Open the Uber Eats app, select “grocery” and a trio of vegetables bob on the screen as content loads.

“The first time I saw these bouncing vegetables I was super excited because it meant we were close to launching finally in the U.S. our integration — and now I can't stand them,” Oskar Hjertonsson, former CEO and co-founder of Cornershop, said during a press conference last week.

He continued: “We hit the ground quickly and really wanted to make it as fast as possible — maybe not as great as possible.”

Uber has conceded that its U.S. launch of grocery delivery on Uber Eats with Cornershop two years ago had a rough start and is now aiming to course-correct by adding new features on Eats for customers, workers and retailers.

A spokesperson echoed Hjertonsson’s comments in an email to Grocery Dive, noting the experience has been “frustrating” to a lot of shoppers. “That’s why we’ve reinvented the Uber Eats grocery app experience to make it more convenient and more seamlessly connected to the app experience consumers have come to expect from Eats,” the spokesperson noted.

The updates come at a pivotal time for Uber, which has seen its stock fall nearly 50% so far this year. In announcing its fourth quarter results in February, the company highlighted its worldwide expansions for grocery and convenience services through Eats, including partnering with West Coast grocery warehouse chain Smart + Final and launching its dark grocery store called Uber Eats Market in Japan.

“We're definitely not the first to launch online groceries and we're definitely not even close to being the biggest at this point,” Hjertonsson said.

Uber has been reinvesting excess incremental margin from its delivery business into its grocery endeavor, particularly to boost customer acquisition and build out grocery selection, Uber CEO Dara Khosrowshahi said at the Morgan Stanley Technology, Media and Telecom Conference in March.

“We've run this play on Rides. We've run this play on Eats, and the grocery play is absolutely no different than the others,” he said, according to a Seeking Alpha transcript of the event.

While the press conference last week left the future of grocery services on Uber’s main app unclear, Khosrowshahi has said the two apps allow for separate optimization of ride-sharing and delivery services while encouraging cross-platform usage.

But the company’s slow start in grocery delivery could cost it dearly as competing firms Instacart and DoorDash roll out new services, including rapid delivery, and deepen their relationships with grocers. Uber has some key U.S. partnerships, including with Albertsons, Grocery Outlet and Costco, though Hjertonsson declined to offer specifics on how many grocers the company works with and how many cities its grocery delivery service operates.

“[The bouncing vegetables] were a really frustrating experience and it kind of talks about how much better the product that we're launching today,” Hjertonsson said.

Looking to stand out

Will Uber’s updates keep it competitive? Some of the newly announced Eats features are similar to ones already used by competitors.

