What will it take to unlock in-store retail media?

Digital retail media has given retailers and advertisers the biggest stage imaginable for reaching consumers. But that giant platform doesn’t guarantee a giant impact when it comes to influencing customers’ purchasing decisions.

As the grocery industry has quickly accelerated retail media efforts over the past few years, digital advancements took center stage in 2023 and now in-store capabilities have stepped into the spotlight throughout 2024.

Recently, retailers, advertisers and industry experts alike have noticed that, despite the numerous possibilities of digital, in-store retail media is proving more influential to consumers.

Currently, 84% of retail sales continue to occur in-store, making the potential of in-store retail media more crucial than ever before, according to a July 2024 report from in-store advertising provider Vibenomics.

In-store retail media advancements are particularly beneficial to regional and mid-market retailers, Kevin Bridgewater, senior vice president of retail media company Quad, said in an interview, noting that these smaller retailers can better articulate their customer base to CPG partners and explain why they would benefit from messaging about a product.

“The site traffic just isn’t enough for these smaller retailers to generate enough excitement from the brands, but the foot traffic is significant,” Bridgewater said.

A grocer’s ability to follow a shopper’s journey throughout the store and link it to their baskets and purchases with in-store retail media capabilities is vital. Impressions, which signify if a customer saw the ad, and impact, which tracks if an ad led to a purchase, are both vital for grocers and CPGs to understand the success of an ad campaign.

Measuring impact

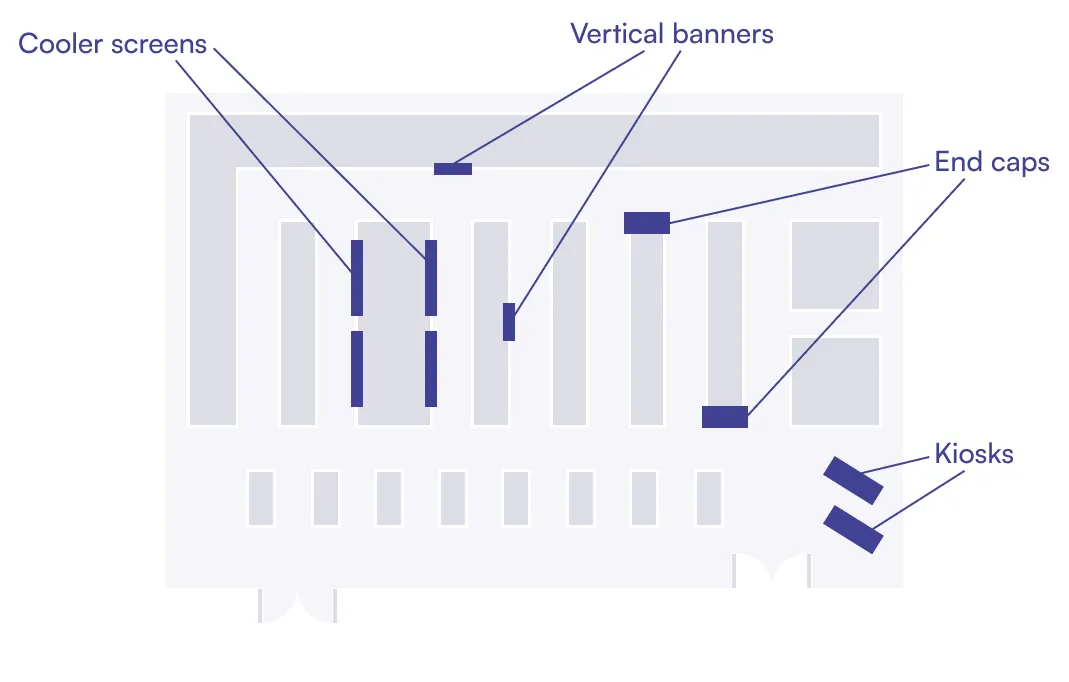

Every section of the grocery store can be decked out with in-store retail media, and the placement of these gadgets is strategic, aiming to garner the most impact and collect the most shopper data, experts said.

Sampling kiosks

The first retail media technology a shopper may encounter is a sampling kiosk, giving customers the opportunity for discovery right as they walk through the door.

Kiosks most commonly live at a store’s entrance and are often interactive, Gil Phipps, senior vice president of global customer solutions at Advantage Solutions and former chief marketing officer with Sprouts Farmers Market, said in an interview. That interaction is essential to measuring the impact of ad messaging.

Wakefern Food Corp. was one of the first to widely implement interactive kiosks back in 2023, installing them at 95 ShopRite and The Fresh Grocer stores. Powered by Freeosk, the units dispensed product samples to shoppers after they scanned in with their phone, allowing the system to collect data and see if that trial led to a purchase.

