Dive Brief:

- About 66% of shoppers said they expect to be buying more of their groceries online within the next five years, according to a new report from retail firm Field Agent that surveyed 3,342 primary grocery shoppers.

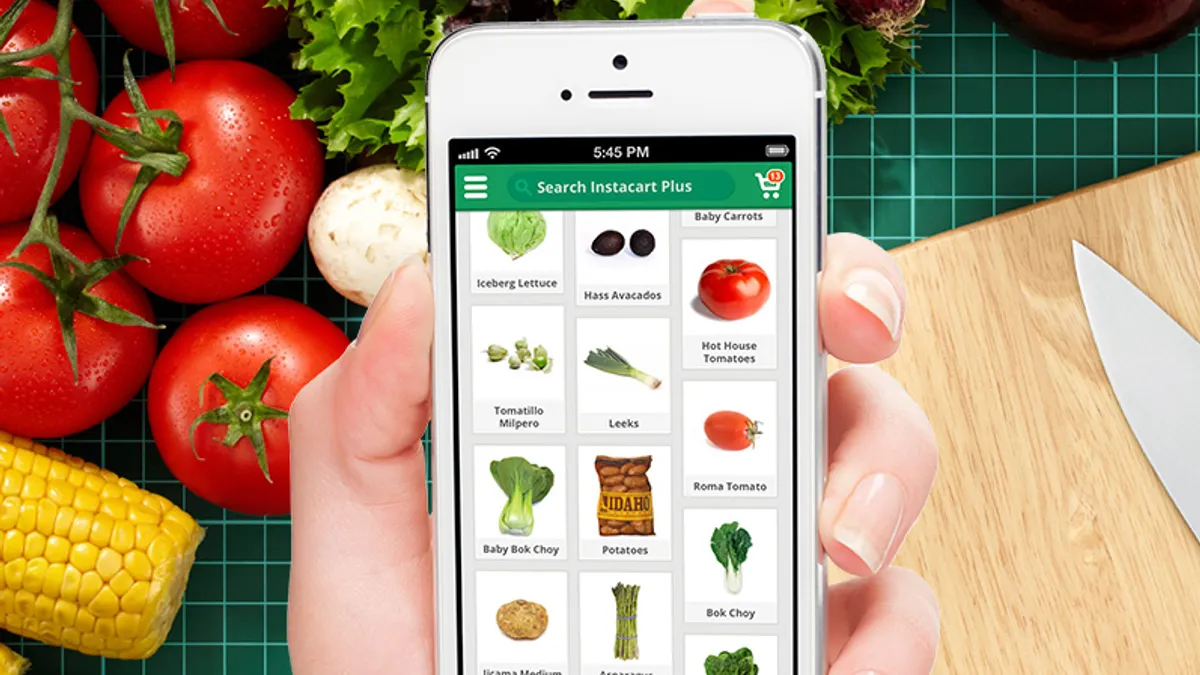

- A majority of shoppers who grocery shop online buy from Walmart (82%), while 35% purchase from Amazon and 29% from Target. Seventeen percent of shoppers said they shop through Instacart, regardless of retailer, and 7% use Shipt.

- Among shoppers who own a smart speaker and purchase groceries for pickup or delivery, 38% reported they would be moderately likely to use a grocery ordering service through the device while 15% are completely likely and 21% are very likely.

Dive Insight:

While none of the findings from Field Agent are groundbreaking, they illustrate the increasing willingness of shoppers to start shifting at least some of their grocery shopping online. As more grocers launch or expand e-commerce services, it is becoming easier for consumers to try online shopping.

Based on the survey, in-store grocery shopping remains the primary method, with 97% of shoppers saying they shop in-store. Among all survey respondents, 52% currently buy some groceries online, and 21% are open to the possibility. These numbers are a good reminder to grocers that the in-store experience is still essential, but that shoppers are increasingly demanding an omnichannel experience.

When it comes to pickup and delivery, 38% report using curbside pickup and 16% using delivery. For retailers, this reinforces the importance of having strong offerings on both services since the target shoppers for each tend to be different. Urban shoppers have a higher tendency to buy for delivery, while pickup tends to serve suburban areas where people get around by car.

Yet again, with this report Walmart has come in at the top of another survey as a popular choice for online grocery — but in this case it beats Amazon and Target by a landslide. According to numerous other reports, Walmart leads the grocery pickup space and has used it to pull in new shoppers. Its massive reach and nominal fees in the space make it difficult for others to catch up, and the company’s investment in e-commerce is not slowing down. Target isn’t far behind Amazon, showing that its recent efforts in e-commerce are paying off, while Amazon’s grocery presence still doesn’t resonate as much as its other retail offerings.

In Field Agent’s report, survey respondents reaffirmed the key reasons why online grocery isn’t being adopted faster. The primary concern for 58% of shoppers is not being able to personally pick out groceries and verify the product quality and freshness. About 51% say they want to be able to take advantage of in-store promos and discounts, and 43% are concerned about the fees associated with online grocery purchases.