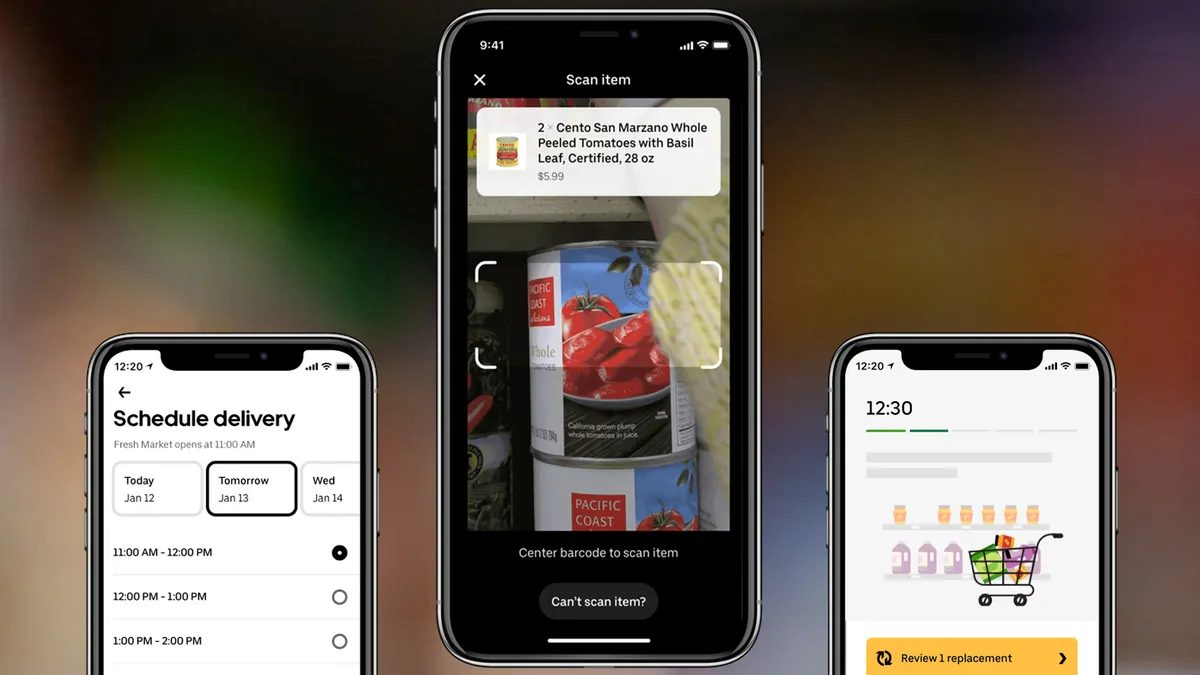

For example, Uber Eats’ new offerings that let customers schedule orders when a grocery store is closed and allow Uber delivery workers to shop customers’ orders resemble capabilities both offered by Instacart and DoorDash.

“A lot of it is really table stakes and must-haves but built with a kind of Uber flavor,” Hjertonsson said about the latest developments.

Meanwhile, grocery pickup — a service Instacart rolled out nationwide in late 2018 — is under consideration for Uber Eats, Therese Lim, Uber’s senior director of new verticals and grocery product, said during the press conference.

Among the new features, Uber will also allow Uber workers to pick orders in addition to delivering them. Previously, “dedicated Cornershop shoppers” had been fulfilling Uber Eats grocery orders, but that is changing this summer with those couriers who had been shopping orders through Cornershop now getting onboarded to Uber’s app to get grocery orders from Uber Eats, the company spokesperson wrote in the email. Meanwhile, existing Uber couriers can gain the ability to shop grocery orders.

One of the other major changes Uber is making is to switch from the WebView experience that’s been in place in the U.S. since early 2020 to a native one, the Uber spokesperson noted. That change allows users to leverage existing Uber Eats features for grocery shopping such as multiple carts and order tracking.

Uber is also focusing on adding more selection, improving substitutions, ramping up marketing and increasing customer acquisition, Hjertonsson said.

Grocers can add more of their SKUs to the platform and use real-time inventory management and improved product catalogs. Lim noted that grocers will also be able to add more product information, such as nutritional content, weight, alcohol by volume, caffeine content and more.

To improve frustrations with substitutions, customers will receive more granular replacement options. If an item the customer originally wanted is not available, the new features allow customers to choose if they want a refund, want the personal shopper to select a replacement or want to share alternatives or preferences.

Uber is leveraging machine learning to help make replacement choices more attuned to customers’ preferences, Lim said, adding that machine learning allows Uber to recommend substitutions based on what other users have selected that are close to the product a customer initially wanted.

The company is also providing workers shopping the orders with support if they encounter a problem with picking a substitution, Lim said.

“The burden is on us to make sure that we are building a product that consumers will love,” Lim said.

And while Uber is rolling out the order-ahead ability for stores that are closed, speed still matters for its grocery delivery. The fastest delivery time is typically 30 minutes, Hjertonsson said.

“We are primarily and first and foremost an on-demand company and we think speed matters,” he said.

Uber is aware that some consumers may perceive Uber Eats as more of a restaurant-delivery company and extension of Uber than a place to order groceries. With these latest updates, the company is hoping to change that perception.

“There are still users that are unaware of the fact that we offer groceries. … On the other end of the spectrum, there are millions of customers that get their groceries on Uber every week around the world,” Hjertonsson said.