While kiosks provide a seemingly direct method to showcase an ad partner’s campaign and gather shopper intel, their main shortcoming is their distance from the register and primary product display, Phipps noted, especially when compared to retail media messaging that is more integrated into a store’s layout.

“Messaging in the store right when you walk in is important, but not as powerful as messaging cereal on the cereal aisle, and, certainly, closer to the product and closer to the point of purchase is more powerful,” Phipps said.

Digital end caps & vertical banners

As shoppers make their way deeper into the store, they may encounter a digital end cap. Positioned at the end of an aisle, these end caps are mainly used to grab shoppers’ attention on stand-out products, like limited-time season offerings, or staple items.

Once a consumer makes their way down the aisle, vertical banners — smaller screens attached to the aisle’s display to draw shoppers to particular goods — will grab their attention next.

These aisle-centered in-store retail media tools often use the same measurement tactics and technology.

In April 2024, The Save Mart Companies began rolling out in-store retail media technology as part of the launch of its In-Store Connect network, which is powered by Quad.

To measure ad performance, Quad collects transaction logs from its retail partners, including The Save Mart Companies, to measure category SKU-level performance of participating brands, Bridgewater said in an interview.

End caps, vertical banners and other aisle screens supplied by Quad determine impressions through “shopper trap encounter technology,” Bridgewater said, a capability that senses and measures a shopper’s in-store maneuvers. The company then analyzes this transaction and SKU-level data alongside impressions.

From there, Quad carries out A/B testing, also known as split testing, to track awareness and compares the results for stores within its network against stores in the same chain that are not part of its network, Bridgewater said.

Cooler screens

Grocers can also bring retail media to their refrigerated doors.

Technology and retail media company CoolerX, formerly named Cooler Screens, is one such company that offers digital refrigerators and freezer doors. These screens showcase ads and product information as well as let shoppers interact with digital merchandising.

Artem Lavrinovich, chief data and product officer for the company, compared the interaction to a consumer clicking on a digital ad. For its retail partners, CoolerX uses sensors on its screens to provide shopper behavior insights, including how close they were to the screen, how long they stayed in front of it and how many shoppers viewed it. This intel, as well as the store’s transaction logs, are time-stamped, allowing CoolerX to understand the correlation between a displayed ad and shoppers’ baskets.

If a customer is standing close to the CoolerX door screen for an extended time, the company can serve them an ad aimed at influencing their purchase choices, such as highlighting a trending item behind the refrigerator door they are looking at or displaying a QR code that offers additional information or savings, Lavrinovich said.

“The sensors are not just there to count how many ads were played and what the dwell time and the distance were. They’re actually there to recognize where the customer is in their journey,” he said.

Smart carts

Smart carts are a way grocers can combine nearly all in-store retail media has to offer — push ads, personalization, in-store app features, loyalty program promotions and digital screens — into one machine.

Though not yet as widely deployed as digital screens, smart carts are gaining popularity amongst grocers.

Instacart is an e-commerce provider that is heavily leaning into the power of smart carts, with “thousands” of its screen-equipped carts, Caper Carts, expected to be in supermarkets by the end of 2024, CEO Fidji Simo said in May.

As in-store retail media has grown, so have Caper Cart’s capabilities. In January 2024, Instacart debuted ads on the smart cart’s screens and began piloting the new capability at Good Food Holdings banner stores. The feature enables CPG brands to engage with customers through ads during their shopping trips and serve them more personalized content based on past purchases and in-store shopping behavior, Instacart said in an emailed announcement about the technology.

With smart carts being one of the newest types of in-store retail media, measurement capabilities are not as standard as stationary in-store screens. In emailed comments, Instacart did not elaborate on Caper Cart’s measurement capabilities.

What’s limiting in-store retail media tech?

While grocers can unlock deeper shopper behavior insights with their newfound retail media capabilities, experts note that advancements are often halted and the technology itself has limitations.

For example, while smart carts may be the next wave of in-store retail media technology, Phipps worries that they may end up restricting shopper spending.

Because there is a limit to the number of items that can go into a cart, Phipps is concerned that specialty features, like being able to tally up a shopper’s total prior to checkout, might not work if a shopper exceeds the cart’s capacity.

Even more pressing for consumers, however, is the potential that grocers might breach their privacy as they look to further personalize the shopping experience.

CoolerX, Quad and Grocery TV don’t currently capture or record personally identifiable information like gender, age and race, they said. Instead, they lean on impressions to measure an ad’s impact.

To dwell or not to dwell

Dwell time is one of the most common metrics in-store retail media technology measures. And while some experts claim it is a crucial way to track customer engagement, others find it less reliable.

According to Phipps, dwell time is an all-encompassing way to measure impressions as it picks up how many customers pass by an ad and how much time a shopper spends in front of an ad. That information can then be contextualized with store transaction logs and time of day to indicate how an ad performed.

