”

During a tour of a Kroger store near the company’s Cincinnati headquarters, Brown scanned a product barcode to demonstrate how consumers can gain nutritional information by using OptUp: “It's in the orange range, which means it’s super great for you. Forty percent of your cart should be orange. But could you improve it and get into the green area? You can do that by just choosing the apples with peanut butter.”

The basket score allows Kroger to get a snapshot of healthy purchasing behaviors by store, allowing them to identify populations that might need help improving their health outcomes, executives noted.

During the in-store demo, though, some of the scanned products had incorrect or incomplete OptUp scores — underscoring how some of Kroger Health’s initiatives are still a work in progress. Since launching OptUp in 2018, Kroger has worked to add more products to its proprietary nutritional rating system and also transferred the tool from a standalone service into its grocery shopping app.

Consumers can be confused and frustrated when it comes to navigating healthcare and making healthier choices, Meggen Brown, chief nursing officer of Kroger Health and The Little Clinic, said in a recent interview at Kroger Health’s headquarters.

“Healthcare is complicated,” Meggen Brown said.

Going beyond groceries

Kroger Health formed in 2017 when the grocery company brought together its clinic and pharmacy businesses and dietitians to work collaboratively across the entire company.

Along with its corporate staff and chief medical officer, the division has grown to span pharmacists, pharmacy technicians, nurse practitioners, dietitians, physician assistants and licensed practical nurses. Kroger Health now provides a variety of healthcare services, from in-store clinics to pharmacy services to OptUp and other nutrition tools.

“We used to be ‘the sniffles clinic.’ The pharmacy — they used to just dispense medication,” Meggen Brown said.

Kroger Health now positions its health and wellness, pharmacy and nutrition offerings as complementary to traditional healthcare in the U.S., with an emphasis on disease prevention, executives said. The division has made strides in recent years and still has a mountain of work ahead.

But health and wellness is a crowded and confusing landscape for people to navigate, Kroger Health executives noted. To stand out, Kroger Health executives noted that the unit is focused on providing a consistent level of service to customers.

“I think the No. 1 currency that we'll have is trust,” Kroger Health Chief Medical Officer Dr. Marc Watkins said. For example, when someone comes in for a multi-dose vaccine, it’s important to immediately schedule their next appointment and provide automatic text reminders about any upcoming appointments, pharmacy pickups or delivery notifications, Watkins said.

Another way that Kroger Health tries to differentiate itself is by taking time with people and not rushing them through the clinics.

“Where an average visit a lot of times in [a doctor’s] office is eight to 10 minutes, we're looking [at] 15 to 20 minutes, because we want to have that personalization,” Meggen Brown said.

With a fleet of more than 2,700 stores under more than a dozen grocery banners along with an online presence, Kroger can leverage its nationwide reach and expertise.

Telenutrition visits with its dietitians, for example, can “demystify the side panel that's on the box and explain, really, what it means, what types of food you should have, what types of food maybe you should avoid,” said Bill Shinton, Kroger Health’s vice president of health and wellness operations.

“You look at where Kroger is positioned, our pharmacists, our nurse practitioners, our dietitians are super accessible to the public,” Shinton said.

To be accessible to customers speaking languages besides English, Kroger Health seeks workers who are bilingual and also has a virtual translation program for more than 170 languages, including sign language, available on workers’ iPads and handheld devices, Meggen Brown said. That’s helping Kroger reach pocketed communities like the one in Columbus, Ohio, where many people speak Afrikaans.

Tackling the challenges

Shinton says Kroger Health is filling healthcare gaps in communities, such as providing vaccines and testing, noting that the company has close to 2,700 certified technicians certified to vaccinate. In some states, pharmacists can work with patients on oral contraception or other types of medicine.

While pharmacists were temporarily allowed to provide more services during the pandemic, new laws are needed to ensure they can continue those offerings, Shinton said.

“We want to continue to make sure our pharmacists, technicians, nurse practitioners, dietitians, all are allowed to do basically what they're trained and capable of doing,” Shinton said.

But Kroger Health grapples with governing bodies, such as state boards of pharmacy and the federal government, as the company pushes for its workers to operate at the “top of their license,” which means being able to provide all of the services they are legally allowed to, he said.

Kroger Health also faces legislative hurdles as it grapples with state and federal laws and regulations. Its biggest advocacy efforts are focused on Medicare and urging Congress to pass legislation that would improve pharmacy reimbursements, Shinton said. Traditional reimbursement has heavily focused on hospitals and physicians even as nontraditional healthcare has grown during the pandemic, including the range of services provided by pharmacists, nurse practitioners, physicians, assistants and dietitians.

Kroger Health is also facing the task of making consumers more aware of its health and wellness services.

“[What] I always find amazing is about a third of our customers don't even realize we have a pharmacy, and we've been in the business for, I don't know, at least 30 years,” McMullen told investors in March.

Finding the right formula

Kroger Health has a myriad of goals on its to-do list, from expanding access to clinical trials to exploring in-store merchandising around healthy foods. In some cases, the division has pivoted in order to address these goals.

For example, Kroger Health initially planned in 2020 to put nutrition technicians in a lot of stores but then pivoted to telenutrition sessions when the pandemic hit. Four years later, Kroger Health is sticking with the virtual appointments.

“Would we love to be able to have a dietitian walk a store with every customer that wanted it?” Shinton said. “We would. Right now that's just not feasible for us to do.”

Earlier this year, Kroger offloaded its specialty pharmacy business, a decision that interim CFO Todd Foley told investors positions the company to better focus on its “health and wellness strategies that revolve around our retail pharmacies.”

Once OptUp is ready for the limelight, Kroger has room to ramp up marketing of the tool, said Jim Kirby, Kroger Health’s chief commercial officer.

Kroger plans to expand the number of items that have an OptUp score. So far, about 80% of items that are responsible for 95% of Kroger’s sales have a score, Kirby said.

Then, Kirby would like to explore merchandising opportunities and in-store testing to see if a designated section or endcaps for OptUp items work better than having OptUp items remain integrated.

As Kroger Health evolves, its executives continue to dream big.

One item on Kirby’s dream list: technology-enabled “food prescriptions” where a dietitian and patient figure out a personalized food plan and then those specific items get automatically added to the shopper’s online basket.

Kroger is “actively developing” a way to personalize OptUp so consumers can find products compatible with specific health conditions like diabetes or heart conditions, Kirby said.

Kroger is also working on a tool that would allow suppliers to test how changing a product — such as adjusting salt and sugar levels — would impact its OptUp score, Kirby said.

Aware of consumer price sensitivity, Kirby said he’s interested in exploring a rewards program that gamifies or incentivizes choosing items with a higher Opt Up score and collaborating with manufacturers to offer coupons and incentives for those items.

“Those are all things that we've got in our dream world that we want to bring to life, but we’ve got to test, because we don't know what's going to resonate,” Kirby said.

Kroger Health executives are careful to point out that the company’s offerings, like OptUp, are not to dictate purchasing decisions, but rather to inform them.

“We don't want to ban people from food,” Meggen Brown said. “We just want to have them have a better-for-you option. We're not saying don't eat that Oreo cookie, but there's options that are better for you.”