Pardon the Disruption is a column that looks at the forces shaping food retail.

The pandemic has changed the in-store shopping experience, requiring customers to follow protocols like mask-wearing and traversing one-way aisles as they quickly go about their business. But what was a highly fraught experience in the early months of the coronavirus crisis is beginning to normalize, and though it will take time, I expect shoppers will eventually return to their pre-pandemic shopping routines.

What has changed for good is online shopping. Those nervous initial months pushed millions of consumers towards e-commerce, where they filled up digital carts and selected pickup and delivery slots for the first time.

Several months later, many of them have stuck around. August saw average online order value climb to $95, the highest monthly total ever, according to Brick Meets Click. A report from Mercatus, meanwhile, predicts online grocery will become a $250 billion business within five years — a particularly hefty figure when considering the Food Industry Association's pre-pandemic projection for 2025 was more than $100 billion less.

That latest projection may be overly optimistic. But what’s clear is that e-commerce has moved ahead by a considerable amount these past several months. Millions more consumers than anticipated are now shopping online, and that’s pushing retailers to innovate, creating a virtuous cycle that’s whirling toward a rapidly evolving digital future.

We'll take a more in-depth look at that the future of online grocery in the coming weeks. For now, I've laid out some of the online developments that we've seen accelerate during the pandemic — the most pressing problems, if you will, that companies are determined to solve. They underscore the opportunities as well as the difficulties that the global pandemic has posed for retailers.

Apps are the connective tissue

For evidence of just how important apps have become for consumers and retailers, look no further than Walmart’s new store prototype, a digital-physical space where shoppers are directed to use the company’s app to navigate stores, gather product info and check out.

The secret sauce in this development is that it gets people using a service through which they can also buy online, thus welding together two channels that the industry has for too long treated like squabbling siblings. The prototype comes on the heels of Walmart’s move to consolidate its grocery app with its main app.

Other grocers are looking to better integrate clicks and bricks with new and refined apps. The key, experts say, is providing shoppers with shortcuts and making the interface something they want to swipe and tap around in.

Choice Market and Farmstead, two retailers that are at the forefront of food retail technology, both recently launched new apps. And both companies' founders have interesting things to say about their launches. Mike Fogarty with Choice said in a recent interview that his company's app is "more than just an app — it's the next iteration of Choice," while Pradeep Elankumaran said that retailer apps "are the new storefront."

These are the ways consumers are thinking about apps — and it's how retailers should be, too.

Moving fulfillment beyond the aisles

Leading minds in e-commerce have long warned about online workers crowding store aisles. That kicked into high gear during the pandemic, with reports noting grocers like Whole Foods are packed with e-commerce workers.

Retailers are realizing that, in stores where online volume is high, they need a strategy for moving fulfillment off the retail floor and into dedicated spaces — whether that’s carved out in the back of a store, in a vacant department or in a separate facility altogether.

That’s easier said than done, of course, and it all depends on grocers being able to identify and forecast demand accurately and then adjust with the right solution. A key question is whether to implement automation, and how. When should grocers build a dark store centered on manual labor, as Whole Foods and Ahold Delhaize have done, and when should they invest in a robotic solution like micro-fulfillment?

Jordan Berke, a former Walmart executive and e-commerce expert who runs Tomorrow Retail Consulting, advises retailers to make step changes to their fulfillment operations based on order volume, moving first from the sales floor to dedicated space in the store, then to a dark store once demand is high enough, and incorporating automation after that. He estimates grocers can increase picking efficiency 70% just by moving fulfillment into a dedicated space.

"It is impractical to try to pick high volumes of online orders in the traditional model, which is sales floor picking," Berke said.

Companies need better platforms

The pandemic has pushed consumers to get in touch with their inner chef. But good luck getting help and menu inspiration from retailers' and third-party marketplaces, whose digital shelves have little to no organizational flair or promotions beyond the search bar and a bunch of category listings.

Technology companies are pushing recommendation tools hard, saying grocers want to personalize shopping more for consumers. Retailers are also linking their platforms with meal-planning software that builds shopping around days and dishes, not just individual items. Services like Dinner Daily and eMeals help shoppers plan meals and link to digital shopping carts at Kroger, Albertsons and Walmart, while companies like ShopRite let shoppers browse by recipe and receive individualized recommendations.

At the same time, many shoppers are burned out in the kitchen and just need some quick meals. Tracy Marik, senior deli merchandiser with PCC Community Markets, recently said he’s worked to offer more packaged prepared foods online.

"We really narrowed our core items and made sure we have oven roasted chicken, mac and cheese and mashed potatoes every single day on Instacart," he said.

Wegmans closed down its beloved restaurant The Pub earlier this year, but has been offering delivery from its other restaurant properties, and Publix has moved delivery of its famous "Pub Subs" online. Especially as restaurants continue to rebound from earlier in the pandemic, helping shoppers solve breakfast, lunch and dinner online is crucial for grocers.

