The Friday Checkout is a weekly column providing more insight on the news, rounding up the announcements you may have missed and sharing what’s to come.

When Ahold Delhaize released its latest quarterly results on Wednesday, the Dutch grocer painted a subdued picture that continued a pattern among the nation’s largest conventional supermarket operators this year.

Ahold Delhaize reported comparable sales growth of just 3.6% during the second quarter for its U.S. operations compared with the same period in 2022, down from the 6.4% comps it posted a year ago. Sales growth for the company, which runs chains including Food Lion and Giant Food, also slowed during the quarter.

The decline in comp sales Ahold Delhaize saw mirrored declines Kroger and Albertsons reported when they disclosed their latest quarterly results. Kroger’s same-store sales dropped to 3.5% in the first quarter, down from 4.1% a year ago, the company reported in June. Meanwhile, Albertsons said in June that the key financial gauge came in at 4.9% in Q1, compared with 6.8% during the same period in 2022.

The latest comps aren’t too shabby when looked at historically, but they highlight an inconvenient truth that seems to be coming into focus for grocers as they adjust to the post-pandemic economic landscape. Shoppers may have come to depend on their neighborhood supermarket during the COVID-19 crisis, but three years later, their loyalty has clearly faded.

Diminishing inflation is also playing a role, underscoring the challenges grocers face as economic conditions quickly evolve.

A look back at Ahold Delhaize’s same-store sales growth underscores how much supermarket operators’ results have come back to Earth. The retailer reported same-store sales growth in the U.S. of 13.8% during the first quarter of 2020, followed by 20.6% in Q2 of that year and 12.4% during the third quarter.

In a sign that traditional supermarket operators may now be in a sustained period of slower comps, discounter Grocery Outlet’s financial performance raced ahead during the company’s latest quarter. On Tuesday, the chain reported net sales of more than $1 billion for the first time in the company’s history.

Of course, comps aren’t the only measure of success in the grocery business, but if the latest figures are any indication, the nation’s biggest grocers have a tough road ahead as they continue adjusting to a world where pandemic-fueled loyalty and record-high inflation are fast becoming memories.

In case you missed it

Rouses to open first drive-thru

Drive-thrus have taken over the restaurant industry and are starting to crop up at convenience stores — but they’re still something of a rarity at grocery stores.

One operator that’s bucking the trend is Rouses. On Aug. 16, the supermarket chain will open a 60,000-square-foot store in Houma, Louisiana, with a drive-thru lane where shoppers can pick up fresh-made fried chicken. The Houma da Chicken on-site restaurant cooks up the birds using a family recipe that goes back three generations, according to the Houma Times.

The store also features a variety of standard grocery departments along with a Rouse Barrel House that sells bourbon.

Giant Eagle renews its savings program

Giant Eagle’s “Price Lock” savings campaign just wrapped up after three months. And it turns out the Pittsburgh-based grocer liked the promotion so much, it’s going to do it all over again.

Between Aug. 10 and Nov. 11, Giant Eagle will offer savings on more than 1,000 items, up from the 800 participating items it included in its first Price Lock wave, the company said in an emailed announcement. The expanded selection will include many seasonal items, with average savings of 15%.

Giant Eagle’s savings program aims to give it a better price image after numerous consumers have defected to discount chains like Walmart

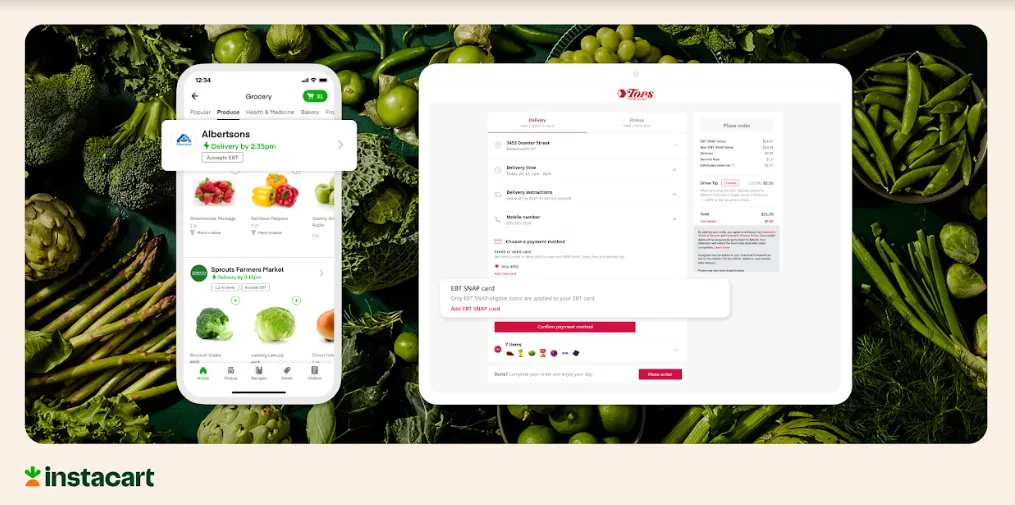

Instacart hits a SNAP milestone

Instacart recently extended SNAP online ordering capabilities to all 50 states — a key milestone in a three-year journey with the food assistance program — the company announced Thursday. The last holdout: Alaska, which Instacart recently integrated in partnership with Albertsons’ banner Safeway at seven stores.

All told, Instacart now offers SNAP digital ordering across more than 120 grocery banners and more than 10,000 stores in the U.S.

Number of the week: $1 billion

That’s the net sales total Grocery Outlet eclipsed for the first time during this year’s Q2. The discount grocer had a blowout quarter overall, reporting a 9.2% increase in identical store sales and a healthy gross margin expansion as price-sensitive shoppers continue to gravitate toward low-price retailers even as inflation tails off

What’s ahead

Walmart and SpartanNash report earnings

Can Walmart keep up its stellar run of earnings as shoppers flock to the company’s stores? How has declining inflation impacted retailer-wholesaler SpartanNash? Industry watchers will find out next Thursday, when both companies release their Q2 earnings reports

July retail sales report

Sales at grocery stores rose just 1.1% in June compared with the same month a year ago, marking the lowest annual growth rate in more than two years. How did July sales fare? The U.S. Census Bureau will release its latest round of monthly sales figures on Tuesday.

Impulse Find

Like many Southerners, Texas grocer H-E-B is trying to find ways to live with the extreme heat seen over the last month. One shopper took notice of a humorous cake the grocer’s bakery department made that read “I’m sorry for what I said when it was 109° outside” decorated with yellow suns.

The shopper captioned the video of the cake “Proof H-E-B has everything you need for the summer” and the clip received over 3 million views and 435,000 likes.

@iamsoufflegirl @H-E-B Proof HEB has everything you need for the summer #hereeverythingsbetter #hebbakery #hebgrocerystore #bakery #cake #funnycake #summer #hot #atx #centraltexas #summerintx #itstoohot #hot #sorryforwhatisaid ♬ Could You Be Loved - Bob Marley & The Wailers