Dive Brief:

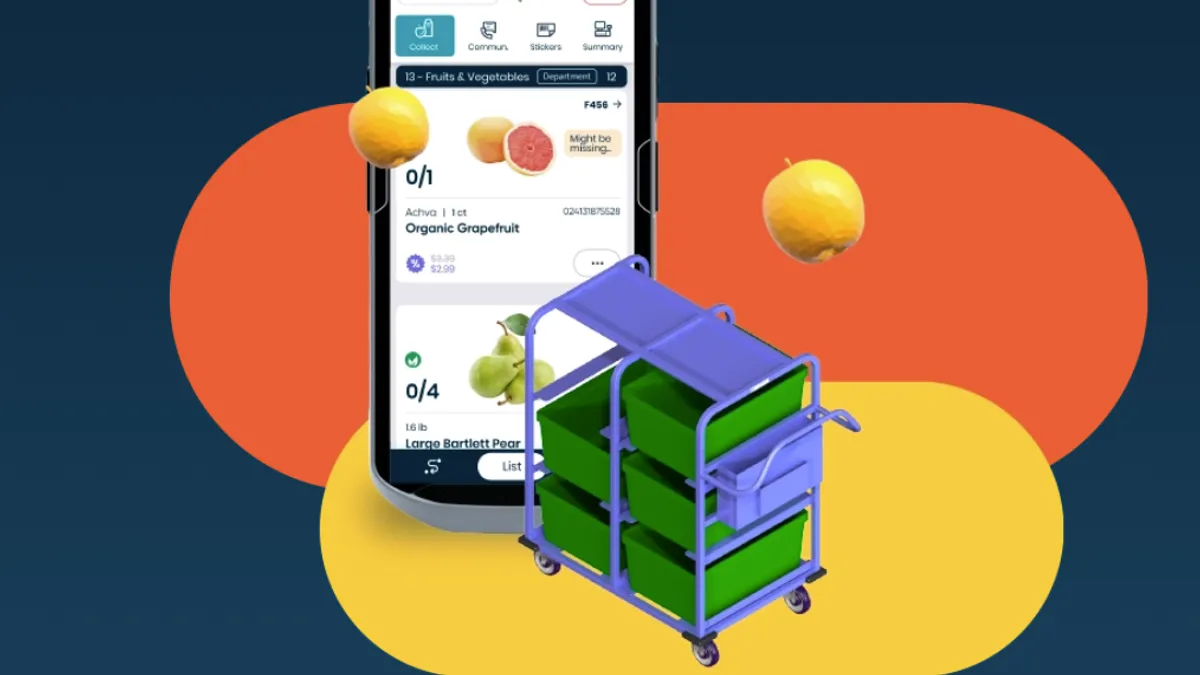

- Stor.ai, a firm that provides end-to-end e-commerce solutions for grocers, announced on Wednesday a partnership with Toshiba Global Commerce Solutions enabling a "holistic e-commerce infrastructure" for grocers.

- Stor.ai already has two-way integration with the retail technology firm's point-of-sale system. Now, the companies are speeding up how quickly grocers can use Stor.ai’s digital tools, allowing them to create a scalable online storefront within a few weeks.

- The announcement is the latest in a string of recent partnerships for Stor.ai as it and other e-commerce providers look to strengthen their competition with Instacart.

Dive Insight:

The strengthened partnership between Stor.ai and Toshiba aims to provide more retailers with tools covering the entire e-commerce journey, from placing an order to the customer receiving it.

A spokesperson for Stor.ai said the two companies have worked together on product integrations in the past, and are now formalizing their partnership to allow Stor.ai to roll out its platform across Toshiba's client base. The partnership also "will greatly expedite Stor.ai's ability to seamlessly integrate and acquire knowhow in different markets around the world," the spokesperson said.

In the announcement, Stor.ai noted that Toshiba Global Commerce Solutions has more than 3.25 million point-of-sale and self-checkout units installed worldwide. Founded in 2014, Stor.ai is working to grow its global presence and using $21 million in new funding to accelerate growth in North America and enter new markets in Europe and Latin America.

In recent months, Stor.ai has linked up with retail computer vision and analytics provider Trax to offer an on-demand order picking workforce and with delivery and fulfillment platform Bringg to expand delivery fleet options for retailers. Its partners also include Unilever, Microsoft, omnichannel payment gateway Cardknox and Tortoise, the maker of electric delivery carts, according to its website.

Combining expertise is a way companies are trying to gain a competitive edge against Instacart and other large third-party services that many grocers relied on during the pandemic-induced e-commerce boom. For example, this year Dot Foods, the largest food industry redistributor in North America, bought ShopHero while technology company NCR acquired Freshop. Last fall, Rosie, an e-commerce provider for independent grocers, integrated ShoptoCook’s website and kiosk service along with AppCard’s personalized marketing and digital coupons into its platform.