Dive Brief:

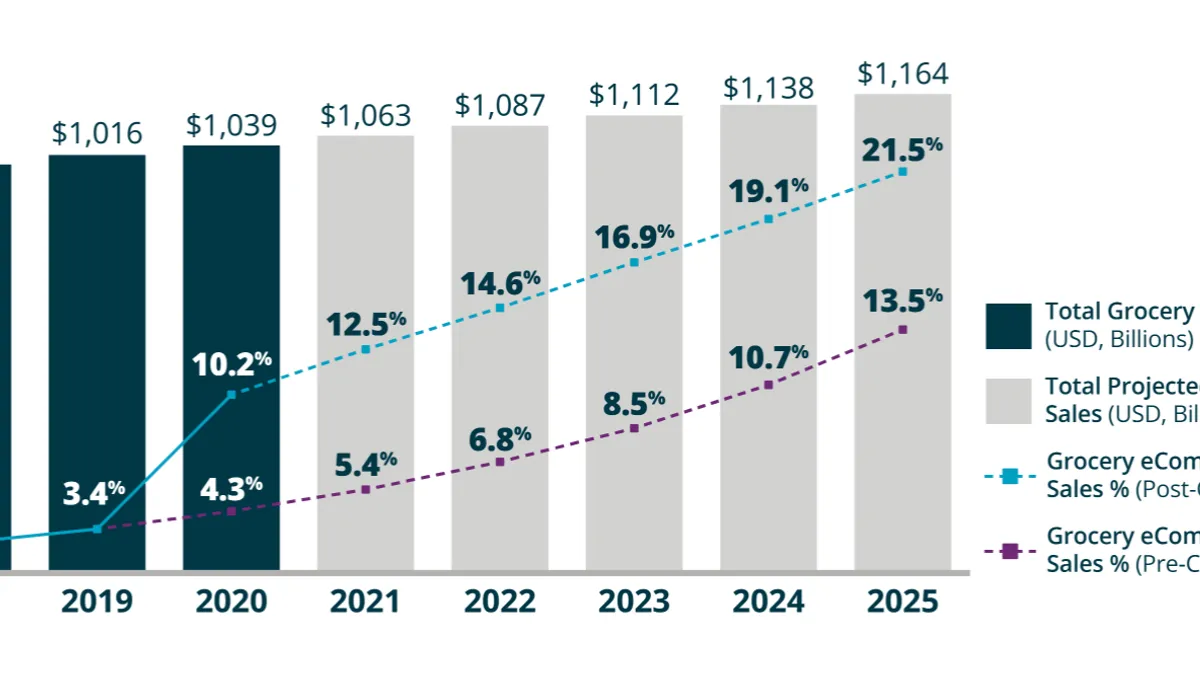

- E-commerce will account for 21.5% of total grocery sales, worth $250 billion, within five years, according to a new survey of 60,000 U.S. shoppers from Mercatus and research firm Incisiv.

- While COVID-19 concerns and convenience largely accounted for the online grocery boom over the last six months, with 43% of shoppers using online grocery compared to 24% two years ago, the findings determined that, going forward, retailers should continue to focus on optimizing both online and in-store shopping.

- The findings also suggest that grocery retailers can attract the growing number of consumers ages 45 and older who have recently turned to new shopping strategies, with 35% trying online grocery orders for the first time and 46% opting for new fulfillment methods like curbside pickup. That population is likely to continue those recent shopping changes, the report notes.

Dive Insight:

The Mercatus/Incisiv report found that shoppers are very loyal to their local grocer when it comes to in-store shopping. But they're less loyal when shopping online, making e-commerce investments an important part of a total-store strategy, Amar Mokha, COO and benchmarking lead at Incisiv, said in a statement.

During the early stages of the pandemic, 30% of shoppers surveyed said they switched their primary shopping destination. Of these, 60% said they switched brick-and-mortar stores and 40% said they switched online providers. Just 8% of those surveyed said they shifted to a pure-play online grocer like Amazon, indicating how much shoppers value grocers having both physical and e-commerce operations, the report stated.

Of the 60,000 respondents across 20 states, approximately 71% were female, just under half were ages 45 to 64 and 31% were ages 65 and older.

While the pandemic has caused disruption to shopping habits, the study predicts online sales growth will stabilize but continue to increase even as shoppers migrate back to in-store shopping. A monthly survey from Brick Meets Click and Mercatus found that the average order value for online grocery set a new record in August of $95, while that same month saw delivery and pickup sales drop to $5.7 billion from the peak in June of $7 billion.

The latest 2025 estimate of $250 billion in sales by 2025 is a favorable finding for Mercatus, which is an online grocery vendor.

Projections for online grocery sales have swelled in recent years. Earlier this year, FMI and Nielsen forecasted online food and beverage sales could achieve $143 billion by 2025 after previously estimating in 2017 that sales would hit $100 billion by 2025 and then saying in 2019 that sales could reach that same amount between 2022 and 2024.

Online grocery services’ expanding user base and growing shopper satisfaction point to an “optimistic” future for grocers, said Neil Stern, senior partner at McMillanDoolittle, a retail strategy and consulting firm.

Mathematically, Stern said it’s possible for online grocery to account for 21.5% of total grocery sales by 2025, but several obstacles could make that estimate difficult to reach.

“What happens is the reality says, ‘No,’ because we don’t have the infrastructure to make it happen,” he said.

Grocers would need to heavily invest in updating their infrastructure and technology, he said, pointing to Kroger’s partnership with Ocado on automated warehouses and H-E-B and Swisslog teaming up to build automated micro-fulfillment centers. Getting the infrastructure in place takes time and resources. “Even if the demand is there for the consumer, it's not that easy to fulfill it,” he said.

Successful online grocery retailers will also need to focus on meeting customers’ expectations and seamlessly offering online and in-store shopping. Real-time inventory visibility is potentially a key component, with 66% of the Mercatus and Incisiv survey respondents who use online shopping rated it as “very important.”

“While the adoption rate of online grocery has increased significantly, grocers need to improve pickup and delivery slot availability, promotion and coupon availability, and product substitutions to improve customer loyalty online,” Mokha said.

Even with the challenges posed by refrigerated, frozen and perishable products and the industry’s typically low-margins, Stern said grocers have an incentive to turn to online grocery as they look to maximize efficiency and profitability.