Dive Brief:

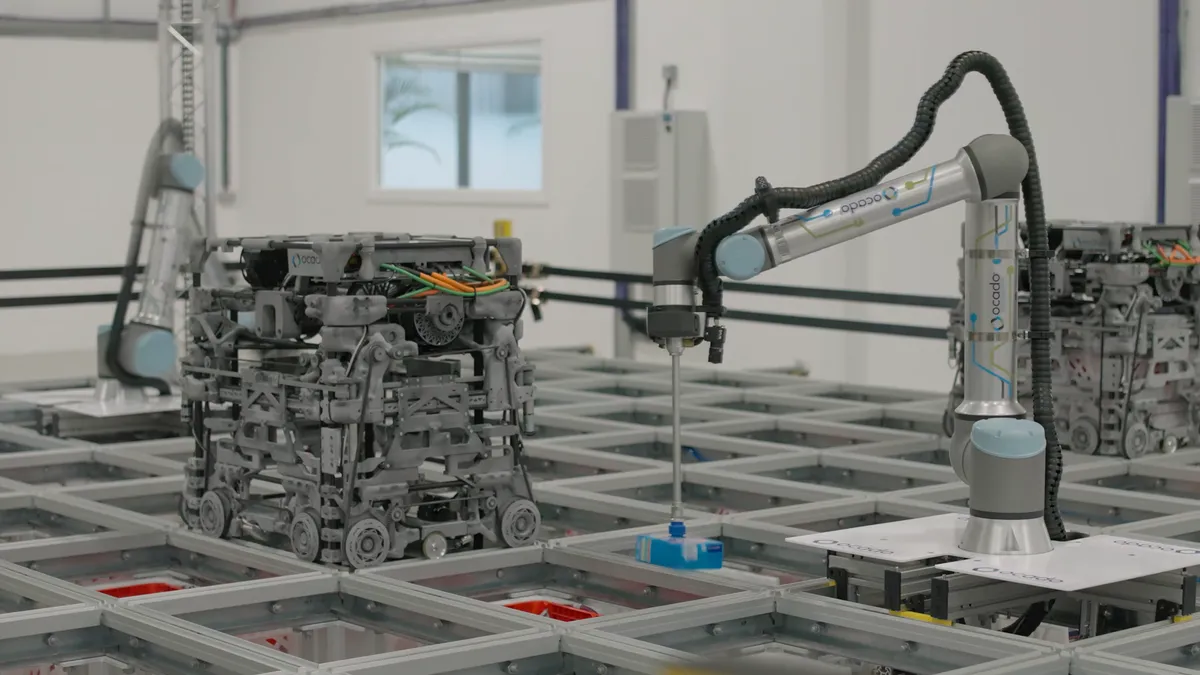

- Kroger has decelerated development of the robotic customer fulfillment centers (CFCs) it is building with Ocado, but remains intent on expanding the network, according to a Tuesday report by Reuters.

- The supermarket chain continues to be optimistic about its partnership with the U.K.-based grocery automation company, but wants to be sure the CFCs perform “as well as they can before they roll out loads,” Ocado CEO Tim Steiner said, per the news report.

- The development follows recent comments by Kroger CEO Rodney McMullen indicating that the grocer is looking to its arrangement with Ocado to eventually turn its e-commerce business into a profit center.

Dive Insight:

When Kroger announced its deal with Ocado to construct automated fulfillment centers across the U.S. in 2018, the grocer projected that it would identify sites for as many as 20 of the facilities within three years.

As of this month, however, Kroger has only started operations at eight CFCs, and while the company has announced it plans to build more of the robot-driven order-assembly centers, it has not publicly fleshed out timelines for those projects. The grocer currently runs CFCs in Monroe, Ohio; Groveland, Florida; Forest Park, Georgia; Pleasant Prairie, Wisconsin; Dallas; Romulus, Michigan; Aurora, Colorado; and Frederick, Maryland.

Kroger executives have said they are bullish on the prospects for the company’s multibillion-dollar investment in automation to pay off.

Responding to a question during Kroger’s fourth-quarter earnings call earlier this month about the pace at which it is rolling out the Ocado facilities, Kroger CFO Gary Millerchip said the retailer is “very much in the middle of that journey right now of sort of 18 months or so into those first two facilities, really kind of fully understanding the scale of demand to how the customers behave and how you optimize that model.”

Millerchip added during the March 2 call that even as it works to better understand the economics of the CFCs, Kroger is “seeing all the sort of things we have hoped to have seen around customer engagement.”

McMullen noted during the call, however, that identifying locations for future CFCs “ended up being a little bit more difficult than what we would have expected.”

Kroger reported that its online sales grew 12% during the final three months of 2022 compared with the same period in 2021.

Speaking during the Bank of America Consumer & Retail Conference on March 15, McMullen said he thinks Kroger’s online business could be at least as profitable as its brick-and-mortar supermarket business. McMullen said during the conference that he elected to proceed with the Ocado deal because he felt confident in the automation’s ability to advance its technology.

“I said we are going to sign, but we are signing this in terms of what we believe you can become, not what you are, because it doesn’t do us any good for what you are,” McMullen said. “But if I look where you are at the time today versus where you were five years ago, I expect you to improve more than that five years into the future because you have learned a lot and technology always gets incrementally better.”

In a sign of how the online grocery market is shifting, Ocado’s revenue stemming from the deployment of its automated fulfillment technology by Kroger and other food retailers around the world more than doubled in fiscal 2022 even as the company’s online grocery revenue in the U.K. fell.