As grocers and convenience stores look to keep their edge in the grab-and-go space, sales strategies like customization, employing cutting-edge technology and offering combo meals can help drive revenue, industry experts said during a webinar on Wednesday.

“Grab-and-go clearly is an individually driven choice, and while that can enable a simplified strategy from a menu perspective, when you get down to the brass tacks of assortment planning, I think it gets complex because you have certain flavors and tastes ... that are all [in] tension,” John Connelly, vice president of innovation at consulting firm Mattson, said.

Grocers have been expanding their prepared foods sections, with many turning to creative approaches during the pandemic. When self-service stations and restaurants closed down, grocers turned to packaged meals and meal kits. H-E-B launched a pilot program to sell meals from local restaurants in its stores alongside its prepared foods selection, with all of the sales proceeds going to the restaurants.

As part of the presentation, Mattson gave an overview of results from a survey taken during the fourth quarter of 2019 and the first quarter of 2020 that showed consumers are looking for new options and combining meal purchases. The survey included 551 participants — roughly half men and half women — between the ages of 18 to 74.

Although the response period primarily fell before the coronavirus pandemic, Connelly said the results offer a valuable window into consumers' attitudes towards grab-and-go foods at a time when grocers are figuring out how to hold onto mealtime customers as restaurant sales tick back up.

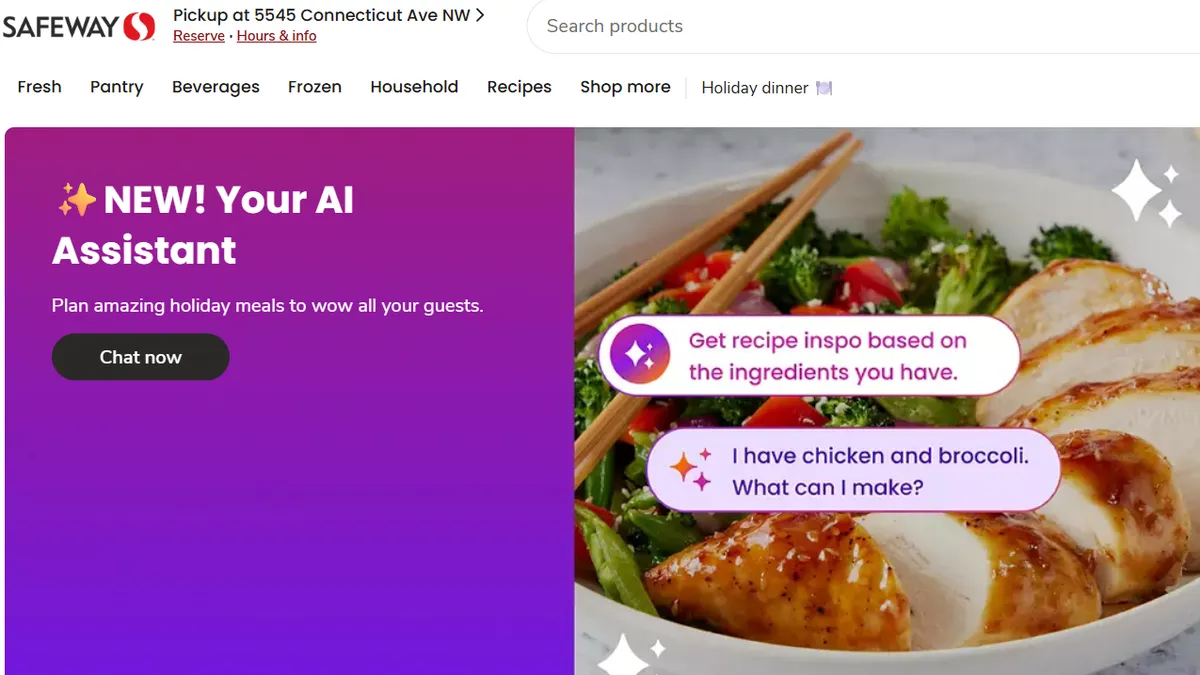

Turning to tech to reach customers

Embracing technology can allow retailers to reach consumers outside of stores, increase online and in-store basket sizes and offer contactless shopping.

