Dive Brief:

- Kroger e-commerce partner Ocado announced on Wednesday plans to roll out fulfillment robots that are five times lighter than its current model and an on-grid robotic arm that will further automate the picking and packing process.

- Ocado also unveiled updates to its order routing operations that will allow shoppers to get a wide assortment of products delivered faster, executives said.

- Kroger CEO Rodney McMullen said in prepared remarks during Ocado's media event Wednesday that his company and Ocado are currently looking at ways these innovations might roll out across its online fulfillment system.

Dive Insight:

Kroger has only just begun opening automated e-commerce warehouses, but its facilities and rollout plans could be getting an update soon, judging from the latest innovations unveiled Wednesday by technology partner Ocado.

In a presentation from Ocado’s home city of London, executives laid out several new technology updates to its Ocado Smart Platform aimed at lowering costs and getting more same-day orders out to shoppers. All of the updates will be going live this year and be able to fully integrate into partner companies' fulfillment centers by the end of next year, said Tim Steiner, CEO of Ocado Group.

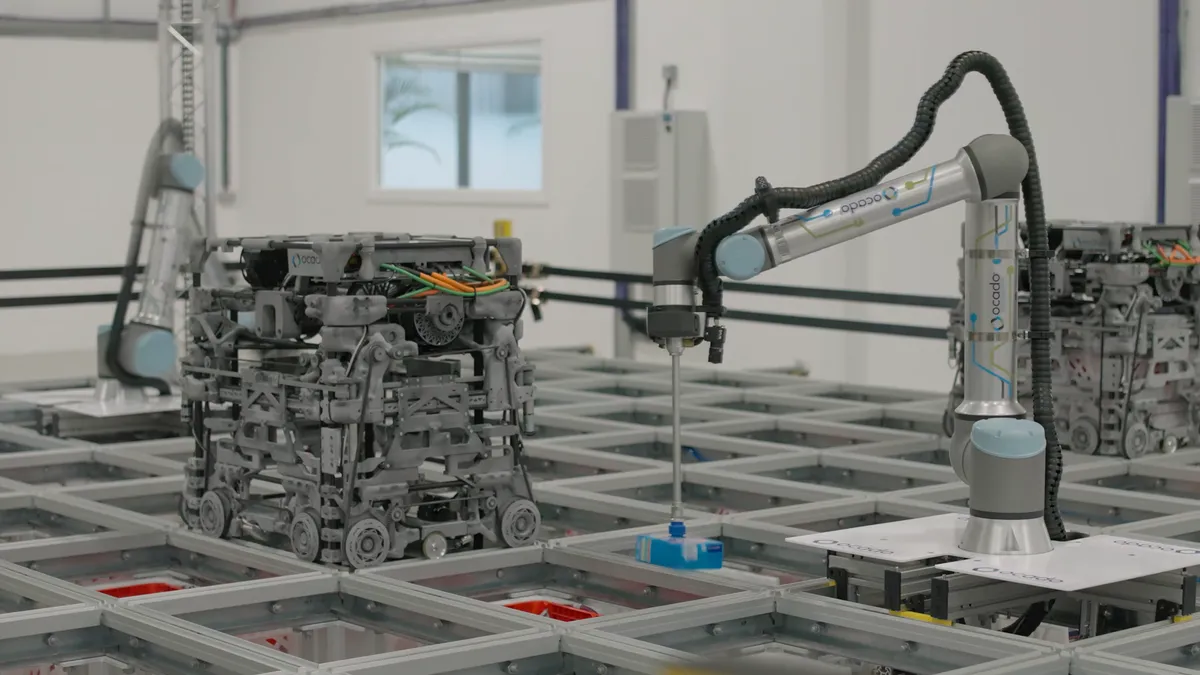

The company’s newest fulfillment robot is an “ultralight” model that requires significantly less power to run, Steiner said. The bots, which are in pre-production mode and have more than half of their parts 3D printed, can run in a wider range of facilities than Ocado's previous models, including micro-fulfillment centers.

With the lighter bots come lighter fulfillment grids that the company says it can build in more types of buildings in a matter of weeks instead of the months Ocado's current systems take to install.

“As we remove significant amounts of material from our sites, we will be able to install the Ocado Smart Platform in a wide range of existing buildings, slashing the timelines and costs associated with the construction of purpose-built facilities,” Steiner said.

Ocado is also rolling out a picking and packing robot that will sit atop its fulfillment grids, allowing the company to shuffle around products and assemble orders in the same space. The move will save square footage and reduce labor costs inside fulfillment centers, said Steiner, by cutting down on the number of manned picking stations it needs. The bots, which could eventually help pick as much as 80% of available goods using machine vision and advanced sensing, will assemble orders during business hours and, to ensure they’re staying busy, organize assortment during off-hours, Steiner said.

In a similar vein, Ocado has also developed a process that automates the loading of order totes onto delivery frames for dispatch, thus turning over a “physically demanding” step to Ocado’s robots, said James Matthews, CEO of Ocado Technology.

Steiner said the company's new robots will help reduce long-term labor costs by 40% over the long term. That could be significant for Kroger, which has faced questions from Wall Street analysts over the high cost of its network buildout. The grocer is currently operating automated warehouses in Florida and Ohio, and has more than a dozen additional customer fulfillment centers announced in markets across the country.

Advanced robotics and efficiency measures, powered by loads of proprietary technology, have been Ocado’s calling card for years. But the company is facing growing pressure from quick-commerce firms and traditional grocers to increase its focus on same-day and on-demand orders. Ocado has been testing out a "Zoom" service powered by automated micro-fulfillment centers (MFCs) in London and plans to build an MFC in South Florida, though it remains committed to its vision of centralized fulfillment of a large assortment of products.

With this in mind, Ocado is introducing routing updates that will provide fast service from its range of facilities. This includes a “Swift Router” system that will pack orders needing more immediate delivery in the same vans that contain its deliveries with longer lead times, then prioritize drop-offs accordingly. Executives said this approach leverages the efficiency and wide product range of Ocado’s facilities for on-demand orders.

The update also includes a distribution framework that will maximize the assortment its smaller facilities can deliver. Under its “Ocado Orbit” system, small facilities will hold a limited number of SKUs but be collectively part of a “virtual distribution center” that combines items from multiple facilities and offers shoppers around 12,000 products. Trucks will circulate between the facilities, loading and unloading products as determined by the company’s artificial intelligence systems.

“Ocado Orbit enables smaller fulfilment centres, closer to the customer, to be able to offer a large range, short lead times, and value simultaneously,” the company noted in a statement.

Throughout Wednesday’s presentation, Steiner spoke about the “trade-offs” consumers and retailers have to make in grocery e-commerce between speed and cost, size and efficiency, and other areas. The company’s new innovations, he said, are aimed at eliminating trade-offs — a bold claim that will be tested in the years ahead as digital shopping continues to evolve.