As Walmart places growing emphasis on digital innovation, the company’s CFO and head of investor relations outlined how supply chain automation, in-store technology and remodels are impacting labor, sales and consumer behavior.

Executive Vice President and CFO John David Rainey and Senior Vice President and Head of Investor Relations Stephanie Wissink shared details about what the mass retailer is doing while at investment banking advisory firm Evercore Inc.’s conference last Wednesday.

Customers who have a very good experience with e-commerce are more likely to come back, Rainey said, noting that as they become more accustomed to the online experience for grocery shopping, they mix in general merchandise to their baskets. Digital upgrades for its supply chain and stores are changing how workers do their jobs, Wissink said, according to a Seeking Alpha transcript of the Evercore ISI Consumer & Retail Conference.

Supply chain and store tech investments

Walmart is looking to make its stores more efficient by using micro-fulfillment centers and automated storage and retrieval systems in its facilities, according to Rainey. “We're making a tremendous investment in our supply chain,” he said.

In October, the retailer announced plans to buy MFC developer Alert Innovation for an undisclosed amount. Walmart President and CEO Doug McMillon said at a conference in December that Walmart is working with four different partners on four types of fulfillment centers along with using store-level fulfillment. Walmart has also worked on outfitting its existing distribution centers with automated storage and retrieval systems, McMillon said.

These efforts to create an automated supply chain are “making it a lot more efficient for us and enabling us to better serve our customers, reduce wait times, have more accuracy in terms of the items that we're picking for that basket because we're continuing to see consumer behavior shift in that direction where they recognize that it is a very convenient process,” Rainey said during the Evercore event.

Walmart is expecting the unit economics around fulfillment to improve by roughly 20% in roughly five years when the retailer has finished its supply chain transformation.

“We're going to have roughly 65% of our stores that are served by automation,” Rainey said. “And so this provides a better experience, more integrity to the experience with our customers also lowers our unit costs.”

While the retailer is placing an emphasis on its supply chain technology, investments in electronic shelf labels are saving workers from hours of work, Rainey said.

The retailer disclosed during its recent Associates Week that some of the remodeled stores are seeing an uplift in sales by as much as 20% after the remodel is finished, Rainey said, noting that the refreshed locations include improved waypoint finding, signage, wider aisles, displays around apparel, more brands that the retailer doesn’t usually carry and overall a “different look and feel.”

“We've seen this historically, when you have a remodel, you're going to get a little bit of an uplift in sales and sometimes that abates over time as that newness wears off,” Rainey said. “The uplift that we've seen around this [remodel effort] is much, much higher than what we traditionally see.”

Rainey continued: “We would again expect it to decline over time. I don't expect any of us to believe that we're going to have a 20% uplift in sales [in] perpetuity. But even if it's a fraction of that, this is a highly accretive ROI initiative for us. And so we're quite excited about it.”

Rethinking labor allocations

As Walmart continues to automate its supply chain and also revamp its stores, Wissink said the company is reconsidering how to integrate its associate workforce.

Walmart does not expect to make major changes to its associate headcount and is planning for that workforce to stay relatively flat over the next several years, Wissink said.

“It's redeploying each individual person to do different jobs and upskilling a good majority of our workforce into places that they're serving the customer or more close in proximity to the customer or doing things within the automation sequence where they're serving and contributing to the overall technology,” Wissink said.

McMillon said at the December conference that Walmart is turning to automation to not only boost productivity but also to cut labor costs.

Pulling back the curtain on Walmart+

While Walmart has remained tight-lipped about Walmart+, its membership program that launched in September 2020, Rainey and Wissink shone more light on its subscriber base and how the retailer is evolving the offering.

Walmart+ subscribers tend to be more affluent, younger, more tech-savvy and value convenience, Rainey said, adding that roughly 50% of Walmart+ members come through the grocery delivery or pickup channels. The customer lifetime value (CLV) of a Walmart+ member is “appreciably higher” than nonmembers because they tend to spend more and shop more frequently, Rainey said.

Walmart+ allows for more digital engagement with customers, Rainey said: “We better understand them and can tailor our offerings that are most relevant to them versus trying to guess and pick and choose certain things that are really based upon more macro level customer stats.”

To that end, the retailer is “co-creating” Walmart+ with its customers, Wissink said.

“There's a very strong feedback loop embedded in the development of Walmart+ as a platform. ... You're seeing value added to the Walmart+ platform based on the feedback loop we're getting from our customers. Going out to the market and finding things that help them live better and making that available as part of their overall plus experience,” Wissink said.

