Despite predictions that online shopping will eventually become a $100 billion behemoth, growth to date has been pretty tame, with the latest figures putting sales at anywhere from 3% to 6% of the total market.

Industry experts have pinned the lack of enthusiasm to two main ideas: That consumers find online grocery too expensive, and that they like to pick their own fruits, vegetables and fresh cuts of meat, thank you very much.

Consumer study after study has born out these points, but there’s another key factor that’s keeping e-grocery interest at bay — and it’s one I’ve seen bubbling up lately in numerous interviews and trade shows.

Online grocery isn’t very inspiring.

Yes, e-grocery is convenient. It can bring 10 pumpkin pies to your doorstep in an hour. And you can reorder a shopping cart’s worth of groceries with just a few clicks. But most platforms don’t offer much in the way of solutions, and they don’t make shoppers want to explore products in the same ways they do in-store.

Take a spin through most online grocery sites and apps and you’ll see a storehouse of products ordered by department, a few assorted promos, a scroll-able list of items that are on sale and, if you’re signed into a profile, some suggestions based on past purchases. It’s the store inventory fed through a digital scanner, with a few sale tags, pretty pictures and personalized snippets thrown in for good measure.

"It looks like their priority has been figuring out how to put all their inventory online," Morgan Hirsh, founder and CEO of online retailer Public Goods, told me.

Founded in 2015, the membership-based Public Goods began offering groceries earlier this year, and now the category makes up a quarter of its inventory. Since the company doesn't have stores to drive awareness, Hirsh said he thinks a lot about online engagement and discovery. He said the company has no revenue churn and that sales have tripled each year.

That online grocery platforms would be sub-par at this point is understandable. After all, a lot of grocers are just getting started. They’ve been focused primarily on building out the operational side of the business. They’ve been busy revamping backrooms, hiring new workers, planting colorful store pickup signs in their parking lots and generally setting the foundation for an omnichannel future. They focus on a store-based presentation because stores are what they know.

Most have also handed over their web development to a few third-party companies, creating a homogenized experience across companies.

E-commerce shouldn’t be a limited experience, especially with the "endless aisles" capacity e-commerce offers. Grocers may not have the wonderful aromas, colorful displays and tactile appeal of store shopping, but they do have a larger product assortment and near endless array of tools at their disposal.

Other retail channels have explored the possibilities. Anyone shopping for furniture online can render that armchair or area rug in their living room before they buy. Home improvement retailers help customers see how a new coat of paint might look on the outside of customers’ homes, while fashion retailers suggest seasonal looks and combinations to go with every selection.

Grocers have a unique opportunity to offer new experiences in food and beverage — a segment of retail where consumers are looking for inspiration and better health, but where they need more help than ever. According to research firm Food Genius, as much as 80% of consumers don’t know what they’re going to have for dinner at 4 p.m. on any given day.

That need means grocers of all types still have an opportunity to claim new customers, and e-commerce can help. Companies seem to have gotten the memo. Chad Petersen, senior director of e-commerce at Lowes Foods, told me recently that grocers need to focus on "humanizing" online shopping and helping guide shoppers.

"You’ve got to get past the blocking and tackling," he said. "But if you’re not really trying to guide guests to the right beer or wine based on their preferences, the right region and so on, then you’re missing an opportunity."

