Dive Brief:

- DoorDash now lists Target’s grocery assortment as a delivery option in numerous major markets, according to listings on the delivery app's platform.

- The listing is part of a strategy known as “ninja shopping,” in which delivery apps list non-partner retailers in a bid to generate customer demand in key areas, according to Jordan Berke, founder of consulting firm Tomorrow Retail and a former e-commerce executive with Walmart China.

- The strategy, which close rival Instacart has also employed with Target, can be a high-risk, high-reward move for delivery apps, Berke said, and underscores DoorDash’s “aggressive” move into the industry.

Dive Insight:

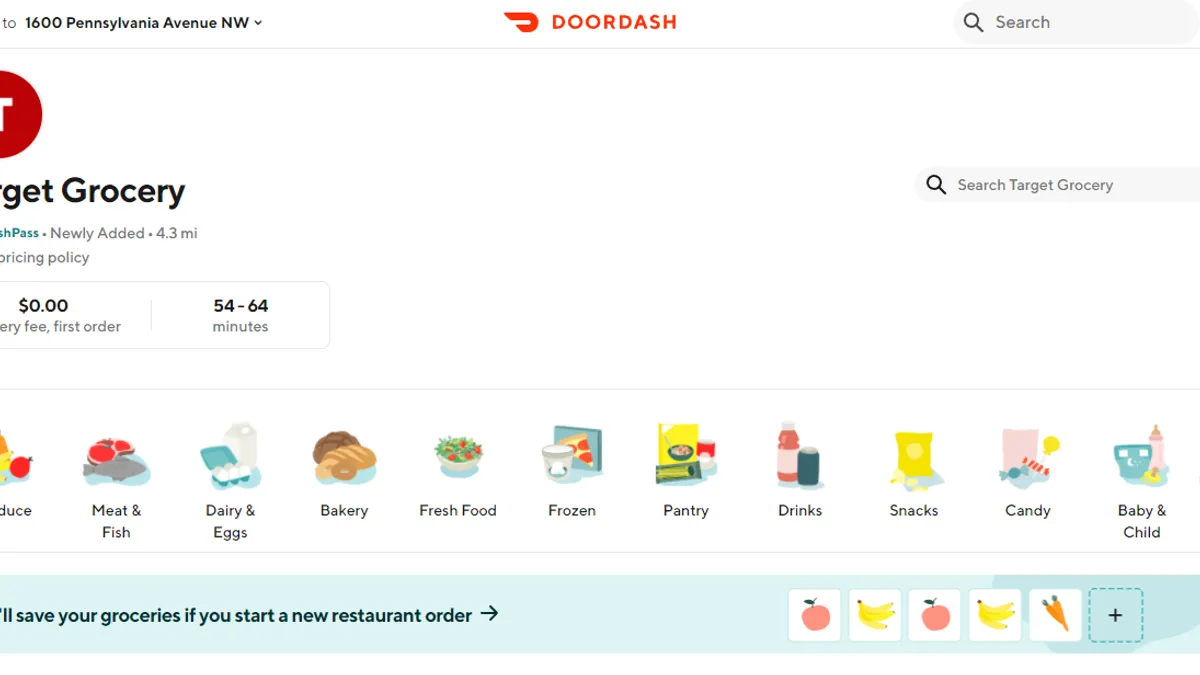

A search of major markets on DoorDash’s website showed that Target grocery delivery is listed on DoorDash’s app in markets throughout the country, including Cleveland; Atlanta; Louisville, Kentucky; Charlotte, North Carolina; and Seattle.

Instead of Target’s distinctive red bull's-eye logo, each listing displays a white capital “T” against a red background. The listings show an assortment of fresh, frozen and shelf-stable products from mainstream brands as well as private label selections like Market Pantry and Good & Gather. The display page for Cleveland, for instance, promotes Good & Gather packaged salads, canned carrots and a chicken salad bowl.

Those listings by DoorDash do not appear to involve Target. "Target exclusively partners with Shipt to offer same-day delivery of online orders to millions of guests across the country. We do not have a business relationship with DoorDash," a Target spokesperson said in an emailed statement, referring to the retailer's delivery subsidiary.

A DoorDash spokesperson acknowledged the delivery company has decided to carry products from Target even though the companies do not have an official partnership. "DoorDash was founded as a platform to help businesses grow, and merchants tell us that being on DoorDash brings them new customers and incremental revenue. We operate informally with Target, and act as an on-demand delivery service from select store locations," the spokesperson said in an emailed statement.

Listing companies without an official partnership in place is not a new strategy for delivery apps. Business Insider reported in 2019 that Instacart was unofficially listing Target grocery products on its platform, nearly two years after the retailer officially cut ties with Instacart in the wake of Target’s $550 million acquisition of Shipt — a practice that Instacart confirmed at the time. A search on Instacart’s website Friday showed that it still offers Target grocery delivery, highlighted by an identical “T” logo, in some of the same markets as DoorDash.

Berke said delivery apps around the world have employed the ninja shopping strategy as a way to scale demand in key markets, and have even used the sales data they gather to convince retailers to forge a formal partnership. Product information can get scraped from retailers’ apps, he said. Gig workers, meanwhile, can enter stores and check out just like a typical customer. In many cases, Berke said, store managers have been aware of the practice but didn’t intervene because it increased their sales.

Restaurant delivery providers like DoorDash and Grubhub have also previously listed non-partner establishments on their apps, sparking lawsuits in some cases.

The strategy isn’t commonly used in grocery today, Berke said, since major companies have been able to scale and establish formal partnerships. But DoorDash is still fairly early in its push to deliver groceries from national as well as regional chains.

“It is definitely indicative of DoorDash being aggressive,” Berke said.

There is risk to the strategy for both delivery apps and grocers. Anne Mazzenga, a Target veteran and co-CEO of retail blog Omni Talk, said using product information that isn't synced up with retailers' systems could lead to a poor shopping experience.

"The benefit of having an official partnership with a retailer is you have real-time, accurate data feeding into your system that's telling you where to route your pickers or drivers and what's the most efficient way to gather goods in a very short amount of time," she said.

Berke noted the practice has led retailers in the past to postpone or cancel partnerships with delivery partners. “We've seen ninja shopping turn into long-lasting partnerships. We've also seen cease-and-desist actions taken depending on the retailer strategy,” he said.

DoorDash has made significant progress since officially launching grocery delivery in 2020, signing up chains like Hy-Vee, Fresh Thyme Market and Albertsons while also rolling out new services like alcohol delivery and a restaurant bundling feature known as DoubleDash. Last week, DoorDash announced a new 30-minute delivery service kicking off with Albertsons.

Instacart is still the leading grocery delivery app, however, after gaining millions of new users during the pandemic while also rolling out new services like convenience delivery.

Listing Target’s grocery assortment also highlights the value of having that company available to shoppers. Target has refreshed its executive team in grocery in recent years, updated its store merchandising and rolled out the store brand Good & Gather, which now brings in more than $2 billion annually.

Sam Silverstein contributed to this story.