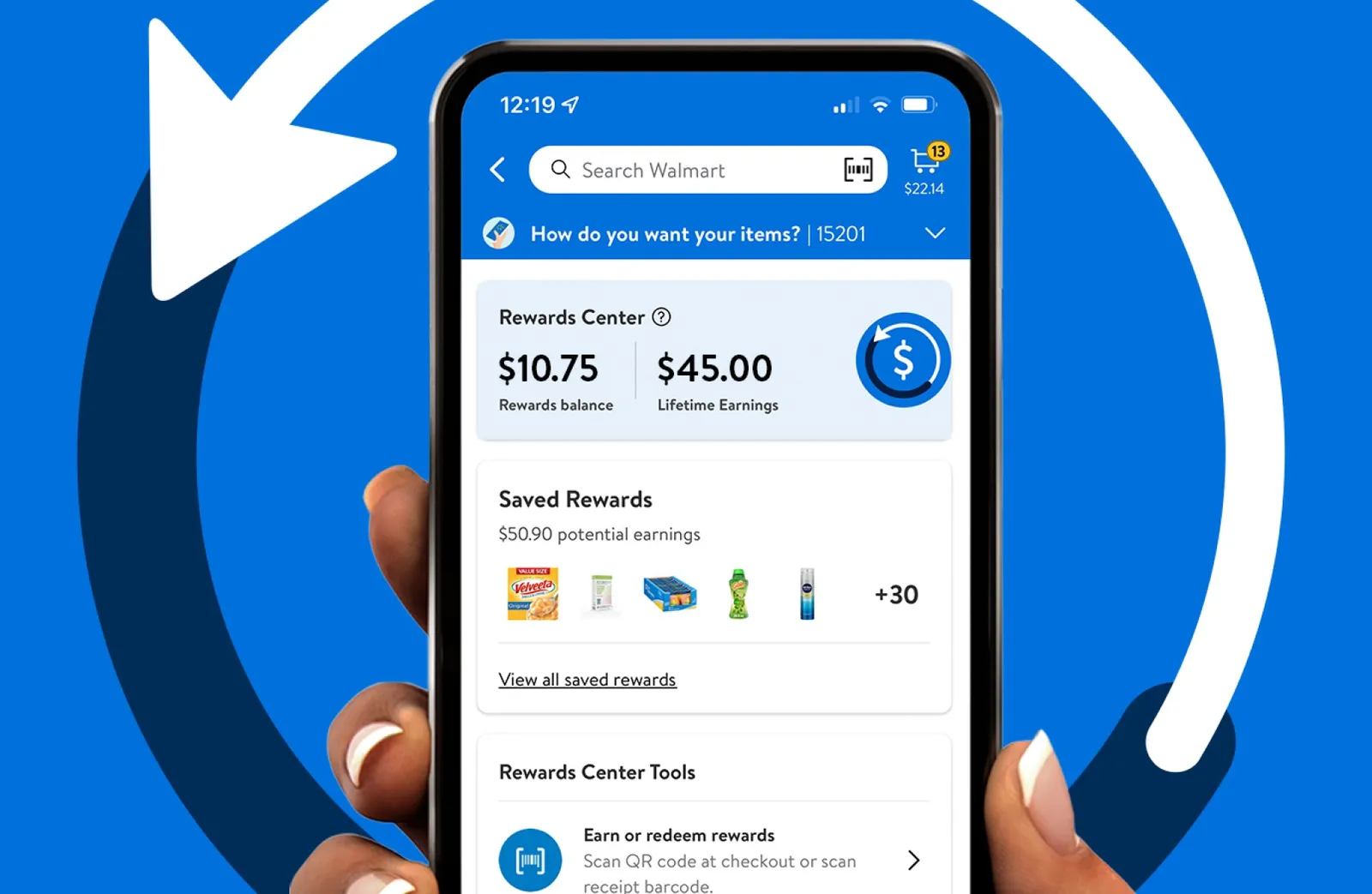

Recently, the retailer added August Walmart Rewards as a new benefit to Walmart+ and a month later, made Paramount+ available to members.

Scan-and-go is taking off

At Sam’s Club, Walmart has seen consumer usage of scan-and-go serve as a successful digital engagement strategy, Rainey said.

Scan-and-go dates back to 2013 for the club retailer, which rolled the offering out chainwide in 2016. In 2021, the retailer piloted a Scan & Ship program, which allows customers to place direct-to-home orders in the aisle by scanning merchandise included in the program.

Now, scan-and-go accounts for roughly one in four of our transactions at Sam’s Club, Rainey said.

“If you step back and you think about that for a second, that's a digital experience in a brick-and-mortar world, right?” Rainey said.

Gaining goodwill with consumers

Digital innovation is just one piece of the pie as Walmart looks to stay within the good graces of its shopper base.

While some shopper behavior trends took off during the pandemic but have since reverted back to pre-pandemic times, the convenience and value of grocery delivery and pickup offerings are sticking with consumers, Rainey said.

“Convenience is a really important part of where we're going here. I think importantly, when we survey the mind share scores from our consumers, we're rated right now for convenience almost as high as value,” Rainey said. “We've never been there historically. And so I think it suggests ... that what we're doing is working and it's resonating with customers. And we want to continue to do that going forward.”

Wissink noted that Walmart’s focus on its value proposition, such as its “inflation-free” promotion for holiday meals and offering last year’s prices for Easter items, is appealing to shoppers. Consumers can expect to see similar efforts later this year, including ones linked to the return to school at the end of the summer, Wissink said.

“I think we're gaining some goodwill among consumers right now in addition to overall working very closely with our suppliers to make sure that their dollars are the most effective for them to drive the volume they need as well,” Wissink said.