Dive Brief:

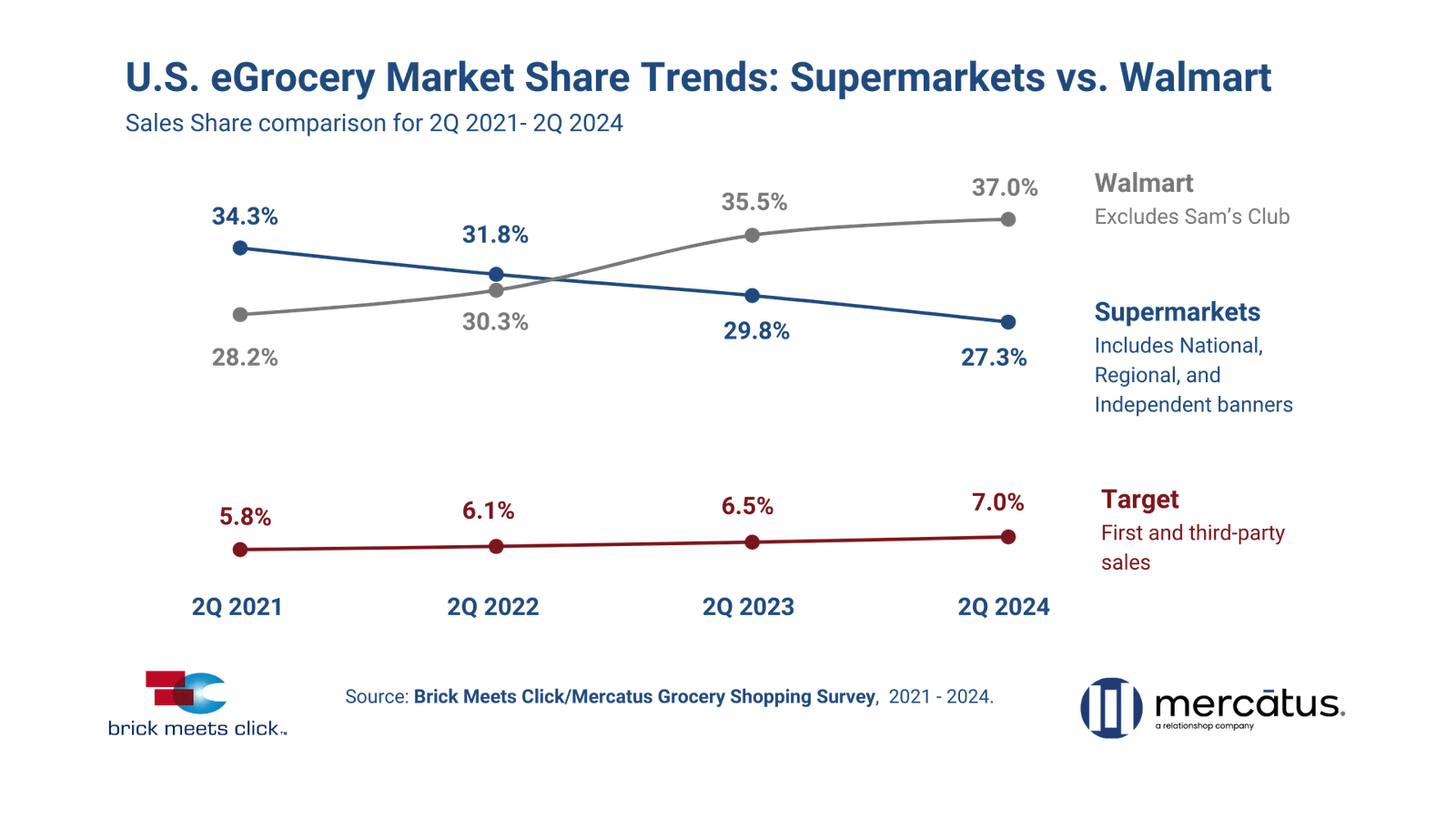

- Walmart captured 37% of the U.S. online grocery market during the second quarter of 2024 — an all-time time high for the company — according to Brick Meets Click and Mercatus’ latest report released Tuesday.

- Meanwhile, grocers continued to lose online sales share, finishing with just over 27%, and lost their lead to mass retailers in the delivery segment.

- The report’s findings highlight that Walmart and other mass retailers continue to be a rising threat to supermarkets’ e-commerce dollars.

Dive Insight:

Grocers’ share of e-grocery sales has been slipping to mass retailers, specifically Walmart, since early 2022 when inflation was hitting record highs, according to the report’s findings. Supermarkets are especially losing the delivery battle to the likes of Walmart.

This time last year, grocery had the lead in delivery share compared to mass retailers, but lost momentum over the past year. This year’s second quarter left grocers lagging behind mass retailers in the category’s total sales by nearly 10 percentage points. Walmart was a driving force for this shift, with a nearly eight percentage point jump in delivery share year-over-year.

Grocers did see a slight bump in the delivery category between 2024’s first and second quarters thanks to recent promotional pushes by Instacart, the report noted.

For pickup sales, mass retailers claimed almost 60% of the segment’s share, down just 100 basis points year-over-year. By comparison, supermarkets ended the second quarter with a nearly 30% share and down 210 basis points year-over-year. Pickup remains the dominant receiving method for online grocery orders, according to the report.

Brick Meets Click noted that supermarkets’ order mix skewed more towards delivery, accounting for just shy of 50% of online orders during this year’s second quarter. The report noted that grocers have seen pickup gain order share as more supermarkets roll out the service.

Meanwhile, the opposite trend is true for mass retailers, who see pickup as the primary receiving method yet are seeing a “significant shift” towards delivery, per the report. For mass retailers, this shift is primarily due to Walmart’s growing focus on first-party services and first-party distribution for delivery orders.

The findings show that grocers shouldn’t expect relief from the pressures brought on by consumers choosing to shop for groceries at mass retailers. In the second quarter, the share of supermarket customers who also shopped at mass retailers rose 370 basis points, totaling to over 32% with around one in five shopping at Walmart.

“The execution of [Walmart’s] omnichannel strategy, plus the operational efficiencies aided by incredibly high order demand, has enabled Walmart to consistently deliver the type of experiences that customers expect and to lower its cost to serve online orders at the same time,” Brick Meets Click Partner David Bishop said in a statement.