Dive Brief:

- The United Food and Commercial Workers International Union hosted a press conference on Friday to further its opposition on the proposed Kroger-Albertsons merger.

- During the conference, UFCW speakers pushed back on claims made by Kroger and Albertsons and raised concerns about C&S Wholesale Grocers potentially taking on more than 400 divested stores.

- “It is unfortunate to see false and misleading information continue to be used to argue against the merger between Kroger and Albertsons,” Kroger said in response to the press conference.

Dive Insight:

Friday’s national press conference was the latest action by the UFCW, which represents more than 100,000 Kroger and Albertsons workers, as it continues efforts to stop the merger between the two grocery giants.

Since the grocers announced plans to combine in October 2022, the UFCW has been raising concerns regarding the merger through steps including hosting protests in front of stores, meeting with federal and state regulators as well states’ attorneys general, funding studies and helping build a website to coordinate opposition, said Faye Guenther, president of UFCW local 3000, which represents workers in Washington state, Oregon and Idaho.

John Marshall, a capital strategies director for UFCW locals 3000 and 324, gave a presentation during the press conference that provided updates on UFCW meetings between Kroger, Albertsons and C&S as well as an overview of the proposed divestiture to C&S. Marshall also discussed a “better path forward for these companies as separate companies” and urged them to invest “in adequate staffing and in their stores.”

UFCW met with Kroger and Albertsons on Dec. 20, 2023, and on Jan. 18 in addition to meeting with C&S on Jan. 11 and Jan. 25, Marshall said.

“I think in general I would characterize the meetings with the companies as them repeating their talking points that the merger would help them compete against companies like Walmart and Amazon and that C&S is a strong company that was going to be able to effectively compete with them themselves, which was not a credible set of assertions from our perspective,” Marshall said.

Marshall also noted that the UFCW’s meetings with C&S did not resolve the coalition’s concerns about the company’s ability to operate as a retail, grocery and pharmacy chain.

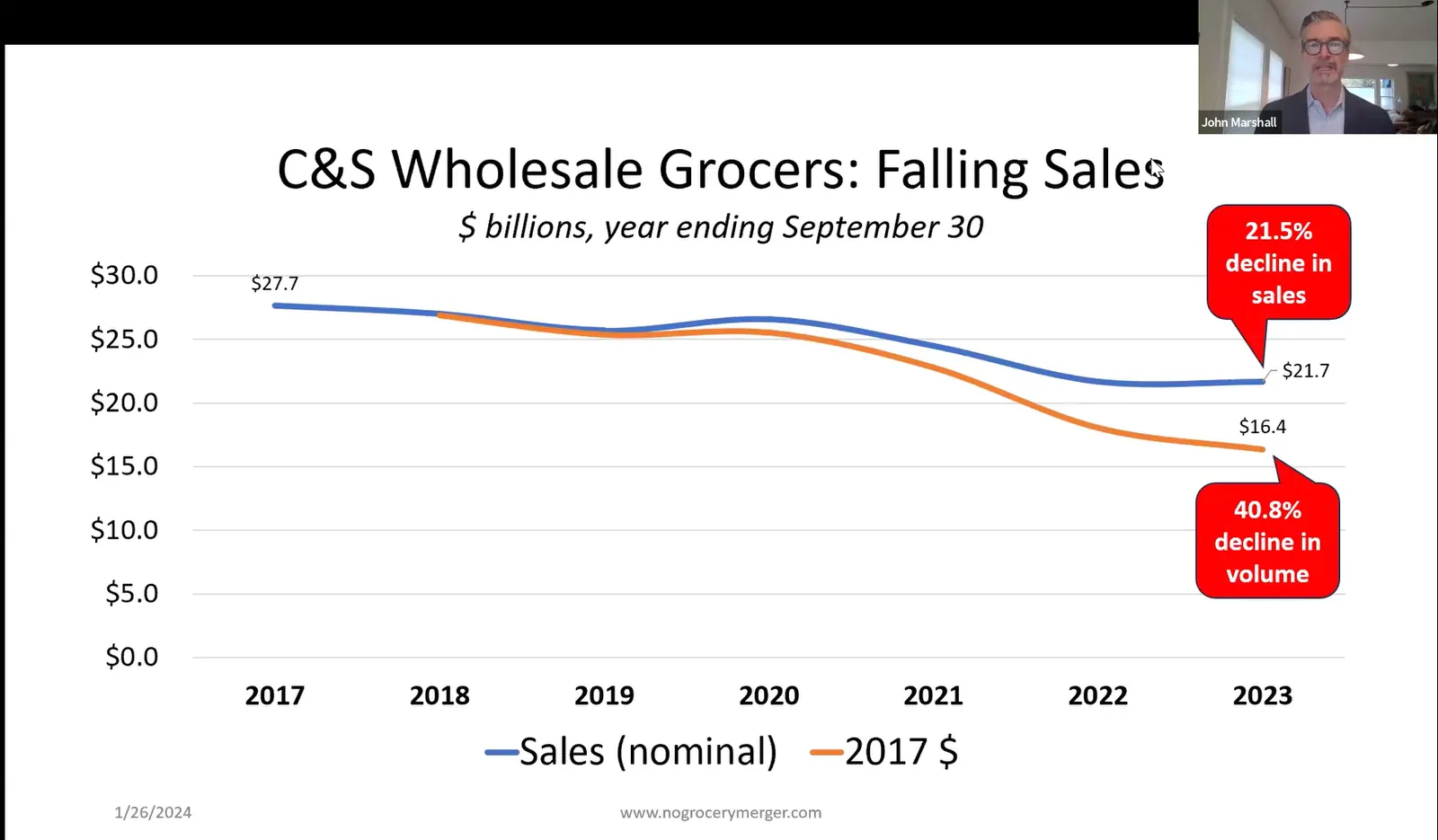

According to UFCW, despite claims about C&S’s financial strength, the company’s revenue has been “declining significantly” over the past six years, dropping 21.5% from $27.7 billion in sales in 2017 to $21.7 billion in sales in 2023, Marshall said. He added that this was during a time of “significant food price inflation,” so on a volume basis, sales dropped over 40%.

The UFCW still has concerns regarding C&S’s corporate structure as well, specifically in regards to its relationship with 1918 Winter Street Partners, an affiliate that would operate C&S acquired Kroger and Albertsons stores — a relationship which Marshall stated was “not clear.”

Marshall added that he has concerns about C&S' willingness to honor collective bargaining agreements.

“We asked [C&S] what would happen if they acquired non-union stores, and if the workers in those non-union facilities sought to join the union, and they were actually very candid with us and they said they would run a campaign opposing the union,” Marshall said. “So contrary to the claims of Kroger and Albertsons, and other advocates of the merger, C&S is clearly not a pro-union company.”

Kroger released a statement shortly after the UFCW conference wrapped up rebutting many of the coalition’s arguments. The grocer stated the “facts are clear” and the merger is “inherently pro-union,” noting Kroger added over 100,000 “good-paying union jobs since 2012 and invested $1.9 billion to grow associate wages and … benefits since 2018.” Both Kroger and C&S are also committed to not closing stores or laying off frontline workers as a result of the merger, the grocer said.