Bridgewater, however, noted that Quad does not find dwell time accurate for measuring an ad’s impact on shoppers or for collecting impressions.

“We don’t feel there is an accurate way to measure dwell time that allows us to communicate back to a brand that they were engaged with the actual media,” he said. “[A shopper] could be looking at a product, they could be looking at something else, they could be stopped looking on their phone.”

Grocery TV CEO Marlow Nickell and Head of Data and Analytics Dallas Griffin noted that the company experimented with measuring demographics on their devices about five years ago, a practice they “abandoned very quickly” after getting inaccurate results. Now, the company relies on third-party audited impressions through a partnership with Placer.ai.

Lavrinovich noted that CoolerX’s technology acts like a radar-based system, sensing a human’s presence without gathering demographic details while Quad bases ad impact on impressions, SKU level movement and retailers’ transaction logs.

“We have no cameras on our device. We have no intention of putting cameras on our devices. Our belief, and my belief specifically, is that crosses the line of what the customer is looking for,” Bridgewater said, noting that collecting demographic information raises privacy concerns for consumers.

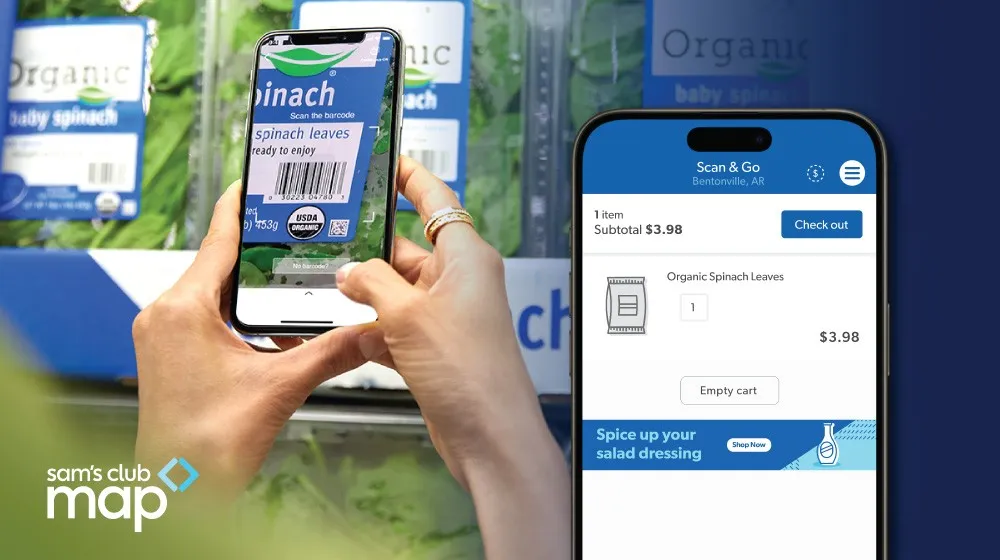

Going forward, tapping into retailers’ apps may be the key to unlocking in-store retail media.

A retailer’s app is “the most powerful in-store media surface” combining first-party data with in-store traffic insights, said Jordan Berke, founder and CEO of Tomorrow Retail Consulting and a former Walmart e-commerce executive.

“As consumers engage with the app while they’re in store, the potential to personalize and monetize and to give brands very targeted engagement opportunities is remarkable,” he added.

According to Berke, the next step for in-store retail media advancement is to combine the power of apps with in-store digital screens, giving customers the most personalized shopping experience possible. This development would involve enabling in-store screens to recognize when a customer’s app is nearby and display product ads and store messages on the aisle screen that fit their specific needs.

Getting to this point, though, would take retailers convincing their customers to trade privacy for this personalization, but it’s a trade-off Berke believes customers will be willing to accept.

“It’s not a gimme, it’s not a low-hanging fruit opportunity,” Berke said. However, the industry has seen “time and time again that if retailers can prove and continuously deliver that value, customers are comfortable with that exchange [of personal information],” he added.

Connecting in-store screens with apps would also improve metrics — specifically incremental return on ad spend (iROAS) — for grocers’ brand and advertiser partners, Berke said.

Measuring iROAS requires precise attribution and control group creation. Currently, though, grocers’ in-store screen metrics are “lighter and looser,” leaving them unable to provide the highly detailed data advertisers seek, according to Berke.

Quad, for example, is getting ready to roll out a capability where people can opt-in to link their retailer loyalty app to then receive personalized offers such as coupons, according to Bridgewater.

“The fact that we are targeting people who are just in the store is so significant … [Previously] you haven’t been able to target them in an excellent environment when they’re ready to make that purchase decision — until now,” Bridgewater said.