Pickup is the new delivery

Grocery e-commerce may have started out with vans and drivers, but it’s rapidly moved into parking slots and order runners. Pickup’s popularity was already surprising grocers before the pandemic. Now it has become the preferred mode for customers who order online.

"It's well north of a billion-dollar business for us, and growing much, much faster than even the delivery business," Instacart President Nilam Ganenthiran said in a recent interview. He noted Instacart has added pickup service at more than 1,400 stores since March 1.

What’s the appeal? Consumers like the lower fees of pickup and having more control over when they can get their order. It also follows a familiar routine of driving to the store, and offers the opportunity to pick up incremental purchases.

Grocers, meanwhile, are happy about click-and-collect’s momentum because it means they have more control over the operation instead of handing it over to a third-party platform, and because they get to rely on their most valuable assets — their stores. Companies like Albertsons, Aldi, Sprouts and Target have expanded their pickup services at breakneck speed so far this year.

But don’t sleep on delivery

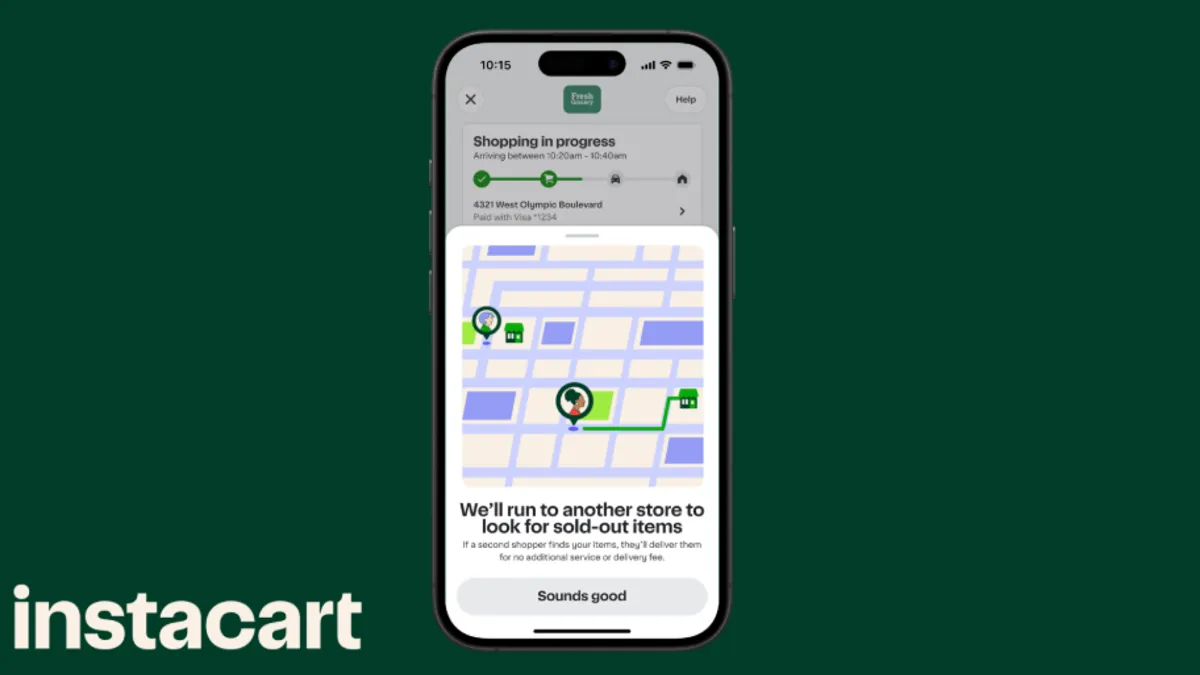

The last mile remains overly expensive and thoroughly complicated for retailers and consumers, who mainly rely on one company — Instacart — to schlep orders from stores to homes.

Things are getting a lot more interesting in delivery, however. Uber and DoorDash, two titans of the restaurant delivery space, have muscled their way over to grocery and promise to bring loads of customers with them. Competition should also spur promotions that get more consumers springing for grocery delivery in the near future.

The company that promises to push the needle furthest in delivery, however, is Amazon. Having dragged the retail industry into a two-day — soon to be one-day — delivery battle, look for the e-commerce giant to hit the accelerator in grocery, it’s new pet industry. All signs point to Amazon building out an army of grocery stores across Prime epicenters in the U.S. where, along with its existing e-commerce facilities, the company with nearly unlimited capital can deliver quickly and cheaply.

"I am convinced that the Amazon Fresh format is the most disruptive factor in grocery retail right now," Berke said. "And part of that means it is going to convince customers that one-hour [delivery] is the new standard before they go to 30 minutes."