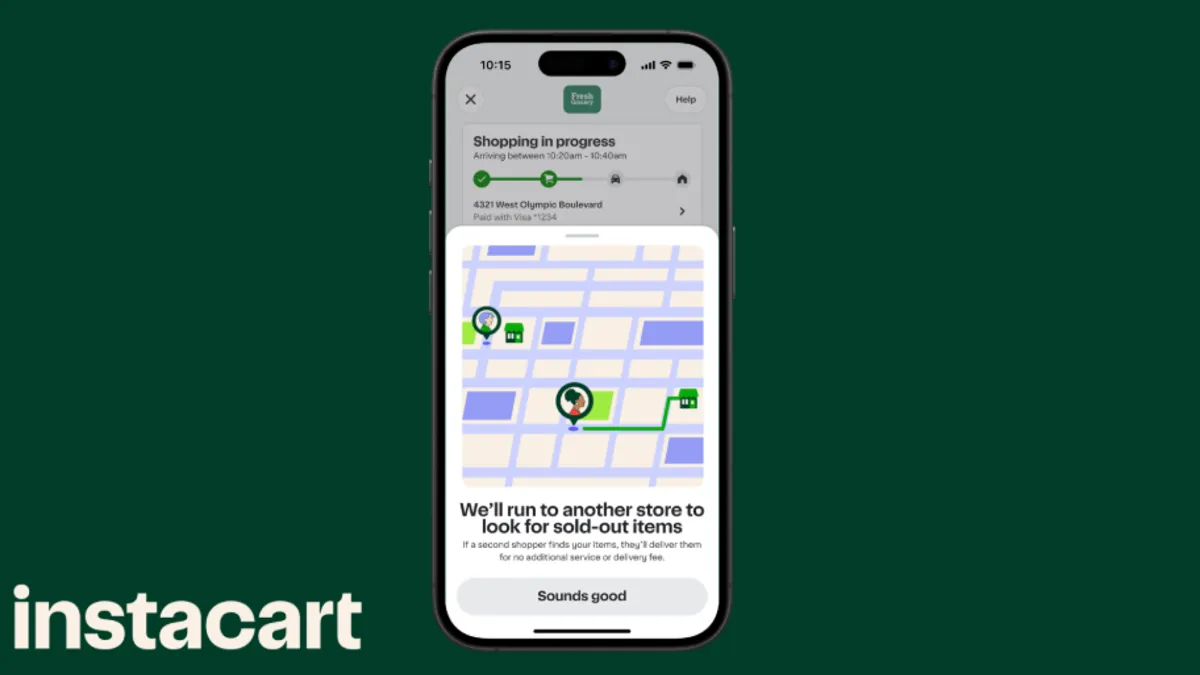

Meanwhile, Instacart’s chief business officer, Nilam Ganenthiran, told me improving shopper "discovery" is a major focus for the company.

"That treasure hunt that happens when you walk into a grocery store and get to find the cotton-candy grapes that are only in season weeks a year — that’s easier to do in a brick-and-mortar environment today than it is to do in a digital environment," he said.

So how might grocers update their e-commerce platforms in the coming months and years? I have a few thoughts:

Better meal planning

Retailers have partnered up on shoppable recipes, but why should they rely on outside sources for menu planning and ideas? I expect retailers to integrate tools into their sites and apps that combine discovery, personalized meal planning and add-to-cart functionality.

Some retailers have started down this path. Food Lion’s ordering site — powered by Instacart’s Unata — features meal ideas like peach pie and "Monster Nachos" on its main page along with the corresponding ingredients.

More customized experiences

Right now, shoppers don’t have much say over the e-commerce content they see, and I suspect that’s tempering enthusiasm for what’s otherwise a very convenient service. Most platforms help users reorder products and can even push recommendations based on past selections, but they need to go deeper, put the shopper in the driver’s seat and focus on needs ahead of promotions.

Companies could eventually offer dashboards that let each shopper select among various tools they want to use. A user could select a menu-planning app along with one that alerts them to deals in the categories they most often shop. There could be a widget that shows their preferred delivery or pickup time, another that offers cooking tips, and more.

Better storytelling

Companies can share troves of information with shoppers in the digital arena. Retailers don’t want to overwhelm, but they also shouldn’t hold back in areas like health and private label where shoppers genuinely want to know more.

Hirsh said one of the keys to deepening engagement with Public Goods’ members has been sharing information about the products they offer.

"We tell them why we chose to make a particular product, how we made it and we let them share their experiences with it," he said.

Private labels have helped retailers distinguish themselves from the competition. Telling customers more about the inspiration and sourcing behind these products could help grocers further carve out a unique identity.

"That treasure hunt that happens when you walk into a grocery store and get to find the cotton-candy grapes that are only in season weeks a year — that’s easier to do in a brick-and-mortar environment today than it is to do in a digital environment."

Nilam Ganenthiran

Chief business officer, Instacart

A stronger link to the store

Most shoppers that shop online still visit the store, so cross-promoting the two channels is key to staying front-and-center with shoppers. Retailers have started down this path with tools like in-store ordering kiosks and online store specials that blur the lines between the two properties.

I expect grocers will go deeper here with additional promos and information. In-store specials and "new to shelves" product information can keep stores relevant as e-commerce grows. Grocers could also bring the store experience online for shoppers who want that familiarity. At Groceryshop in September, Loblaw chief commerce officer Gary Senegal said the Canadian chain is working on an immersive virtual store that customers can shop.

Thinking beyond sites and apps

Hirsh said another key to solidifying engagement is communicating regularly — and effectively — over email and social media. Grocers use these same tools to acquire customers, but they should also use them to keep their most loyal customers engaged. As more customers adopt delivery and pickup and membership programs, push alerts and email can steer shoppers to new promotions, products and services.