Stores can use their mobile app to offer shoppers targeted offers like BOGO or bundling fresh food with chips or a drink, Ryan Boothe, director of food and beverage at convenience-store retailer Maverik, said during the webinar.

“The Maverik digital app allows us to execute these customized promotions in one-to-one marketing, which allows us to have targeted offers that are tailored to each guest based on their preferences, making every customer feel that they are getting a personalized deal,” Boothe said.

In addition to deals, Jac Ross, vice president of fresh infrastructure at 7-Eleven, said during the webinar that the convenience store chain uses its app to collect customer input. One of the consumer behaviors 7-Eleven has noticed during the pandemic is that shoppers want minimal interaction and quick visits. Expanding mobile checkout has allowed just that, Ross said.

“Having that safe and clean environment is absolutely critical” to encouraging multiple trips, Ross said.

With online shopping surging during the pandemic, Melissa Kenny, executive vice president of Delaware Supermarkets, said her company, which owns and operates several ShopRite stores, is using digital strategies like suggesting items shoppers might like, promoting a finished product and featuring price promotions with a minimum order size.

Delaware Supermarkets has launched home delivery on DoorDash and is looking to partner up with other popular food service apps. When working with third-party delivery companies, Kenny said operators need to have strict standards, like ensuring deliveries happen quickly to maximize freshness and making sure food is stored in a temperature-controlled environment, to keep customers happy.

Combo meals in a grab-and-go world

Grocers and convenience stories are advised to follow the restaurant industry’s combo meal concept and apply it to grab-and-go.

The majority of the survey’s participants bought grab-and-go items multiple times a week, with 40% saying they bought items two to three times and 23% buying four to five items per week. Coupled with the findings that 83% of participants bought food and beverage together, compared to 17% only buying food, and that the items have popularity across dayparts, Connelly said that grab-and-go is prime for combo meals and customization.

“In our COVID world, guests are limiting trips,” Connelly said, noting that most consumers are largely buying grab-and-go items for themselves. “Once on a trip, the operator can help guests be efficient with their time and shopping and for dayparts across a current trip.”

While 91% of the survey participants consumed their grab-and-go items within one hour of buying them, Mattson said that selling add-ons could help increase sales.

Ross, of 7-Eleven, said that combo opportunities, just like seasonal flavors, give shoppers a chance to try something they wouldn’t usually buy.

Customization challenges

With customers willing to pay more for their items, Mattson sees customization as a way to create a unique experience. The survey found that more than 96% of respondents said they would buy the same or more grab-and-go items in the future. As for pricing, 73% of consumers are willing to pay more for uniquely designed grab and go products, with 26% saying they would pay 10% more and 15% saying they would pay 20% more.

“This need and this recognition that [grab-and-go items] are unique drives pricing and profit opportunity,” Connelly said.

Combining tech with customization, Publix rolled out a digital deli counter with customized sandwiches available for delivery through Instacart.

While customization staves off boredom, having too many options runs the risk of overwhelming shoppers, ultimately taking away the ease of picking grab-and-go items, Ross said. “For us, it’s about ensuring you have those accessories but not too many because equally convenience means speed and you want to get in and out as quickly as possible,” he noted.

Fewer choices can make it more likely that consumers will make a choice, leading to a better turnover in items, Ross said. Still, it’s a “delicate balance” between offering too little and too much.

“This need and this recognition that [grab-and-go items] are unique drives pricing and profit opportunity."

John Connelly

Vice president of innovation, Mattson

Optimizing in-store grab-and-go

Grab-and-go items are usually merchandised in the foodservice section, but Kenny said grocers should strategically place the items throughout their stores alongside beverages to reach shoppers who didn’t plan on buying a grab-and-go item, but can’t resist its freshness and low price.

Supermarkets should pay careful attention to making sure each package has a time and date stamped so that shoppers aren’t left guessing about how fresh it is, Kenny said.

Placing prepared food items, ranging from snacks to meals, in high traffic areas up the odds of impulse shopping, Boothe said.

Physical stores have an advantage when it comes to grab-and-go items. Boothe said that the “theater” of customers watching their food get made in-store gives credibility to its freshness.

“If you put some time and effort and thought in it, it could be a very powerful business for any operator to drive because it is a bit unique,” Connelly said.