Dive Brief:

- Mercatus announced Monday that it is enabling client grocers to tap into Instacart’s fulfillment infrastructure to pick, pack and deliver grocery orders using a tool developed and supported by the e-commerce giant.

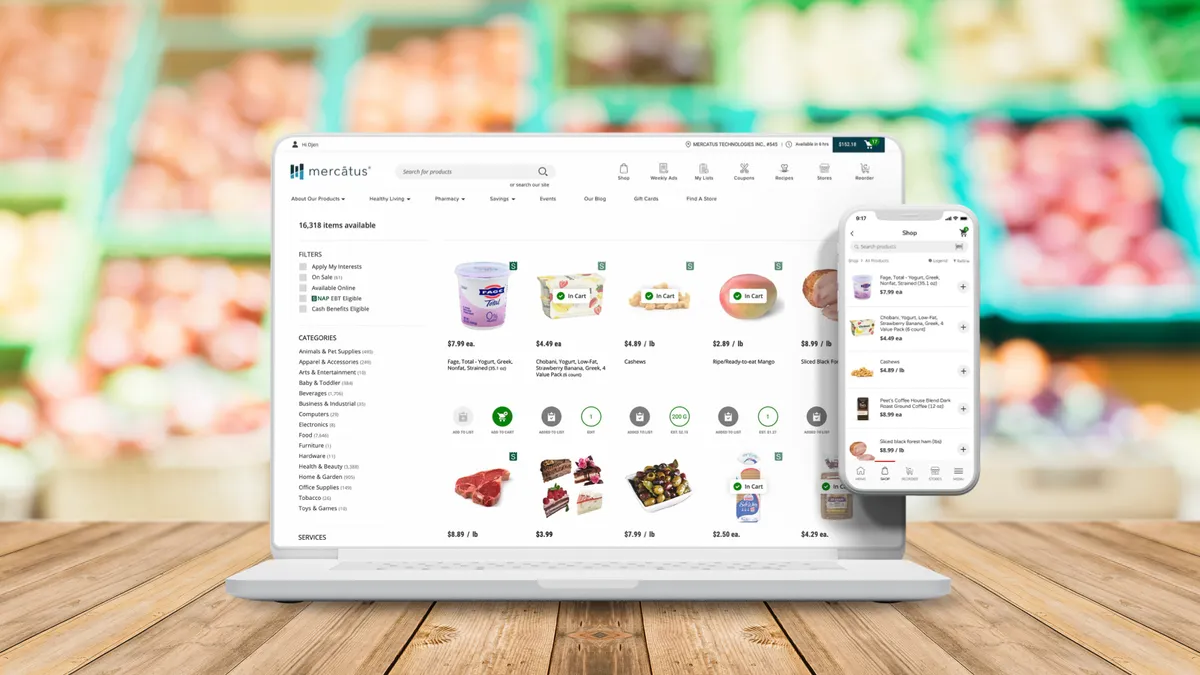

- The tool, known as "Instacart Connect," lets retailers run their own front-end storefronts while relying on Instacart’s gig workforce and other support tools to fuel order fulfillment.

- The addition of Instacart's technology to Mecatus' platform offers another example of the ways retailers and e-commerce providers are trying to navigate Instacart’s dominant position in online grocery.

Dive Insight:

E-commerce providers have largely avoided integrating with Instacart as they focus on positioning themselves as an alternative to the end-to-end provider. But Mercatus’s integration nods to Instacart’s prodigious workforce, which includes around 500,000 gig workers, and its existing connections with retailers.

The goal, Mercatus noted, is to allow a way for retailers to own the front-end experience and retain direct customer relationships while pushing the pricier work of picking and delivery over to Instacart. For small grocers with limited resources, the integration can help them meet demand surges without having to expand their own teams, according to Mercatus.

The ability to scale a workforce is particularly important right now, as retailers battle a labor shortage that’s making hiring difficult across stores and warehouses.

Once an order is placed through a retailer’s site, information is then routed along to Instacart, which deploys one of its shoppers to pick the order and either hand it off for click-and-collect service or drive it to the shopper’s home. The integration, which relies on an application programming interface, gives grocers “more control over the shopping experience and, more importantly, the ability to retain the customer relationships they’ve worked so hard to foster,” according to a press release from Mercatus.

In addition to Instacart, Mercatus also works with delivery providers Shipt, Point Pickup, Delivery Solutions and DoorDash to fulfill orders, according to its website.

Grocers are keen to get shoppers placing orders through company-run websites and apps instead of Instacart’s marketplace in order to gather valuable customer data and leverage their own marketing materials. But Instacart’s marketplace has proven to be immensely popular during the pandemic as the company signs up new members. Instacart has beefed up its marketplace with profitable digital ads, and has appointed new executives, including recently appointed CEO Fidji Simo, with deep experience in digital advertising and marketplaces.

Emarketer estimates Instacart's sales topped $23 billion last year and that it now accounts for 21.3% of grocery e-commerce sales. By 2023, the firm said, that it will reach $35 billion but control a slightly smaller share of sales.