Pardon the Disruption is a column that looks at the forces shaping food retail.

Online grocery shopping may have cooled off considerably in the past year or so, but the evolution of digital across all aspects of the industry feels like it’s just getting started.

A confluence of factors, from the growth of e-commerce to the rise of artificial intelligence, have put new tools within reach for retailers. With that comes a broad array of questions companies must consider as they look to new technologies to save money and deepen customer engagement.

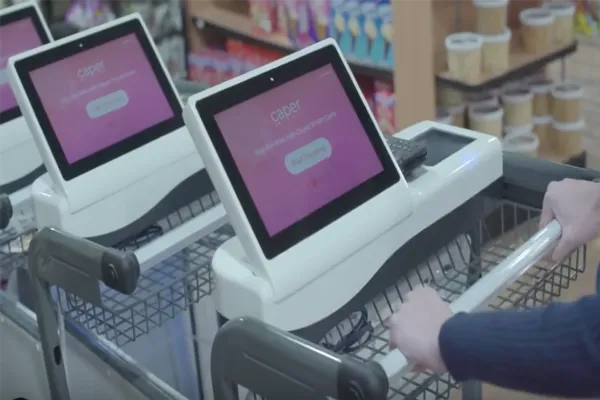

Do grocers need to invest in smart carts? What about scan-and-go payment programs? Is an app refresh worth executing? What are the best uses for AI? And how might ChatGPT eventually fit into their online shopping experience?

Figuring out where to invest is just part of the challenge. Grocers also need executive leadership to guide decision making and the operational structure to take full advantage of digital tools at every step. They need to foster a culture that encourages experimentation, evaluation and the ability to fail and learn quickly — all qualities that are required to keep up with digital innovations but that aren’t part of grocers’ traditional game plan.

This is all very difficult for any retailer. And it’s especially tough for regional companies.

Regional grocers are caught in a challenging middle ground. They often position themselves as hometown grocers, yet at the same time are expected to compete with the industry’s biggest players.

Regional chains operate stores in prime real estate that puts them in direct competition with Walmart, Kroger and Albertsons, and they carry many of the same products. Regional retailers also have the money to invest in online grocery shopping, to develop new apps and scale technologies that help them operate more efficiently.

But regional operators don’t have the same capital advantages and capabilities as the big names. As technology evolves and as consumers’ digital habits change, the gulf between regional grocers and national players threatens to grow. The proposed Kroger-Albertsons merger, which is currently working its way through the regulatory process, would only add more pressure.

“I do worry that these regional grocers are playing in a very expensive poker game where they can’t afford to ante up, much less lose,” Kevin Kelley, co-founder and principal of Shook Kelley, a store design firm that works with regional grocers, told me recently.

When regional grocers try to excel at both digital innovation and hometown charm, it's easy to fall short on both fronts. The result can be a middling experience.

But it doesn’t have to be that way. Digital innovations can accentuate the strategies that grocers have long employed to differentiate themselves from their competitors. Digital menu boards, order-ahead functionality and kitchen orchestration systems can strengthen a grocer that prides itself on prepared foods. A company that aims to be a great employer can roll out an employees-only app that provides training, scheduling and other resources to give workers a greater sense of autonomy.

Regionals also can be the first ones to surface or scale new technology. H-E-B acquired its own delivery company well before Kroger began rolling out its own delivery vans. Schnuck Markets has rolled out aisle-scanning robots to track inventory across most of its stores, while The Fresh Market has embraced livestreaming and innovative social media marketing.

Retailers need to realize, if they haven’t already, that digital offers numerous ways for them to reach new shoppers and refine their brand image.

“The walls of a brand aren’t confined to the four walls of a store anymore,” Nick Bertram, the current president and COO of food waste company Flashfood who previously spent several years at the helm of The Giant Company, told me.

In an industry where consumers are increasingly shopping across channels, and where the right technology can save companies heaps of time and money, it’s critical for regional grocers to have the infrastructure and internal culture that allows them to evaluate, test and scale the right opportunities

Over the course of this summer, Grocery Dive will look at how a few well-known regional grocers are approaching digital innovation. We’ll start this week with an in-depth look at Lowes Foods, the chain with around 80 stores in the Carolinas that’s embracing an omnichannel shopping approach.

Each month, we’ll publish an in-depth profile of a new grocer in a different region of the country. We’ll also bring you articles in the coming weeks on how regionals are approaching key digital topics such as retail media, data collection, e-commerce ownership and internal structuring.

Our goal with this series isn’t to answer all the questions I’ve laid out in this column. As any expert will tell you, so much depends on the market conditions in which a retailer operates, its corporate strategy and much more. Instead, we aim to provide information on how some top regional grocers are approaching these key topics, and some of the best practices grocers should keep in mind as they structure their businesses to succeed in digital.

Regional grocers have a reputation for following in the footsteps of larger players, and this trend is bound to continue as digital technology advances in the industry.

But I don’t believe keeping pace with digital innovation is strictly an arms race in which the smaller players are destined to struggle while the largest players thrive. Companies need to serve up the right digital innovations for their business, be it a cutting-edge tool for the back-end or a basic online shopping feature for consumers.

In other words: Have a strategy, and don’t go chasing blindly after the latest eye-catching innovation.