Dive Brief:

- Walmart has a 15% price advantage online compared to regional grocers based on the average price of a large basket of groceries, according to research from e-commerce firm Mercatus.

- The retailing giant has a direct labor cost that’s around half what regionals face thanks to retail media, automation and other advantages that stand to grow over time for the company.

- Regional grocers can battle Walmart’s online advantages by playing up the convenience of their pickup services and by employing cost strategies like tiered pricing and marking up products.

Dive Insight:

Regional grocers face an uphill battle in challenging Walmart for online pricing and value in an e-commerce industry that’s seen declining interest since the highs of the pandemic. But they can still effectively compete by pulling a few levers that help communicate convenience and value to shoppers.

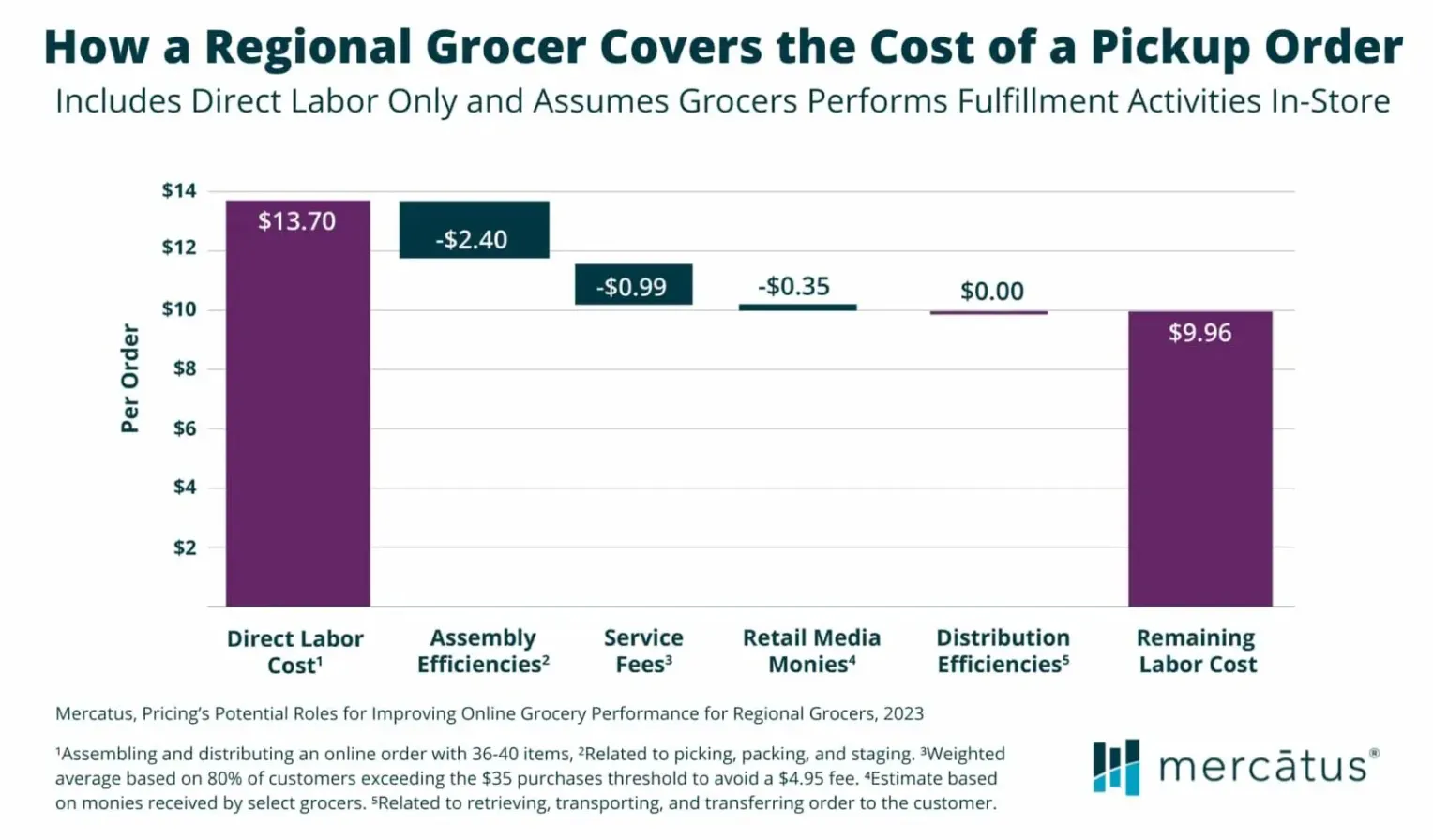

The cost of filling an online order is steep. Mercatus estimates that a large pickup order incurs just over $13 in direct costs. That includes assembling, staging and transferring the order to a shopper’s car.

Grocers can offset some of that cost through assembly technology, retail media income and service fees. But Walmart enjoys sizable advantages here and ultimately faces a remaining direct cost of just under $5, compared to the nearly $10 regional grocers face.

Mercatus notes that these advantages will only grow for Walmart as it continues expanding its retail media empire, which generated $2.7 billion last year. The company is currently able to offset around $2.90 in cost per order thanks to retail media for its U.S. grocery e-commerce business, Mercatus estimates, and by 2025 that will grow to around $4.20 per order.

Walmart is also investing significantly in automation to lower the cost to serve, adding micro-fulfillment centers and other technology to stores around the country.

Nevertheless, Mercatus noted that regional chains have a few advantages of their own. Many regionals are conveniently located in their markets — a fact they use to their advantage with in-store shoppers, and that they could do more to play up with pickup consumers since that service also requires a trip to the store.

Regional grocers can also investigate and deploy various pricing strategies that enhance the value of online shopping. They could, for instance, utilize a tiered fee structure that rewards shoppers for orders that cost the retailer less to fulfill, like those with a longer wait time that allows the company to batch order picking. Grocers can also selectively implement “free” service tiers and special offers that make ordering look like a good value and can keep customers shopping with the company.

Shoppers often look for deals when they shop at regional chains, which frequently mark down their everyday prices by 7%-10% according to Mercatus.

In addition, regional grocers shouldn’t be afraid to embrace price markups for online goods where it makes sense. Some grocers insist on offering the same prices online that they offer in stores, but Mercatus noted that consumers are willing to pay more, especially if grocers can effectively communicate the higher prices and value shoppers get for them. From an analysis of grocers in Plano, Texas, in mid-March, Mercatus found that H-E-B marked up its online groceries 4% versus in-store, while Aldi featured a 9% markup and Costco had a 17% markup.

The return of in-store shopping and record-high inflation have crimped online grocery shopping over the past two years or so, making it hard for regional grocers to justify hefty investments in e-commerce. Forty-seven percent of grocery retailers surveyed recently by FMI - The Food Industry Association said their online sales declined last year, while just 31% said sales increased.

Mercatus estimates that U.S. grocery e-commerce will grow by 6.5% per year through 2027, compared to 2% for in-store sales.