Dive Brief:

- The percentage of consumers trialing online grocery increased from 25% in 2017 to 36% in 2018, according to a survey by RBC Capital Markets. Nineteen percent of people surveyed who do not online shop for groceries say they plan to start in the next six months. The survey also found that 79% of those that purchased groceries online plan to continue doing so.

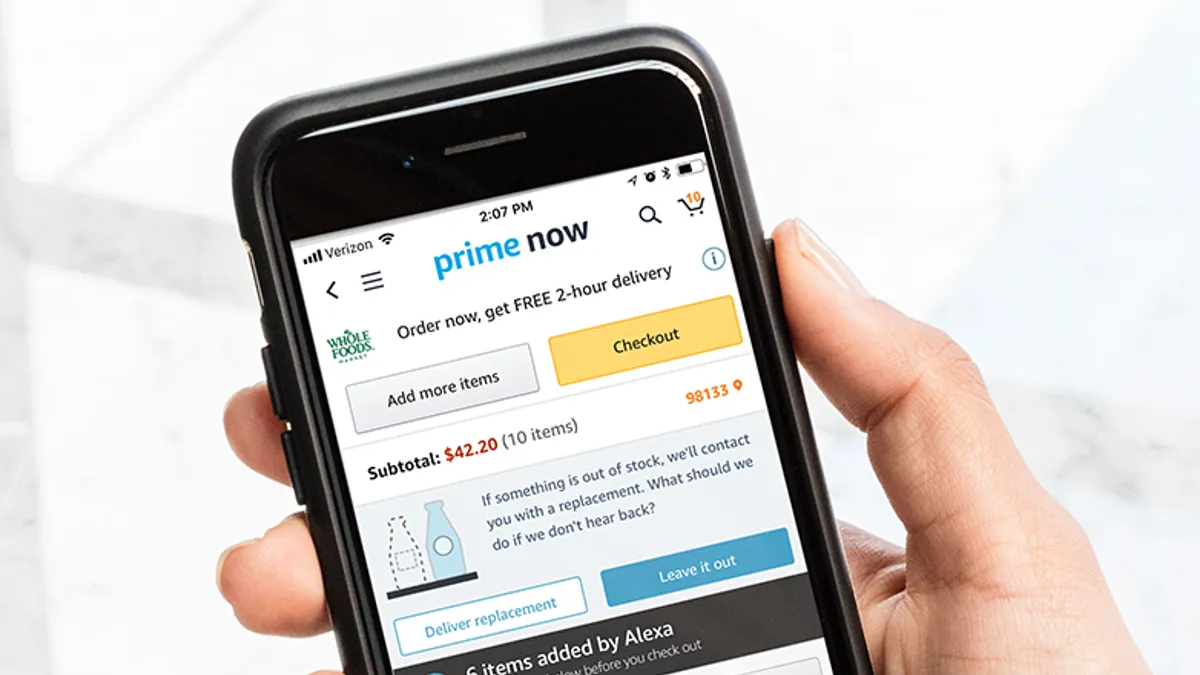

- The report noted that Amazon’s Prime membership grew by 10 percentage points with 64% of respondents reporting they're members versus 54% in 2017. Of those Prime members, 20% said they used Prime Now to order groceries from Whole Foods, but the study expects this number to grow.

- Amazon's lead as the grocer of choice among surveyed shoppers dropped dramatically between last year and this year — from 74% to 38% — reflecting the increase in e-commerce options across the industry. Walmart/Jet.com, Click and Collect and Instacart gained a significant chunk of that share while "other" grocers were listed as the online grocer of choice by 29% versus just 11% last year.

Dive Insight:

As expected, online grocery has grown significantly in 2018, with an increase in shopper frequency and digital basket size accompanying a dispersion of sales across a wide range of grocers. According to the RBC report, 22% of those surveyed said they bought groceries online at least once a week (versus 11% last year), while 48% said their basket size was equal to or greater than their in-store baskets (compared to 26% last year).

What's driving these increases? RBC noted that increased availability of delivery and store pickup options, particularly from major retailers like Kroger and Walmart, were primarily responsible, as is an improving perception of product quality among consumers.

Although Amazon lost significant share as the preferred online grocer among those surveyed, RBC is still bullish on the e-tailer's prospects due to increasing adoption of Prime and Prime Now as well as growing interest in Whole Foods. Nineteen percent of those surveyed said they plan to shop more at the specialty grocer, versus 13% who said the same last year.

Amazon has been working diligently to stitch together its Prime membership with Whole Foods, primarily through in-store discounts and online shopping options. Home delivery is now available through Prime Now in more than 60 markets nationwide. Amazon last reported its Prime membership count to be about 90 million. If the survey’s results hold up to scale, that means about 18 million people use Prime Now.

Outside of its Whole Foods stores, Amazon continues to dominate pure-play online grocery, though it has struggled to build large basket sizes with shoppers. Its AmazonFresh service, meanwhile, recently had to pull back on the markets it serves. Despite these struggles, Amazon will likely strengthen its offerings as it learns from Whole Foods and integrates its various offerings.

The survey also found that although online grocery is growing, in-store shopping is still preferred, with Walmart Supercenters coming in first followed by warehouse stores Costco and then Sam’s Club.

Walmart's substantial store presence and rapid online shopping rollout make it a significant threat to Amazon and to grocers across the country. Another survey by Retail Feedback Group found that customers favored Walmart over Amazon in online grocery. In addition to its delivery and store pickup expansion, Walmart has rolled out an app for employees that lets them browse shopping options for store customers, continued to deploy Pickup Towers, trialed driverless delivery and automated fulfillment, and more.

Amazon’s click and collect services with Whole Foods alone will never be able to scale up to Walmart, whose stores far outnumber Whole Foods'. In order to keep its position as the top online grocer, Amazon will need to continue to scale and improve its online-only operations.