Dive Brief:

- The number of U.S. consumers who are interested in trying meal kits has hit 93 million as the model has evolved from subscription-based to in-store and on-demand, according to NPD's What's Next for Meal Kits report.

- Users tend to be millennials, households with children and those with higher incomes, with in-store meal kit buyers skewing toward homes with children under 13. More than 25% of recent meal kit users have bought them both in a store and online.

- There is more to prepared meals than just dinner. NPD also found that there is room for meal kits to expand into breakfast, snacks and specialty products.

Dive Insight:

Since their inception, meal kits have appealed to consumers' desire for convenient, home-cooked meals with fresh ingredients. However, the way people are purchasing the kits is changing. Meal kit companies are moving away from subscription services and striking deals with grocery stores and other retailers, which widens the potential customer base, helps cut down on shipping and delivery costs and combats the waste that comes with shipping perishable ingredients that has frustrated many consumers.

In-store partnerships are gaining traction and leading growth in the industry. According to Nielsen, sales of in-store meal kit offerings reached $93 million in 2018 as in-store users jumped by 2.2 million households — accounting for 60% of all meal kit user growth.

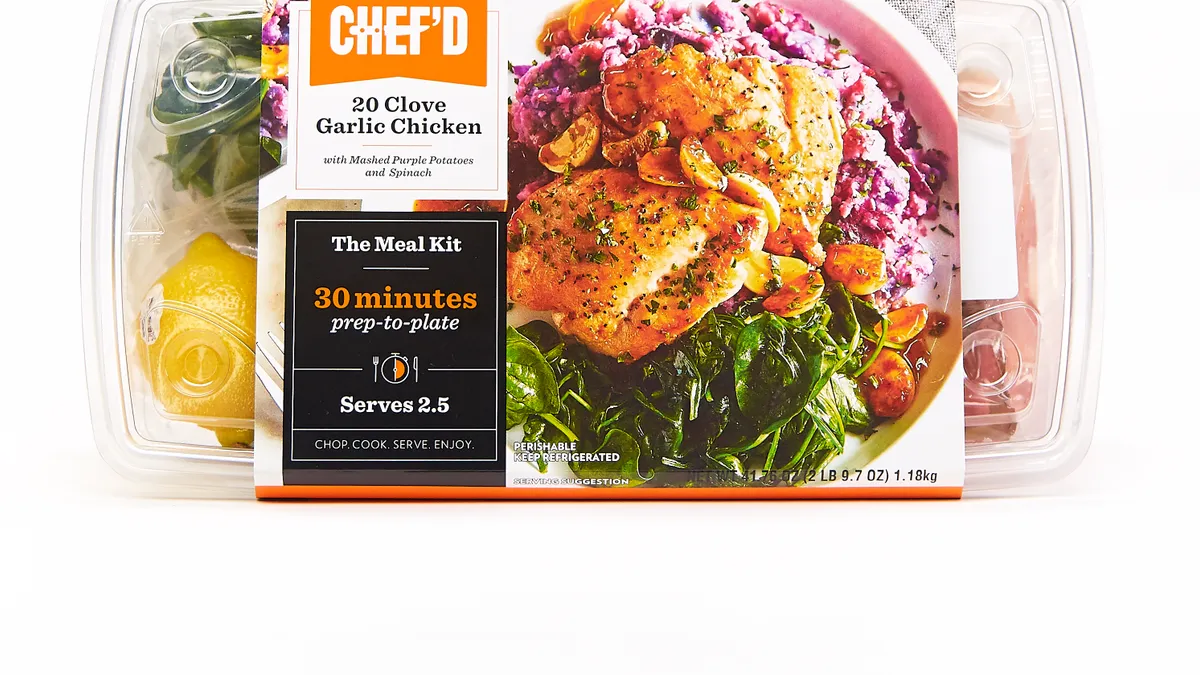

Kroger acquired Home Chef last year to manage its meal solutions. Chef'd, which shuttered last year, is back in Gelson's Markets. Albertsons-owned Plated continues to expand in stores. In a twist on the traditional grocery store partnership, Blue Apron has partnered with Grubhub for home delivery and WW for diet meals. These collaborations may have led to renewed optimism with shares last month reaching its highest levels since September, but some of the luster has since worn off as the long-term challenges weigh on the company shares.

The global meal kit market was valued at $2.5 billion in 2017 and is expected to reach $8.9 billion by 2025, according to new findings by Hexa Research. The 93 million Americans who have yet to try them could be contributors to that growth if grocers and meal kit companies can convert them to actual customers.

With so many companies making meal kits — more than 150 at last count — they have an opportunity to increase their market share with customized menus based on trending food habits. Both Blue Apron and Green Chef, for example, offer gluten-free menus. Purple Carrot and Sun Basket feature vegan and vegetarian options.

Companies can also address time and money. In addition to diet-specific options, some meal kit makers are marketing the speed with which their meals can be prepared — a big advantage for diners who only have a few minutes to get a meal on the table. Gobble's offerings can be made in one pan in 15 minutes or less. EveryPlate and Dinnerly are targeting the cost-conscious shopper with meals that ring in at about $5 per serving.

Is there room for everyone at the table? Meal kit growth is predicted to slow in the coming years, so grocers and meal kit companies should seize the opportunity now to tap into the large number of people who still want to try the trend.