Dive Brief:

- Walmart is expanding its market-leading position in grocery e-commerce and is on track to control 26.9% of the market by the end of 2024 — well ahead of Amazon, its closest competitor, according to data released earlier this month by Insider Intelligence.

- Amazon’s share of the digital grocery space is set to decline to 18.5% over the coming year even as its sales continue to grow.

- Walmart is gaining ground on its top online grocery rival so quickly that “it will be difficult for Amazon to reverse the trend,” Insider Intelligence said.

Dive Insight:

The latest figures from Insider Intelligence underscore the sustained momentum Walmart has built as it takes advantage of its size and scale to cement its dominance of the U.S. digital grocery market.

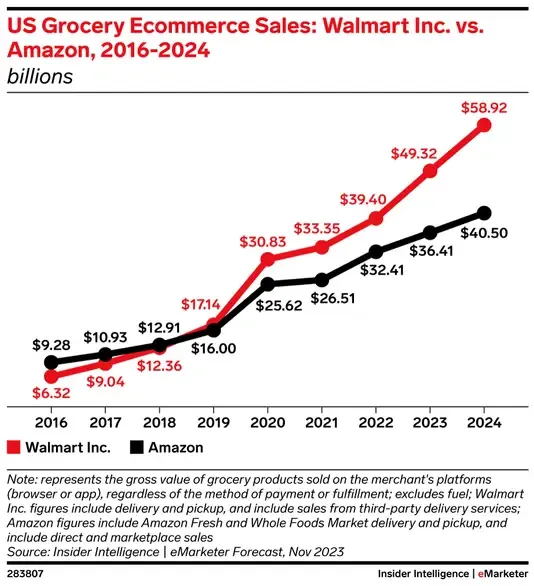

Insider Intelligence expects Walmart to generate online sales of $58.92 billion in 2024, up from $49.32 billion this year — an increase of 19.5%. By comparison, Amazon will see its digital grocery sales rise by just 10% during the same period, from $36.41 billion in 2023 to $40.5 billion next year, the research firm predicts.

The growing divide between Walmart on Amazon on the digital grocery front represents a stark change from the dynamics that defined the market several years ago. Amazon controlled 24% of the online grocery market in 2016, compared with Walmart’s 16.4% share, but Walmart overcame that deficit in 2019 and hasn’t looked back since.

The figures for Walmart include delivery and pickup as well as sales from third-party delivery services, according to Insider Intelligence. Data for Amazon encompasses Amazon Fresh and Whole Foods Market delivery and pickup as well as direct and marketplace sales.

Walmart’s digital dominance in grocery is attributable in part to the close proximity of its stores to the vast majority of the U.S. population, a factor that gives the company an edge in the number of curbside and in-store pickup locations it offers to shoppers, Brian Lau, forecasting analyst at Insider Intelligence, said in a press release about the firm’s research. The retailer has also benefited as inflation has pushed shoppers to seek lower prices, he said.

Walmart’s e-commerce sales in the U.S. rose 24% in the third quarter, driven by strong performance in pickup and delivery. The company’s overall grocery business also performed well during the period.

The retailer also continued to invest in its e-commerce infrastructure during its latest quarter, opening the third in a fleet of next-generation facilities it is building in an effort to speed up delivery.

Amazon has been taking steps to improve its online grocery fortunes as it looks to catch up with Walmart. In October, the company reduced the amount shoppers need to spend on an online grocery order to qualify for free delivery, and earlier this month announced that it has started offering grocery delivery and free pickup services in certain areas to shoppers who are non-Prime members.